Managing employee salaries can be a complex task for any organization. From calculating deductions to ensuring accurate payments, there are many factors to consider. To streamline this process, many businesses use employee salary calculation sheets.

This article will explore what these sheets are, why they are essential, how to create one, and provide useful tips for successful salary management.

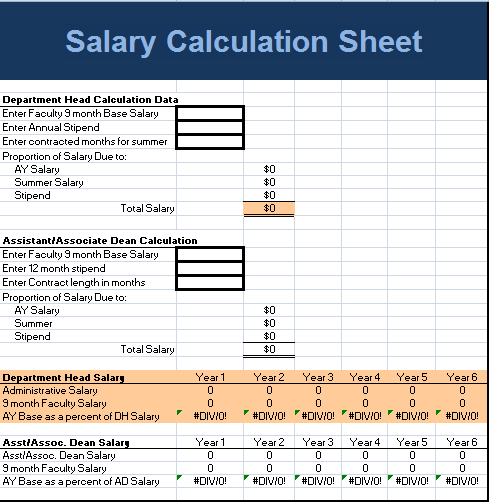

What is an Employee Salary Calculation Sheet?

An employee salary calculation sheet is a document that helps businesses calculate and record employee salaries. It includes various components such as basic salary, allowances, deductions, and net pay.

This sheet serves as a comprehensive tool to ensure accurate salary calculations and maintain transparency.

Why are Employee Salary Calculation Sheets Essential?

employee salary calculation sheets are essential for several reasons:

- Accuracy: These sheets help ensure accurate salary calculations, reducing the chances of errors or discrepancies.

- Transparency: By providing a detailed breakdown of salary components, these sheets promote transparency between employers and employees.

- Record-keeping: salary calculation sheets serve as a record of salary calculations, facilitating easy reference and documentation.

- Compliance: These sheets help businesses comply with legal requirements by ensuring accurate deductions and payments.

How to Create an Employee Salary Calculation Sheet

Creating an employee salary calculation sheet involves several steps:

- Gather employee information: Collect all necessary information, such as employee names, employee IDs, basic salary, allowances, and deductions.

- Identify salary components: Determine the various components that make up an employee’s salary, such as basic salary, overtime, bonuses, and incentives.

- Calculate deductions: Calculate deductions such as taxes, health insurance premiums, retirement contributions, and loan repayments.

- Calculate net pay: Subtract the total deductions from the total salary to arrive at the net pay amount.

- Design the sheet: Use spreadsheet software or a template to design the employee salary calculation sheet. Include appropriate headings, columns, and rows to organize the information.

- Enter employee data: Input the gathered employee information into the designated cells of the sheet.

- Calculate salaries: Use formulas or functions in the spreadsheet software to automatically calculate salaries based on the entered data.

- Review and finalize: Double-check all calculations and ensure the sheet accurately reflects each employee’s salary details.

- Print and distribute: Print the finalized salary calculation sheet and distribute it to the respective employees.

Tips for Successful Salary Management

Managing employee salaries effectively is crucial for maintaining employee satisfaction and organizational success. Here are some tips for successful salary management:

- Stay updated with labor laws: Stay informed about labor laws and regulations to ensure compliance with minimum wage requirements, overtime rules, and other legal obligations.

- Regularly review and update salary structures: Regularly assess and update salary structures to ensure competitiveness in the job market and retain top talent.

- Communicate transparently: Maintain open and transparent communication with employees regarding salary components, changes, and any other related matters.

- Automate salary calculations: Use software or tools that automate salary calculations to minimize errors and save time.

- Regularly audit salary calculations: Conduct periodic audits to ensure accuracy in salary calculations and identify any discrepancies.

- Provide clear salary statements: Issue detailed salary statements to employees, clearly outlining each component and the calculation method.

- Train HR personnel: Provide training to HR personnel responsible for salary management to ensure they have the necessary knowledge and skills.

- Seek professional assistance if needed: If salary management becomes too complex, consider seeking professional assistance from accountants or payroll service providers.

Free Employee Salary Calculation Sheet Template!

An employee salary calculation sheet is a valuable tool for businesses to accurately calculate and manage employee salaries. By following the steps mentioned in this article, businesses can create their salary calculation sheets and streamline their salary management processes.

Implementing the provided tips for successful salary management will contribute to improved employee satisfaction and organizational success.

Employee Salary Calculation Sheet Template Excel – Download