As a business owner, there are many expenses you need to keep track of to effectively manage your finances. One often overlooked expense is the cost of fuel for your vehicles or equipment. Gas receipts are an essential tool for business owners to track and document these expenses.

In this article, we will explore the importance of gas receipts and how they can benefit your business.

Why Do Gas Receipts Matter?

Gas receipts serve as proof of purchase and can be used as a valuable record for tax purposes. They provide evidence of your business expenses and can help you claim deductions, ultimately reducing your taxable income. Without gas receipts, it can be difficult to accurately calculate your fuel costs and potentially miss out on valuable tax benefits.

Gas receipts also play a crucial role in tracking your business expenses and maintaining accurate financial records. By keeping track of your fuel costs, you can monitor your spending patterns, identify any discrepancies, and make informed decisions about your budget. Additionally, gas receipts can be used as evidence in case of an audit or legal dispute, providing you with the necessary documentation to support your claims.

What Information Should Gas Receipts Include?

Gas receipts should contain specific details to ensure their validity and usefulness. The following information should be present on your gas receipt:

- Date and time: The date and time of the purchase should be clearly stated on the receipt.

- Location: The name and address of the gas station or establishment where the purchase was made.

- Amount: The total amount paid for the fuel should be indicated on the receipt.

- Gallons/liters: The quantity of fuel purchased, measured in gallons or liters, should be included.

- Vehicle: If the fuel was purchased for a specific vehicle or equipment, it’s helpful to note the vehicle’s details, such as the license plate number or equipment identification number.

Having all of this information on your gas receipts ensures that they are accurate and can be easily referenced when needed.

How to Organize and Store Gas Receipts

It’s important to establish a system for organizing and storing your gas receipts to ensure easy access and retrieval. Here are some tips to help you effectively manage your gas receipts:

- Create a dedicated folder: Designate a folder specifically for your gas receipts. This will help keep them separate from other receipts and documents.

- Sort by date: Arrange your gas receipts in chronological order to make it easier to locate specific receipts when needed.

- Digitize your receipts: Consider using a receipt scanning app or software to digitize your gas receipts. This will help reduce paper clutter and make it easier to search for specific receipts.

- Backup your digital receipts: If you choose to digitize your gas receipts, ensure that you have a reliable backup system in place. This will protect your receipts from loss or damage.

- Keep a log: Consider maintaining a log or spreadsheet to track your gas expenses. This can serve as an additional reference tool and make it easier to calculate your total fuel costs.

By organizing and storing your gas receipts effectively, you can streamline your record-keeping process and save time when it comes to tax preparation or financial analysis.

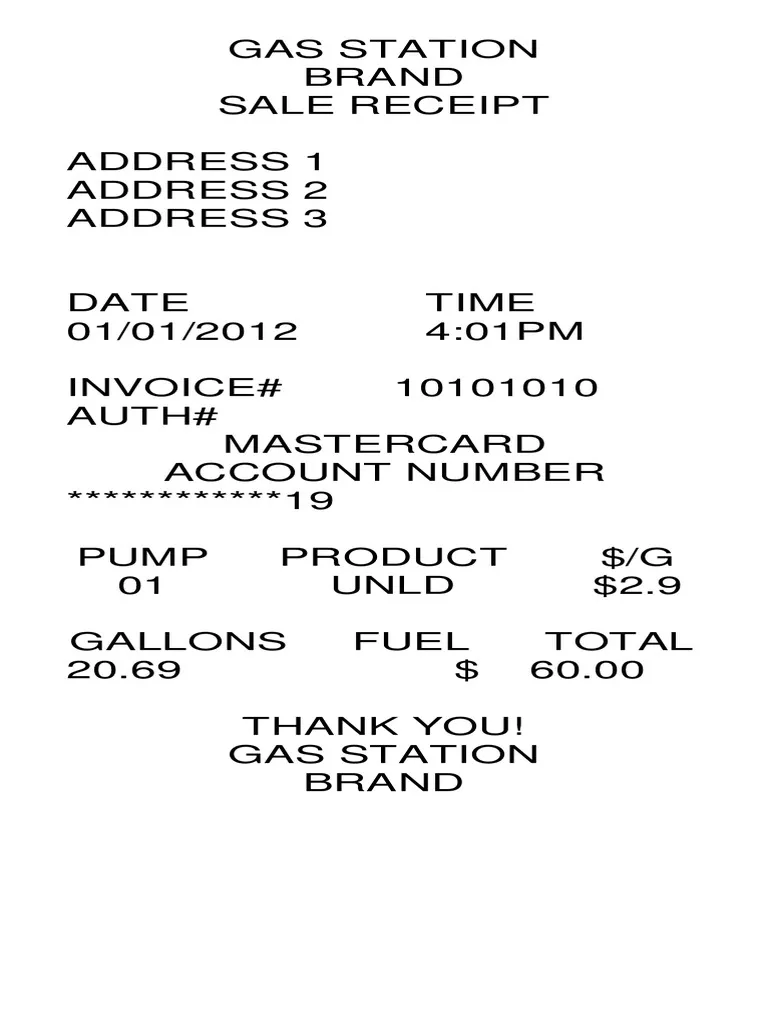

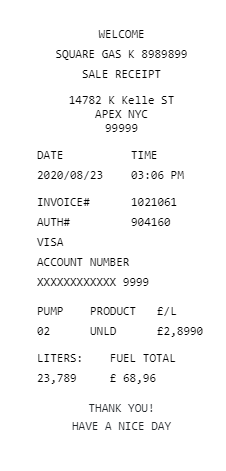

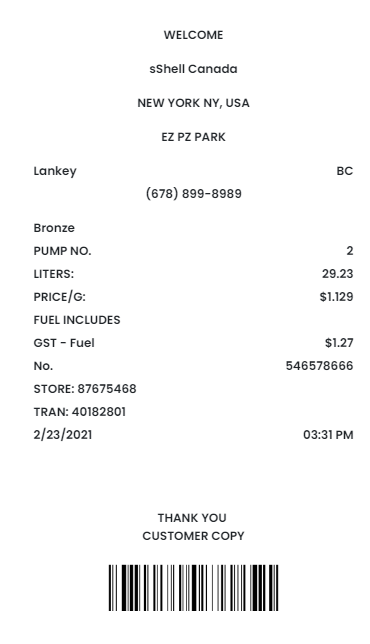

Sample Gas Receipt

Here is an example of how a gas receipt should look:

Date: January 15, 2022

Time: 12:30 PM

Location: ABC Gas Station

Address: 123 Main Street, Anytown, USA

Amount: $50.00

Gallons: 10.5

Vehicle: License Plate XYZ123

Ensure that your gas receipts include all the necessary details as shown in the sample above.

The Benefits of Gas Receipts

Gas receipts offer several benefits for business owners:

- Accurate financial records: Gas receipts help ensure that your financial records are accurate and up to date. By keeping track of your fuel expenses, you can easily monitor your spending and identify any discrepancies.

- Tax deductions: Gas receipts serve as evidence for claiming tax deductions related to your business’s fuel expenses. This can help reduce your taxable income and potentially save you money.

- Evidence in case of disputes: In case of an audit or legal dispute, gas receipts can provide vital evidence to support your claims and protect your business’s interests.

- Budgeting and cost analysis: By analyzing your gas receipts, you can gain insights into your fuel costs and make informed decisions about budgeting and cost management.

- Compliance with regulations: Properly documenting your fuel expenses with gas receipts ensures compliance with tax and accounting regulations.

Overall, gas receipts are a valuable tool for business owners to track, document, and manage their fuel expenses. They provide financial and legal benefits while helping you maintain accurate records and make informed decisions about your business’s budget and expenses.

Conclusion

Gas receipts are an essential part of managing your business’s finances. They serve as proof of purchase, aid in tax deductions, and help you monitor and analyze your fuel expenses. By organizing and storing your gas receipts properly, you can ensure easy access and retrieval when needed. Make sure to include all the necessary information on your gas receipts and keep them separate from other receipts. By utilizing gas receipts effectively, you can maintain accurate financial records, comply with regulations, and make informed decisions about your business’s budget and expenses.

Gas Receipt Template Excel – Download