Managing your bills can be a daunting task, especially when you have multiple payments to make each month. Keeping track of due dates, amounts, and payment methods can easily become overwhelming. However, a printable bills payment schedule can simplify the process and ensure you never miss a payment.

This article will explore the benefits of using a printable bills payment schedule, where to find one, and how to use it to stay organized with your finances effectively.

What is a Bills Payment Schedule?

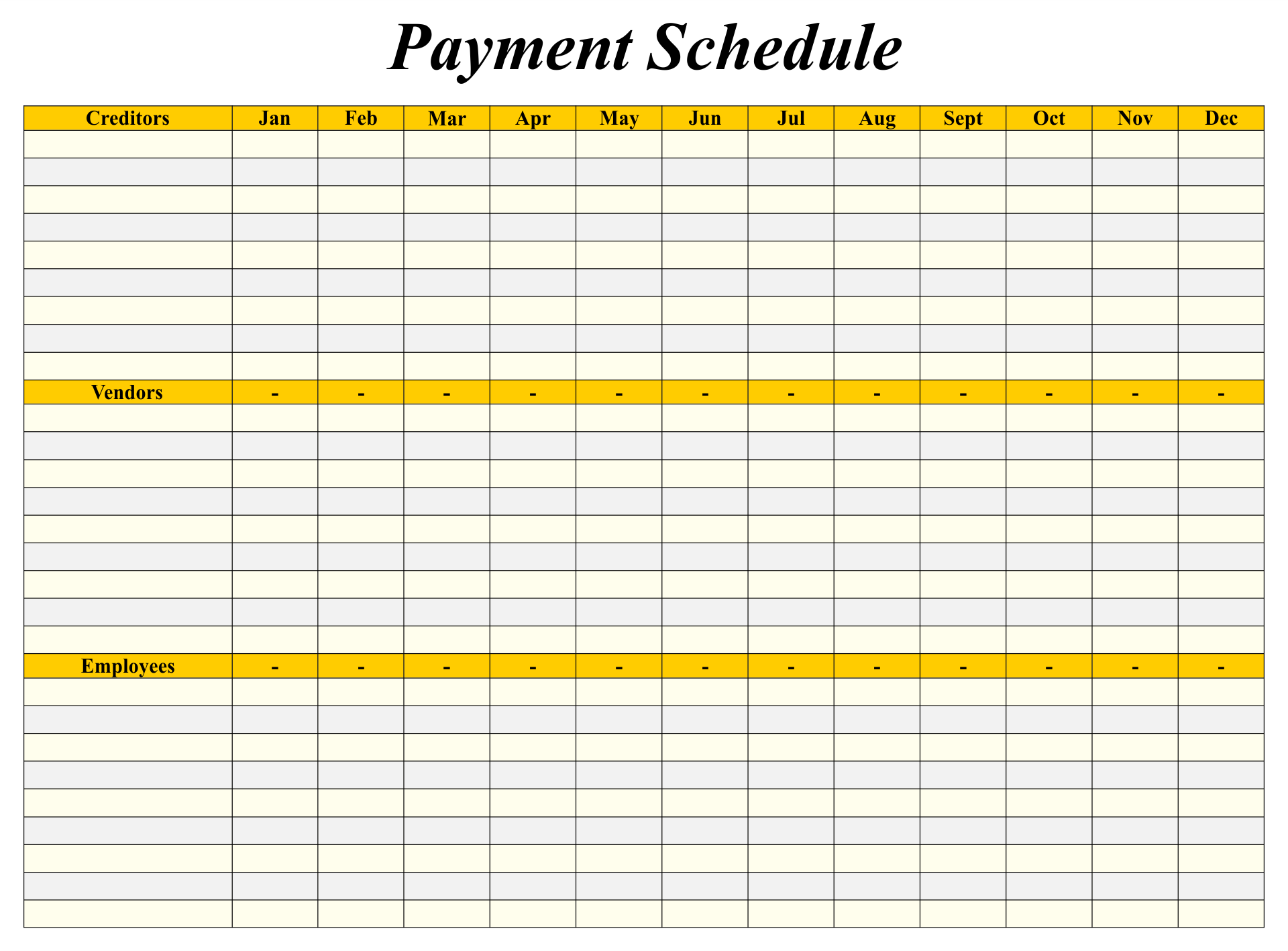

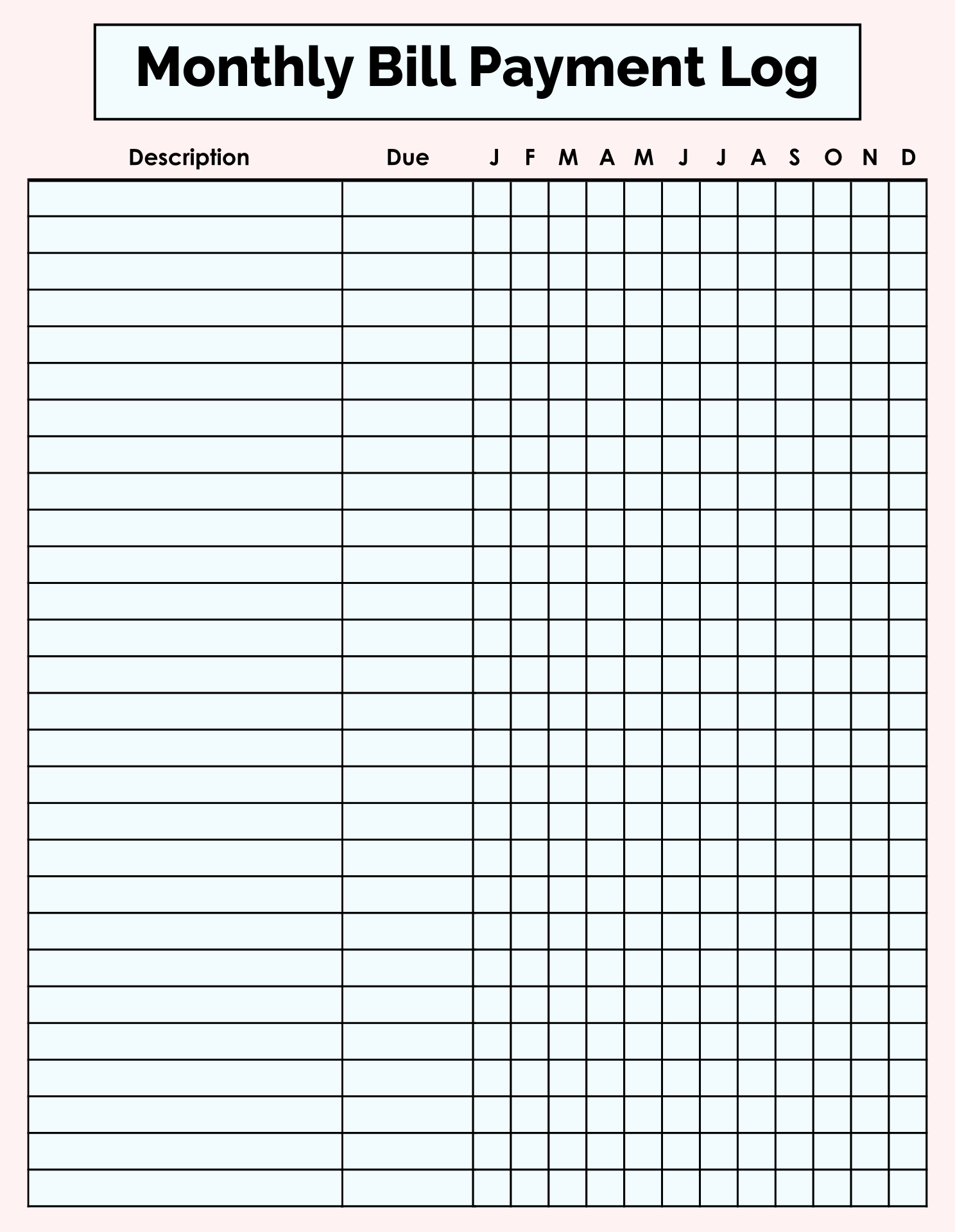

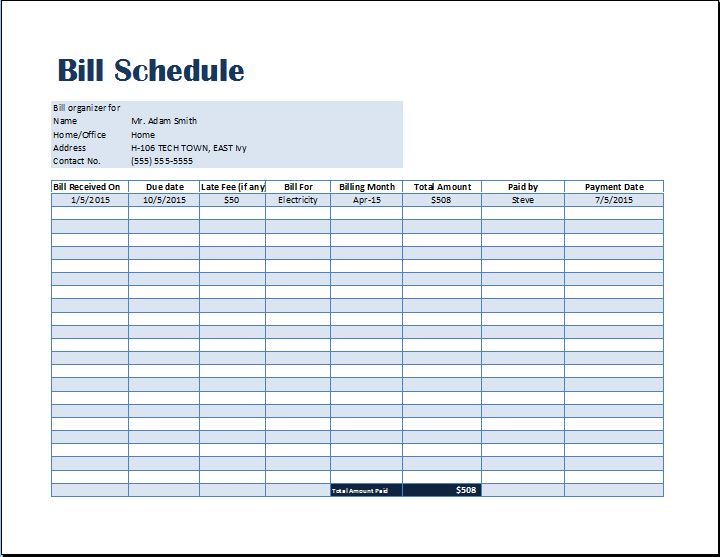

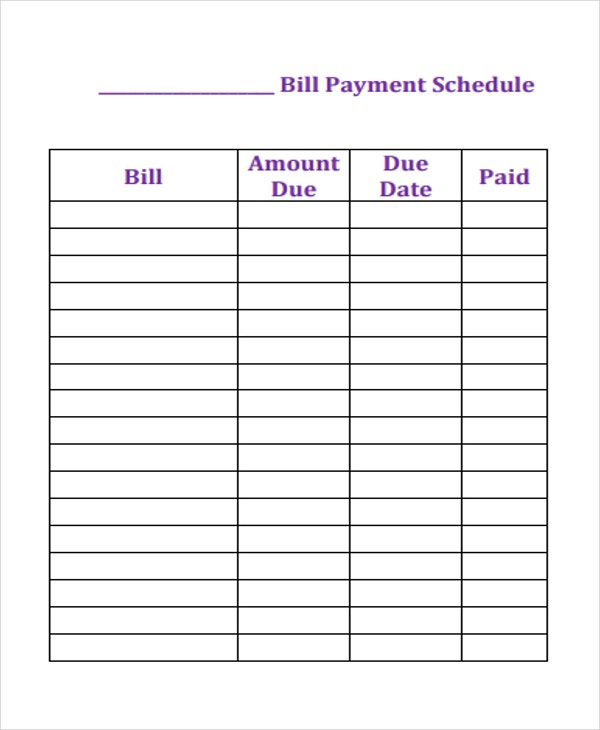

A bills payment schedule is a document that allows you to track and organize your bill payments. It typically includes columns for the due date, bill name, amount, and payment method. By filling out the schedule with your upcoming bill payments, you can easily see what needs to be paid and when. This helps you plan your finances and ensure that you have enough money to cover all your expenses.

How to Use a Printable Bills Payment Schedule

Using a printable bills payment schedule is simple. Here are the steps to follow:

- Step 1: Download or create a printable bills payment schedule.

- Step 2: Fill in the schedule with the necessary information for each bill, including the due date, bill name, amount, and payment method.

- Step 3: Review the schedule regularly to ensure that you are aware of upcoming bill payments.

- Step 4: Set reminders for yourself to make the payments on time.

- Step 5: Check off each bill payment as it is made.

- Step 6: Update the schedule whenever there are changes to your bills, such as a change in due date or amount.

By following these steps, you can effectively use a printable bills payment schedule to stay organized and on top of your finances.

The Benefits of Using a Bills Payment Schedule

There are several benefits to using a printable bills payment schedule:

1. Organization: A bills payment schedule helps you stay organized by providing a clear overview of all your upcoming bill payments.

2. Avoid Late Payments: By tracking your bill due dates, you can avoid late payments and the associated fees and penalties.

3. Financial Planning: A bills payment schedule allows you to plan your finances and ensure that you have enough money to cover all your bills.

4. Reduce Stress: Knowing that your bills are organized and under control can help reduce stress and anxiety related to managing your finances.

5. Save Time: With a bills payment schedule, you don’t have to waste time searching for due dates or scrambling to make last-minute payments.

6. Track Expenses: By recording your bill payments in a schedule, you can easily track your expenses and identify areas where you can save money.

7. Maintain Good Credit: Paying your bills on time is crucial for maintaining a good credit score. A bills payment schedule can help you stay on track and avoid any negative impact on your credit.

8. Stay on Budget: By knowing exactly when your bills are due, you can better plan your budget and allocate funds accordingly.

9. Easily Shareable: If you share finances with a partner or family member, a printable bills payment schedule can be easily shared and updated by multiple people.

10. Peace of Mind: Ultimately, using a bills payment schedule provides peace of mind, knowing that your bills are organized and that you are in control of your financial obligations.

Final Thoughts

A bills payment schedule is a valuable tool for managing your finances and ensuring that you stay on top of your bill payments. By using a schedule, you can avoid late payments, reduce stress, and maintain good credit. Whether you choose to download a template or create your own, incorporating a bills payment schedule into your financial routine can bring peace of mind and help you achieve your financial goals.

Bills Payment Schedule Template Word – Download