What is a Nanny Receipt?

A nanny receipt is a document that serves as proof of payment for the services provided by a nanny or caregiver. As a business owner who employs a nanny, it is essential to maintain accurate and detailed records of these payments. Not only does it help you track your expenses, but it also ensures compliance with tax regulations and provides transparency for both you and your nanny.

Why is a Nanny Receipt Important?

Creating and providing nanny receipts is crucial for several reasons:

- Legal Compliance: Keeping nanny receipts helps you comply with tax laws and regulations. It ensures that you accurately report your expenses and fulfill your obligations as an employer.

- Transparency: Providing nanny receipts to your caregiver demonstrates transparency and professionalism. It establishes a clear record of payment and helps prevent any misunderstandings or disputes.

- Tax Deductions: Nanny expenses may qualify for tax deductions or credits, depending on your location. Having proper receipts will support your claims and potentially save you money.

- Financial Management: Nanny receipts allow you to track your expenses and budget effectively. It provides a clear overview of your childcare costs, helping you make informed financial decisions.

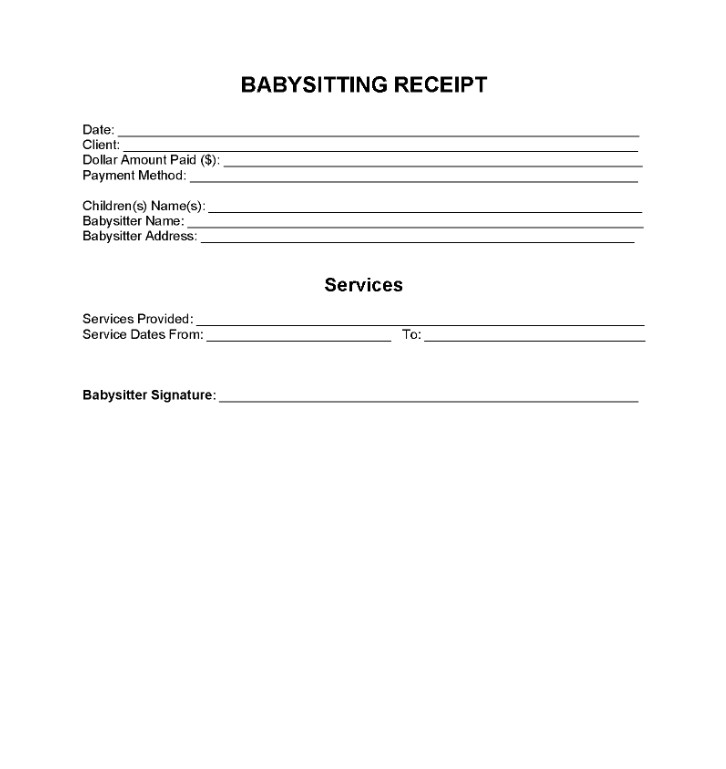

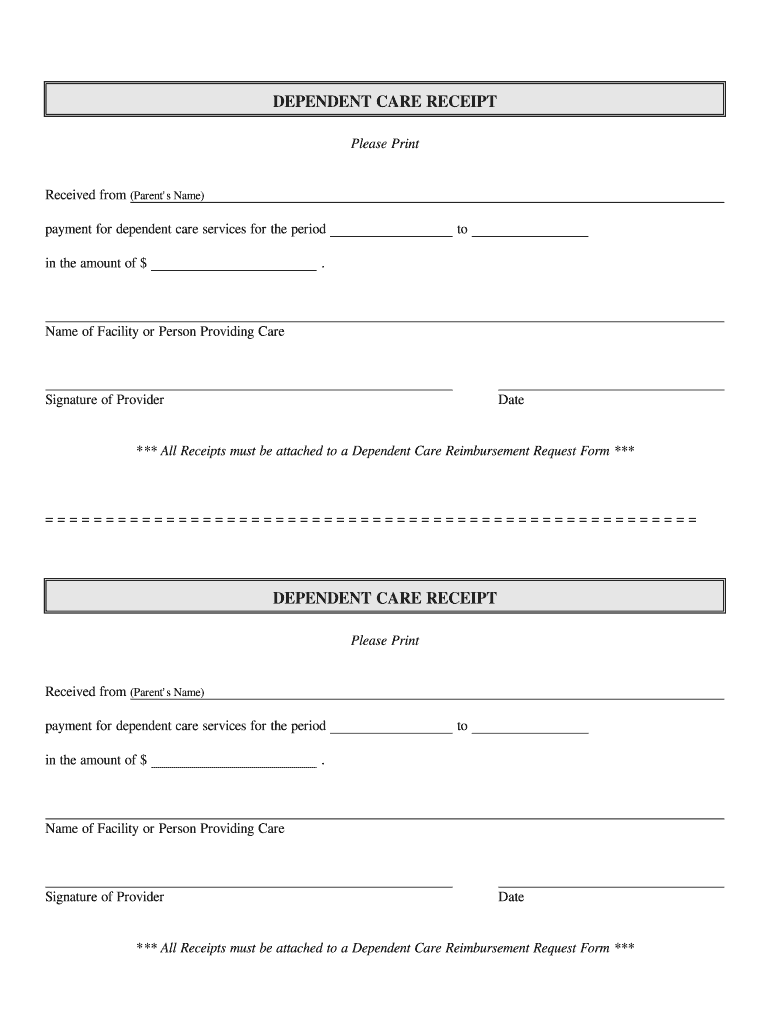

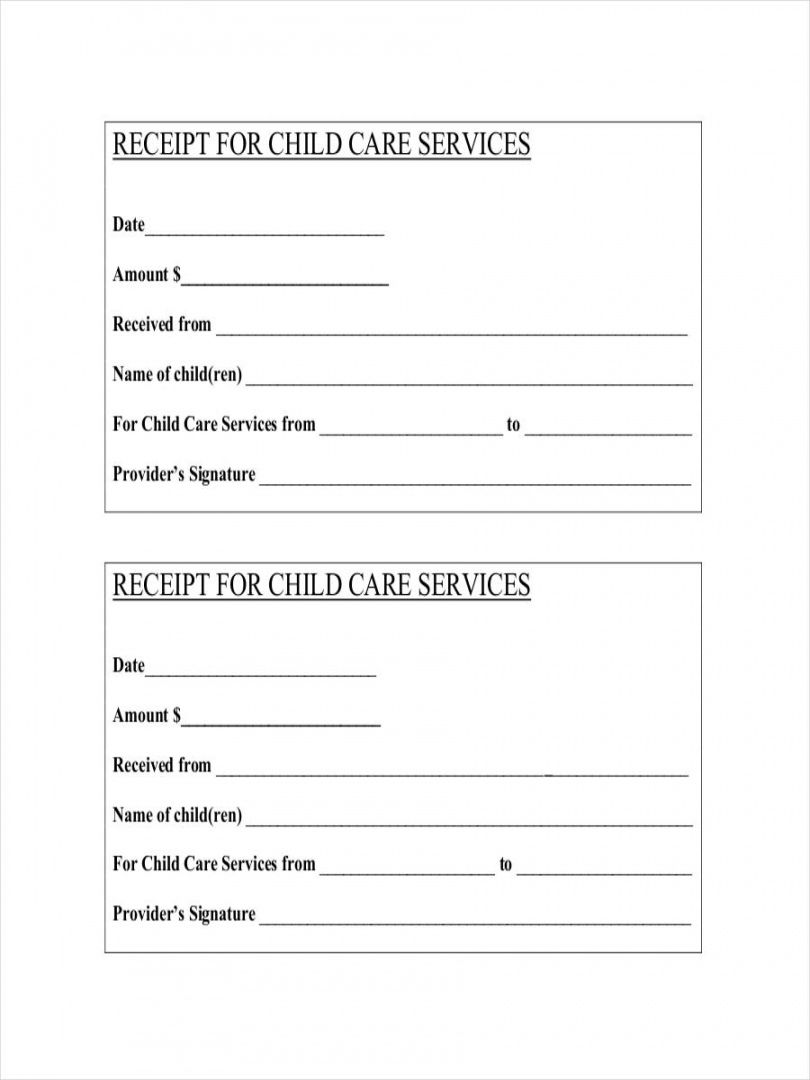

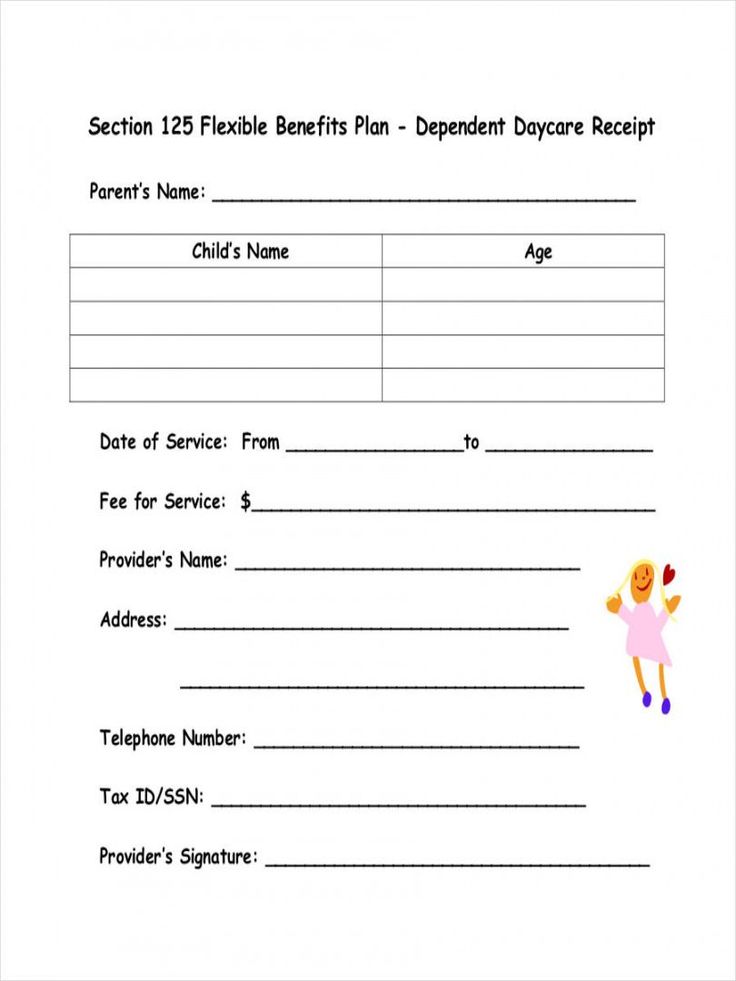

What Should a Nanny Receipt Include?

A comprehensive nanny receipt should contain the following information:

- Date: The date when the payment was made.

- Business Information: Your business name, address, and contact details.

- Nanny Information: The nanny’s name, address, and contact details.

- Payment Details: The amount paid, the payment method (cash, check, or electronic transfer), and the purpose of the payment (weekly, monthly, etc.).

- Tax Information: Your tax identification number (if applicable) and any relevant tax codes or references.

- Signatures: Both your signature and the nanny’s signature, acknowledging the payment.

How to Create a Nanny Receipt?

Creating a nanny receipt is a straightforward process. You can either create one from scratch using word processing software or use a template available online. Here’s a step-by-step guide:

- Choose a Format: Decide on the format you prefer, such as a document or spreadsheet.

- Add Business Information: Include your business name, address, and contact details at the top of the receipt.

- Include Nanny Information: Enter the nanny’s name, address, and contact details below your business information.

- Specify Payment Details: Clearly state the payment amount, payment method, and purpose of the payment.

- Add Tax Information: If applicable, include your tax identification number and any relevant tax codes.

- Leave Space for Signatures: Create a section at the bottom of the receipt for both your signature and the nanny’s signature.

- Proofread and Print: Review the receipt for accuracy and then print multiple copies for your records.

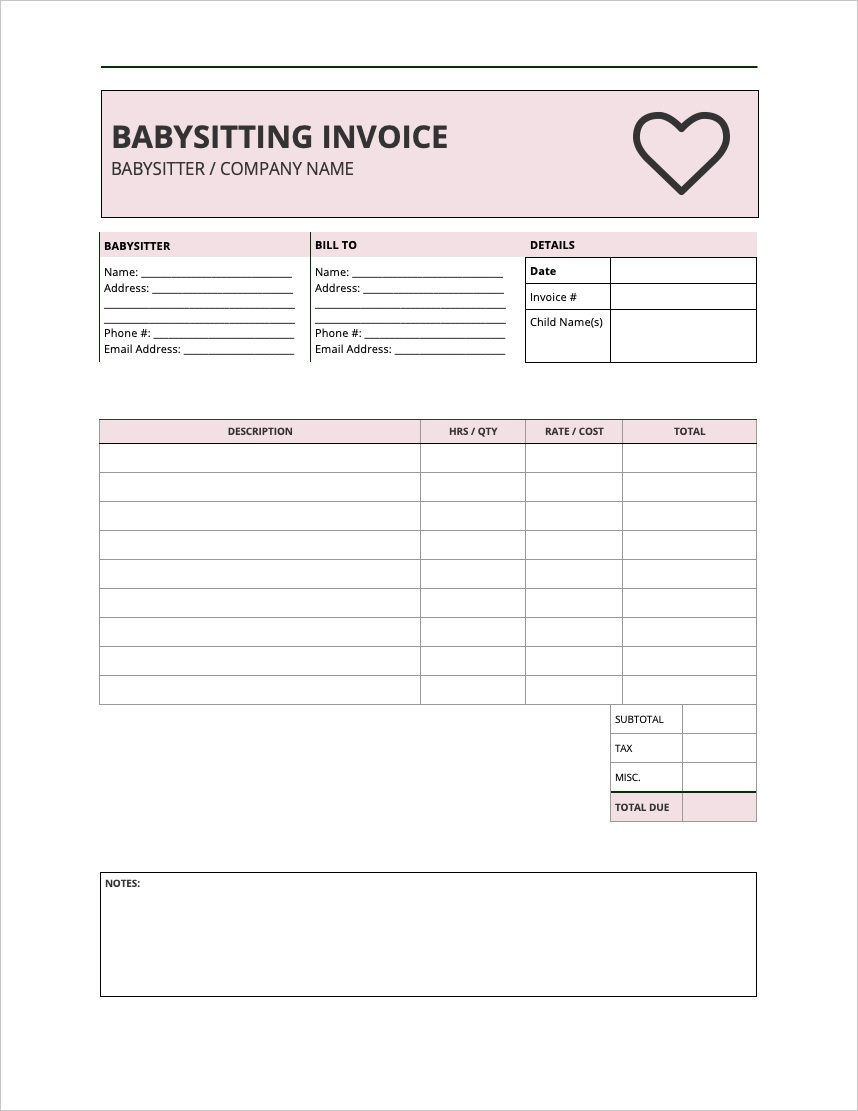

Sample Nanny Receipt

Here’s an example of how a nanny receipt may look:

- Date: January 1, 2022

- Business Information: ABC Childcare Services

123 Main Street

Anytown, USA

Phone: 123-456-7890

Email: [email protected] - Nanny Information: Jane Smith

456 Elm Street

Anytown, USA

Phone: 987-654-3210 - Payment Details: Amount: $500

Payment Method: Cash

Payment Period: Weekly - Tax Information: Tax ID: 1234567890

- Signatures:___________________________ (Business Owner)

___________________________ (Nanny)

Please note that this is just a sample, and you should customize it to fit your specific needs and requirements.

Tips for Keeping Nanny Receipts Organized

Managing your nanny receipts can be made easier by following these tips:

- Digitize Receipts: Consider scanning or taking pictures of your receipts and storing them digitally. This saves physical space and allows for easy access and organization.

- Create a Filing System: Establish a system for storing and organizing your receipts. Use folders or envelopes labeled with the nanny’s name and payment period for easy retrieval.

- Maintain a Record Book: Keep a record book or spreadsheet where you can log all the payments made to your nanny. Include dates, payment amounts, and any other relevant details.

- Backup Your Data: Regularly back up your digital files to prevent loss in case of computer malfunctions or data corruption.

- Consult with a Professional: If you’re unsure about tax regulations or need assistance with record-keeping, consider consulting with a tax professional or accountant.

In Conclusion

As a business owner employing a nanny, it is essential to maintain proper documentation, including nanny receipts. These receipts not only ensure legal compliance but also provide transparency and help with financial management. By following the tips mentioned above and creating detailed nanny receipts, you can effectively manage your childcare expenses and maintain a healthy professional relationship with your nanny.

Nanny Receipt Template Word – Download