As a business owner, it is crucial to understand the importance of providing a security deposit refund receipt to your customers. A security deposit is a common practice in many industries, such as rental properties, car rentals, and even certain types of services. It serves as a form of insurance for the business, protecting them against any potential damages or losses caused by the customer.

However, returning the security deposit to the customer is equally important, as it establishes trust and strengthens your relationship with them. By providing a security deposit refund receipt, you not only fulfill your legal obligations but also demonstrate professionalism and transparency. In this article, we will explore the significance of a security deposit refund receipt and how to create one effectively.

What is a Security Deposit Refund Receipt?

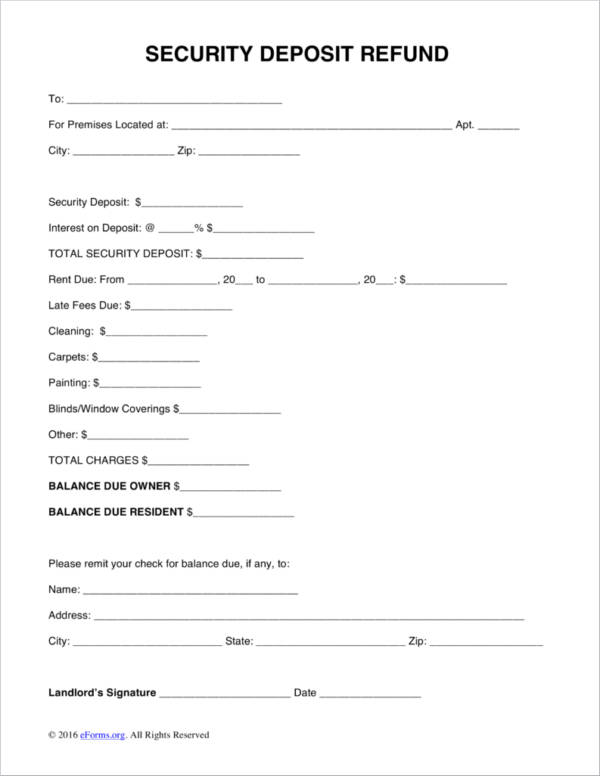

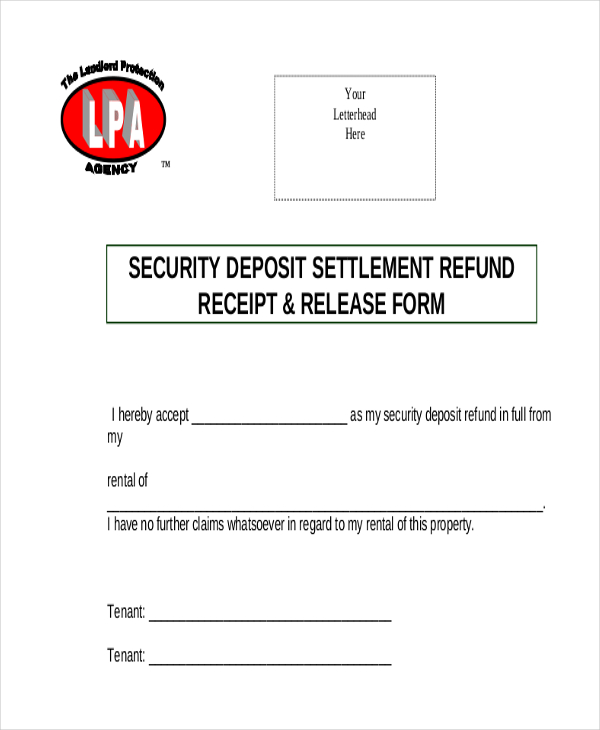

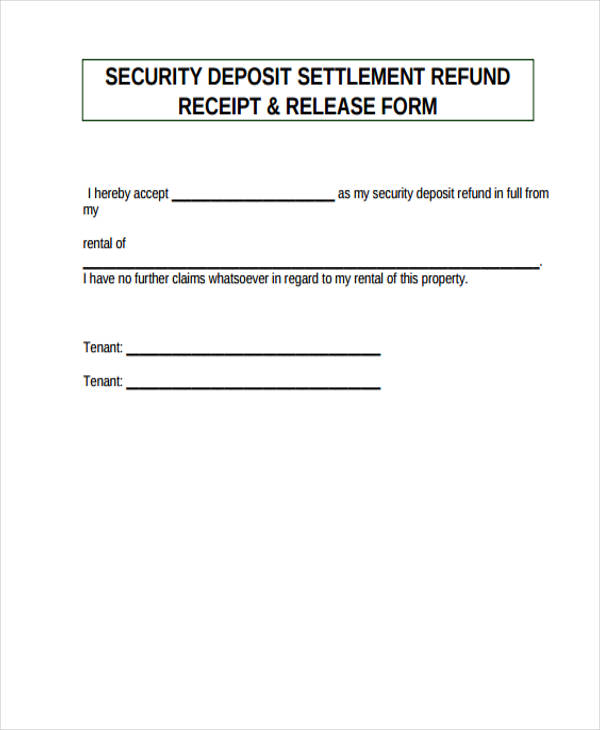

A security deposit refund receipt is a document provided to a customer when their security deposit is returned by a business. It serves as proof of the refund and outlines the details of the transaction. The receipt typically includes information such as the amount refunded, the date of the refund, and any deductions made for damages or outstanding payments.

By providing a security deposit refund receipt, you not only ensure transparency but also protect yourself from any potential disputes or misunderstandings with the customer. It acts as a legal record of the transaction and can be used as evidence if any issues arise in the future.

Why Should You Provide a Security Deposit Refund Receipt?

Providing a security deposit refund receipt is not only a legal requirement in many jurisdictions but also a best practice for businesses. Here are some reasons why you should always provide a security deposit refund receipt:

- Transparency: A receipt provides clear documentation of the refund process, ensuring transparency between you and the customer.

- Proof of Payment: The receipt serves as proof that you have returned the security deposit to the customer.

- Dispute Resolution: In case of any disputes or disagreements, the receipt can be used as evidence to resolve the issue.

- Professionalism: Providing a receipt shows professionalism and attention to detail, enhancing your reputation as a business owner.

- Legal Compliance: In many jurisdictions, it is a legal requirement to provide a security deposit refund receipt to customers.

How to Create a Security Deposit Refund Receipt

Creating a security deposit refund receipt is a simple process that requires attention to detail and accuracy. Here are the steps to create an effective security deposit refund receipt:

1. Include Your Business Details

Start by including your business name, address, contact information, and any relevant identification numbers, such as a tax ID or business registration number. This information helps identify your business and provides credibility to the receipt.

2. State the Purpose of the Receipt

Clearly state that the document is a security deposit refund receipt. This ensures that both you and the customer are aware of the purpose of the document and its legal implications.

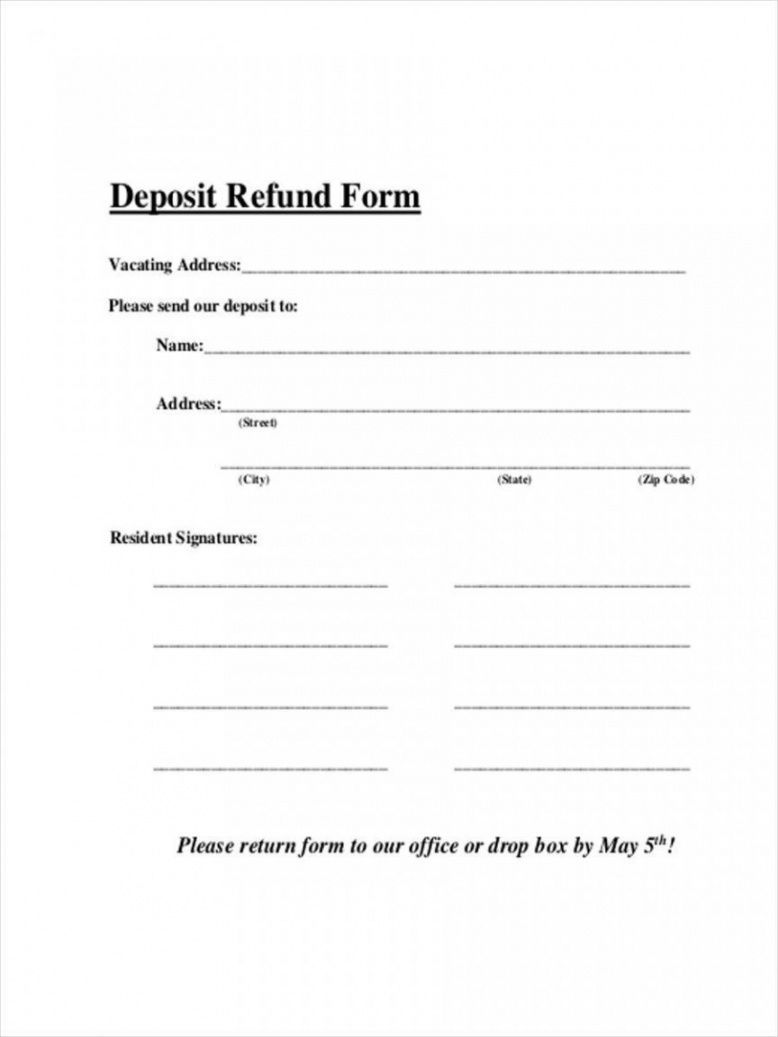

3. Provide Customer Details

Include the customer’s name, address, contact information, and any other relevant details that help identify them. This ensures that the receipt is specific to the customer and can be easily referenced in the future.

4. Specify the Amount Refunded

Clearly state the amount refunded to the customer. This should match the original security deposit amount, minus any deductions for damages or outstanding payments.

5. Include the Date of the Refund

Specify the date on which the refund was issued to the customer. This helps establish a timeline and acts as a reference point for both parties.

6. Outline Deductions (if any)

If there were any deductions made from the security deposit, clearly outline them in the receipt. This includes any damages or outstanding payments that were deducted from the refund amount.

7. Provide a Signature Line

Include a signature line for both you and the customer to sign and date the receipt. This adds an extra layer of authenticity and ensures that both parties acknowledge the refund.

8. Keep a Copy for Your Records

Make sure to keep a copy of the security deposit refund receipt for your records. This is essential for future reference and can be used to resolve any disputes or inquiries that may arise.

Example of a Security Deposit Refund Receipt

Here is an example of how a security deposit refund receipt should look:

[Your Business Name]

[Your Business Address]

[Your Business Contact Information]

[Your Business Tax ID or Registration Number]

Security Deposit Refund Receipt

Customer Details:

[Customer Name]

[Customer Address]

[Customer Contact Information]

Amount Refunded: [Amount]

Date of Refund: [Date]

Deductions:

- [Deduction Reason 1]: [Deduction Amount 1]

- [Deduction Reason 2]: [Deduction Amount 2]

- [Deduction Reason 3]: [Deduction Amount 3]

Signature:

_____________________________

[Your Name], [Your Position]

Date: [Date]

_____________________________

[Customer Name]

Date: [Date]

Final Thoughts

Providing a security deposit refund receipt is not only a legal requirement but also a best practice for businesses. It establishes trust, ensures transparency, and protects you from any potential disputes or misunderstandings with the customer. By following the steps outlined in this article, you can create an effective security deposit refund receipt that strengthens your relationship with your customers and enhances your professionalism as a business owner.

Security Deposit Refund Receipt Template Word – Download