Keeping track of your credit card expenses is an essential part of managing your finances effectively. With a printable credit card use log, you can easily monitor your spending and stay on top of your budget. Whether you’re trying to pay off debt, save money, or simply gain better control over your finances, a credit card use log can be a valuable tool.

In this article, we will explore what a printable credit card use log is, why you should use one, and how to create and utilize it effectively.

What is a Credit Card Use Log?

A credit card use log is a document that allows you to record and track all of your credit card transactions. It provides a comprehensive overview of your spending, including the date, merchant, amount, and category of each transaction. By logging your credit card expenses, you can easily identify where your money is going and make informed decisions about your spending habits.

Why Should You Use a Credit Card Use Log?

There are several benefits to using a printable credit card use log:

1. Financial Awareness: By tracking your credit card expenses, you become more aware of your spending habits and can identify areas where you may be overspending.

2. Budgeting Tool: A credit card use log helps you stay within your budget by allowing you to see how much you have spent in different categories.

3. Expense Tracking: With a credit card use log, you can easily monitor and categorize your expenses, making it easier to analyze your spending patterns.

4. Debt Management: If you’re working towards paying off credit card debt, a use log can help you track your progress and prioritize your payments.

5. Fraud Detection: Keeping a log of your credit card transactions allows you to quickly identify any unauthorized charges and report them to your credit card issuer.

6. Financial Goal Setting: By analyzing your credit card use log, you can set realistic financial goals and track your progress toward achieving them.

How to Create a Credit Card Use Log

Creating a printable credit card use log is simple and can be done using a spreadsheet program or even a pen and paper. Here’s a step-by-step guide:

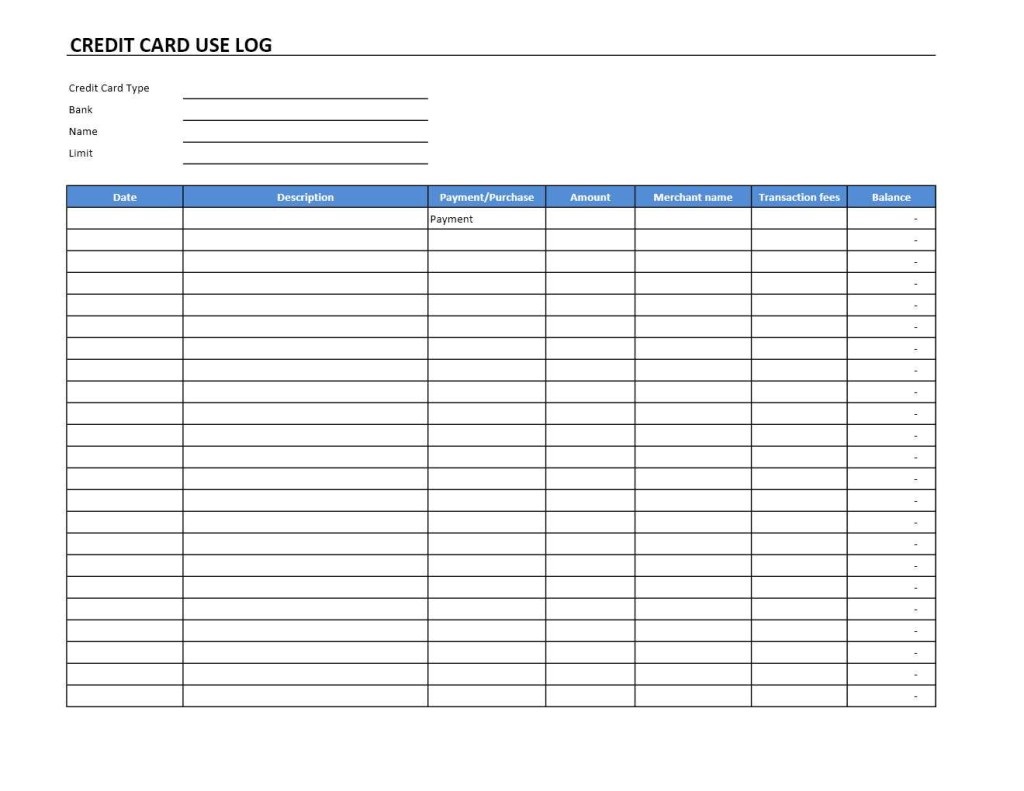

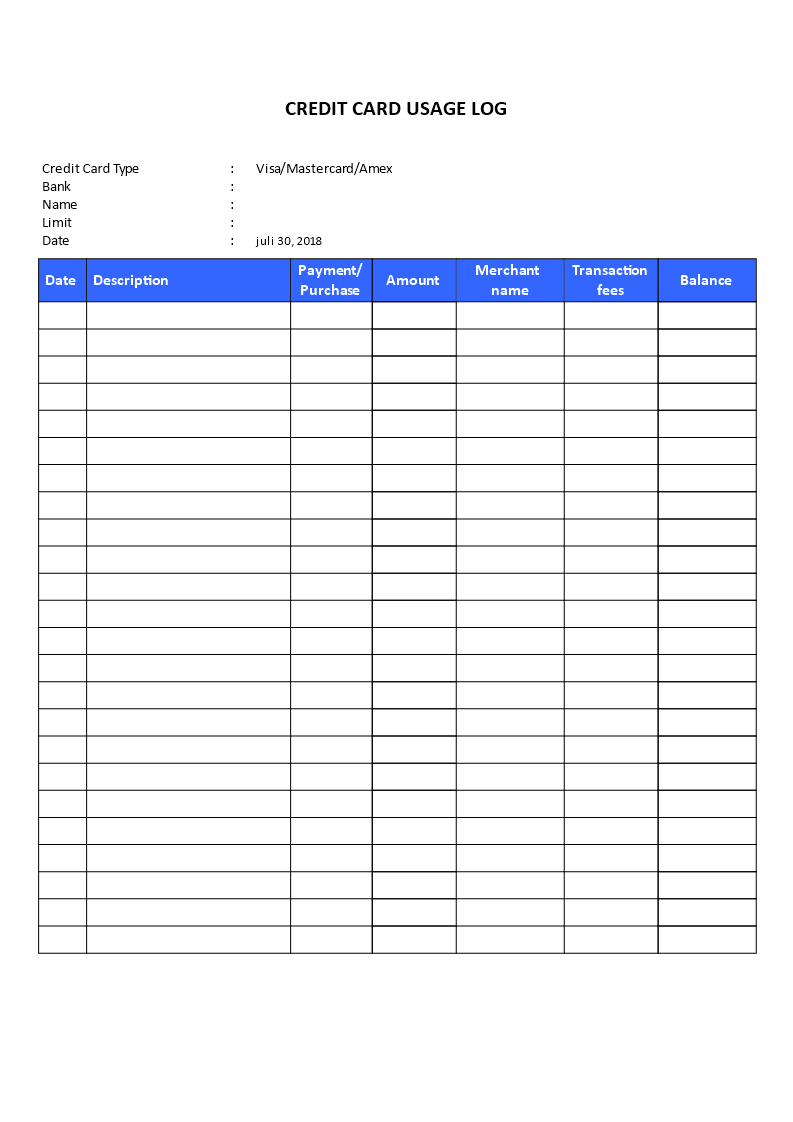

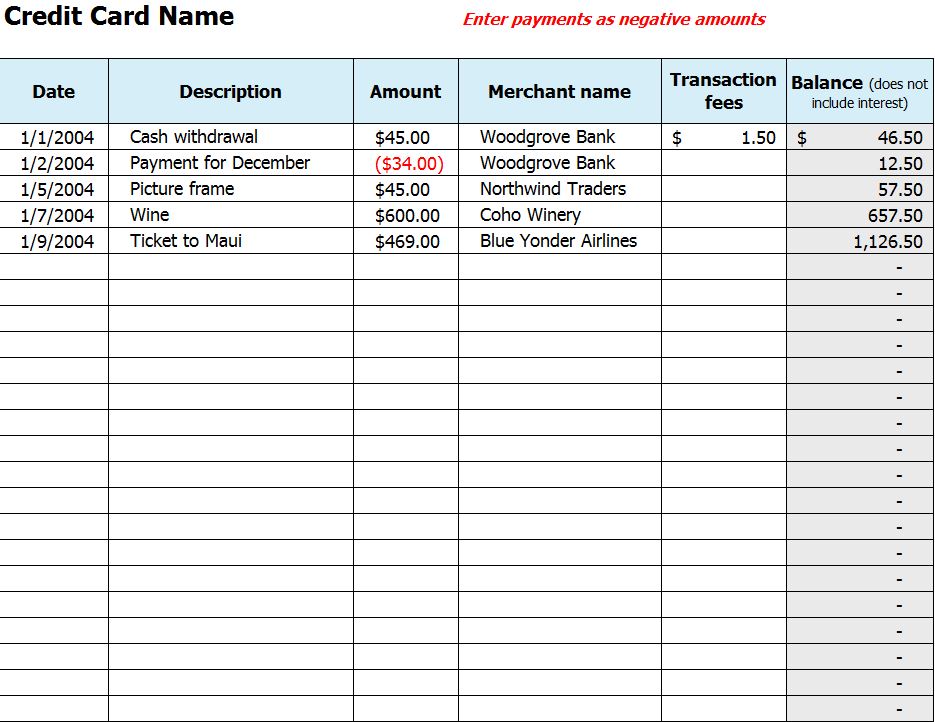

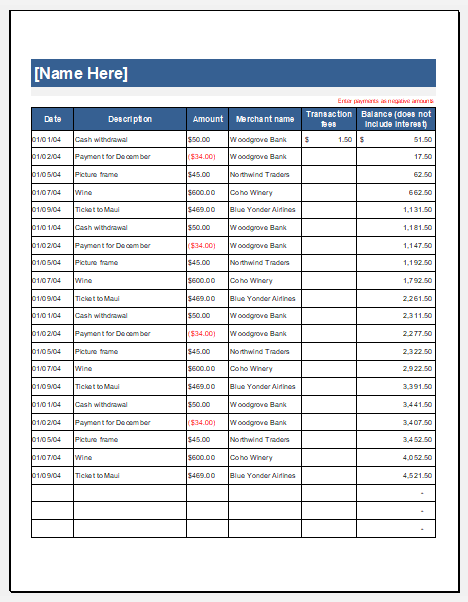

1. Choose a Format: Decide whether you want to create a digital log using a spreadsheet program like Excel or Google Sheets, or if you prefer a physical log that you can print and write on.

2. Set Up Columns: Create columns for the date, merchant, amount, and category of each transaction. You can also include additional columns for notes or any other information you find relevant.

3. Customize Categories: Create categories that align with your spending habits, such as groceries, dining, entertainment, and transportation. This will make it easier to analyze your expenses later on.

4. Record Transactions: Whenever you make a credit card purchase, log the details in your credit card use log. Be sure to include the date, merchant name, amount spent, and category of the transaction.

5. Review and Analyze: Periodically review your credit card use log to gain insights into your spending patterns. Look for areas where you can cut back or make adjustments to align with your financial goals.

Benefits of Using a Credit Card Use Log

There are numerous benefits to using a printable credit card use log:

1. Improved Financial Awareness: By tracking your credit card expenses, you become more aware of your spending habits and can make informed decisions about your finances.

2. Better Budgeting: A credit card use log helps you stay within your budget by providing a clear overview of your spending in different categories.

3. Enhanced Expense Tracking: With a credit card use log, you can easily monitor and categorize your expenses, making it easier to identify areas where you can cut back.

4. Debt Management: If you’re working towards paying off credit card debt, a use log can help you track your progress and prioritize your payments.

5. Fraud Detection: Keeping a log of your credit card transactions allows you to quickly identify any unauthorized charges and report them to your credit card issuer.

6. Goal Setting: By analyzing your credit card use log, you can set realistic financial goals and track your progress toward achieving them.

Bottom Line

A credit card use log is a valuable tool for anyone looking to gain better control over their finances. By tracking your credit card expenses, you can identify areas where you may be overspending, stay within your budget, and work towards achieving your financial goals. Whether you choose to create a digital log or a physical one, the key is to consistently record your transactions and periodically review and analyze your spending patterns. Start using a printable credit card use log today and take control of your financial future.

Credit Card Use Log Template Word – Download