Tracking mileage for business trips is an essential task for both employers and employees. It helps businesses accurately calculate expenses, reimburse employees, and maintain detailed records for tax purposes. An employee office car mileage report sheet can simplify this process by providing a standardized template for employees to record their travel information.

This article will explore what an employee office car mileage report sheet is, why it is important, how to create one, and provide tips for successful mileage tracking.

What is an Employee Office Car Mileage Report Sheet?

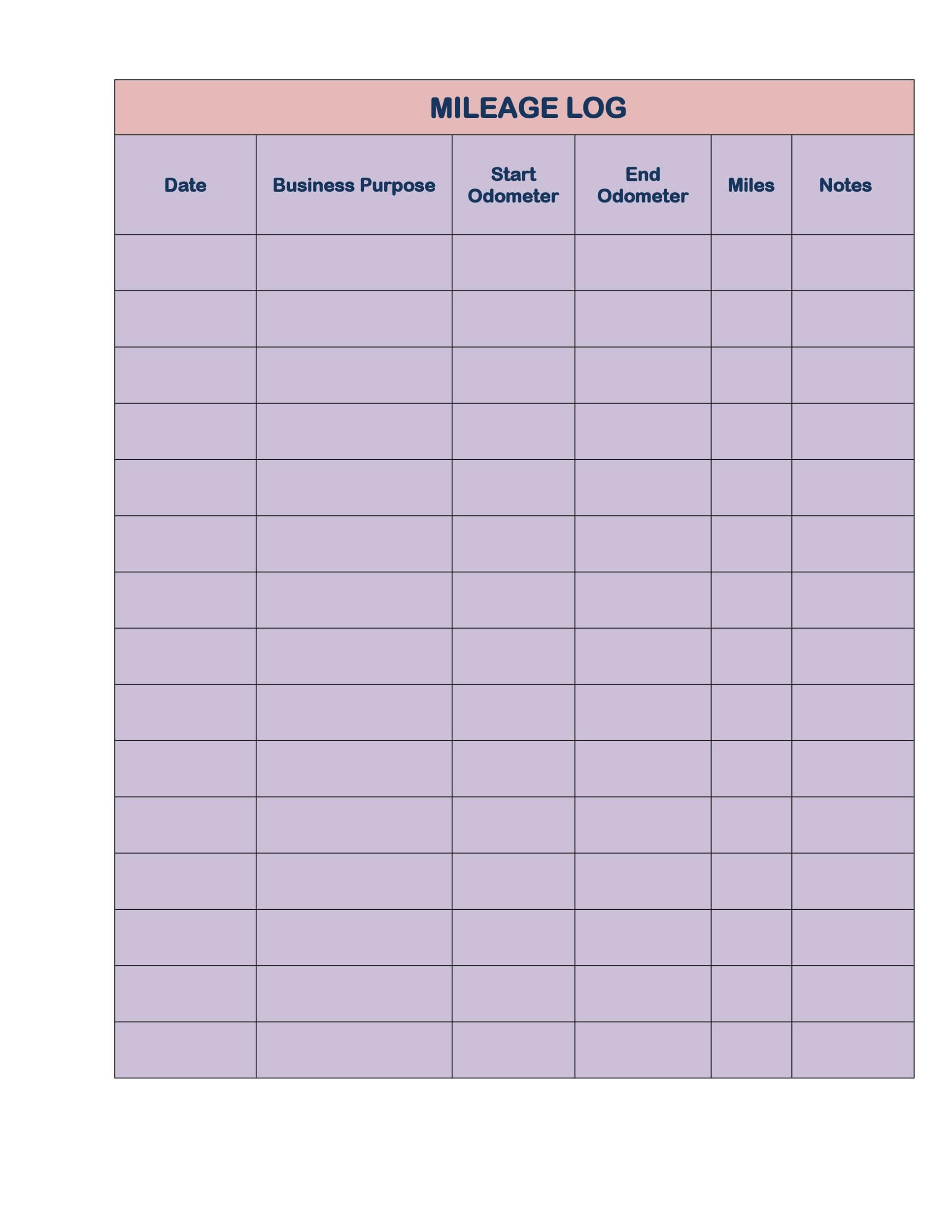

an employee office car mileage report sheet is a document that allows employees to record their business travel mileage. It typically includes fields for the date of the trip, starting and ending locations, the purpose of the trip, total mileage, and any additional notes. This sheet can be printed and filled out manually or filled out digitally using programs like Microsoft Excel or Google Sheets.

By using a standardized mileage report sheet, employees can easily track their business travel and provide accurate information to their employers. This ensures that employees are properly reimbursed for their mileage expenses and allows businesses to maintain accurate records for financial and tax purposes.

Why is an Employee’s Office Car Mileage Report Sheet Important?

Keeping track of business travel mileage is important for several reasons:

- Accurate expense reimbursement: A mileage report sheet helps ensure that employees are reimbursed accurately for their business travel expenses. By recording the mileage for each trip, employees can provide evidence of their travel expenses and receive the appropriate reimbursement.

- Financial recordkeeping: Businesses need to maintain accurate financial records, including records of business travel expenses. A mileage report sheet provides a detailed record of each trip, making it easier for businesses to track and report their expenses.

- Tax deductions: Both individuals and businesses can claim tax deductions for business-related travel. A mileage report sheet provides the necessary documentation to support these deductions.

- Audit protection: In the event of an audit, businesses may be required to provide documentation for their expenses. A mileage report sheet serves as evidence of business-related travel and can help protect against potential penalties or fines.

How to Create an Employee Office Car Mileage Report Sheet

Creating an employee office car mileage report sheet is relatively straightforward. Here are the steps to follow:

- Choose a format: Decide whether you want to create a sheet that can be filled out manually or a digital template that can be filled out electronically.

- Determine the necessary fields: Identify the information you want employees to record, such as the date of the trip, starting and ending locations, purpose of the trip, and total mileage.

- Create the template: Use a program like Microsoft Excel or Google Sheets to create a table with the appropriate fields. You can also search for pre-made templates online that can be customized to fit your specific needs.

- Add additional fields or notes: Consider including additional fields or notes for employees to provide more context or details about their trips.

- Design the sheet: Make sure the sheet is visually appealing and easy to read. Use fonts and colors that are legible and consider adding your company logo or branding elements.

- Print or share the template: Once the template is complete, you can print copies for employees to fill out manually or share a digital copy that employees can fill out electronically.

Remember to provide clear instructions to employees on how to fill out the mileage report sheet and where to submit it once completed.

Tips for Successful Mileage Tracking

Here are some tips to ensure successful mileage tracking:

- Record trips promptly: Encourage employees to fill out the mileage report sheet as soon as possible after each trip to ensure accuracy and prevent forgetting important details.

- Be specific: Instruct employees to provide specific details about their trips, such as the purpose of the trip and any additional notes that may be relevant for reimbursement or recordkeeping purposes.

- Regularly review and audit: Regularly review the mileage report sheets submitted by employees to ensure accuracy and compliance with company policies. Conduct occasional audits to verify the information provided.

- Keep supporting documentation: In addition to the mileage report sheet, employees should keep supporting documentation, such as receipts for gas or tolls, to further validate their travel expenses.

- Stay up to date with tax regulations: Tax regulations regarding mileage deductions may change over time. Stay informed to ensure compliance and maximize tax benefits.

- Train employees: Provide training to employees on how to accurately fill out the mileage report sheet and explain the importance of proper mileage tracking.

- Implement a digital solution: Consider using a digital mileage tracking solution that automatically calculates mileage and integrates with expense management systems for streamlined reporting and reimbursement processes.

Free Car Mileage Report Template!

An employee office car mileage report sheet is a valuable tool for businesses and employees alike. It simplifies the process of tracking business travel mileage, ensuring accurate expense reimbursement, maintaining financial records, and supporting tax deductions.

By following the tips provided and implementing a standardized mileage report sheet, businesses can streamline their mileage tracking processes and ensure compliance with regulations. This ultimately leads to better financial management and a more efficient operation overall.

Employee’s Office Car Mileage Report Sheet Template Excel – Download