A debt verification letter is a written request sent by a consumer to a debt collector or creditor to verify the legitimacy of a debt. It is a crucial tool in protecting consumers’ rights and ensuring that they are not being unfairly pursued for debts they may not owe.

When a consumer receives a debt collection notice or is contacted by a debt collector, they have the right to request debt verification. This is important because debt collectors sometimes make mistakes or pursue debts that are not valid. A debt verification letter allows consumers to challenge the validity of a debt and request evidence to support the claim.

Why Do You Need a Debt Verification Letter?

There are several reasons why you may need a debt verification letter:

- To protect your rights: The Fair Debt Collection Practices Act (FDCPA) gives consumers the right to request debt verification. By exercising this right, you can ensure that debt collectors are following the law and not engaging in unfair or deceptive practices.

- To dispute a debt: If you believe that you do not owe the debt, a debt verification letter provides an opportunity to challenge its validity. Debt collectors must provide evidence that you owe the debt, and if they cannot provide sufficient proof, they may be required to cease collection efforts.

- To prevent identity theft: Sometimes, debt collection notices may be the result of identity theft or mistaken identity. By requesting debt verification, you can confirm whether the debt is yours or if it is a case of mistaken identity.

- To negotiate a settlement: If you do owe the debt but are unable to pay the full amount, a debt verification letter can be used as a starting point for negotiating a settlement. By requesting detailed information about the debt, you can better understand your options for resolving it.

When Should You Send a Debt Verification Letter?

You should send a debt verification letter as soon as you receive a debt collection notice or are contacted by a debt collector. The FDCPA gives you 30 days from the initial contact to request debt verification. It is important to act within this time frame to protect your rights.

Additionally, if you are unsure about the validity of a debt or if you believe there may be errors or inaccuracies, it is wise to send a debt verification letter. It is always better to be proactive and address any concerns early on, rather than letting the situation escalate.

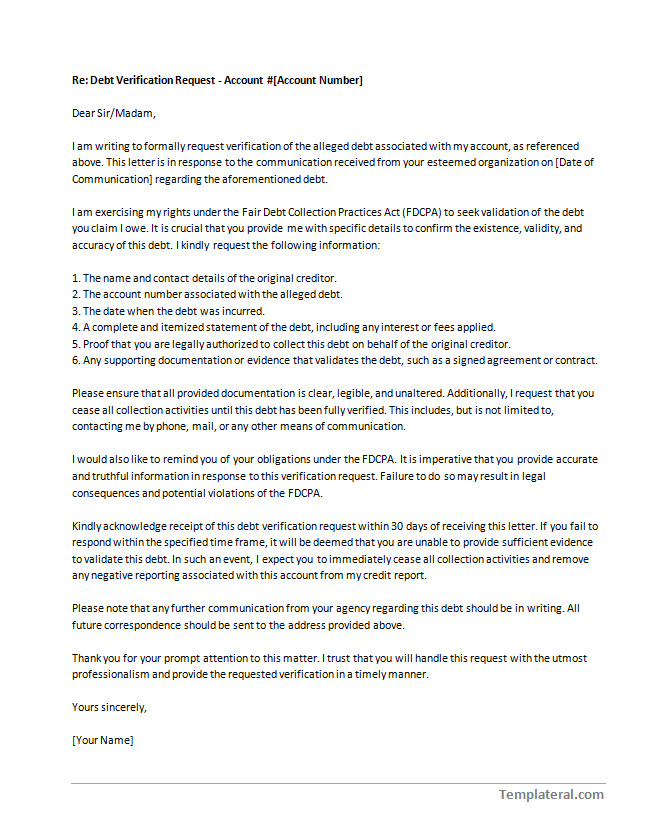

What to Include in a Debt Verification Letter

When writing a debt verification letter, several key elements should be included:

- Your contact information: Include your name, address, and phone number at the top of the letter.

- Date: Indicate the date the letter is being sent.

- Creditor’s information: Provide the name and address of the creditor or debt collector.

- Account information: Include any relevant account numbers or references provided in the debt collection notice.

- Description of the debt: Clearly state that you are requesting debt verification and provide a brief description of the debt in question.

- Request for evidence: Ask the creditor or debt collector to provide documentation that proves you owe the debt. This can include copies of the original contract, account statements, or any other relevant records.

- Deadline: Specify a reasonable deadline for the creditor or debt collector to respond to your request. The Consumer Financial Protection Bureau suggests giving them 30 days to provide the requested information.

- Proof of delivery: Keep a copy of the letter and send it via certified mail with a return receipt requested. This will provide proof that the letter was received by the creditor or debt collector.

How to Write a Debt Verification Letter

When writing a debt verification letter, it is important to keep the following tips in mind:

- Be clear and concise: Clearly state that you are requesting debt verification and provide all necessary information concisely.

- Use a professional tone: Keep the tone of the letter polite and professional, even if you are frustrated or angry about the debt collection notice.

- Provide specific details: Be specific about the debt in question and what you are requesting from the creditor or debt collector.

- Keep copies of all correspondence: Make copies of the letter and any other documents related to the debt verification process for your records.

- Consult with a legal professional: If you are unsure about how to write a debt verification letter or if you need assistance with the debt verification process, consider consulting with a lawyer who specializes in consumer law.

Mistakes to Avoid

When writing a debt verification letter, it is important to avoid the following mistakes:

- Using aggressive or confrontational language: Keep the tone of the letter professional and avoid using aggressive or confrontational language.

- Providing unnecessary personal information: Only provide the information that is necessary to request debt verification. Avoid including personal or financial details that are not relevant to the debt in question.

- Missing the deadline: Be sure to specify a reasonable deadline for the creditor or debt collector to respond to your request and keep track of the deadline. If they fail to respond within the specified time frame, you may have grounds to dispute the debt.

- Not keeping copies of all correspondence: It is crucial to keep copies of all letters and documents related to the debt verification process. This will help you track the progress of your request and provide evidence if needed in the future.

By following these guidelines and utilizing a debt verification letter, you can protect your rights as a consumer and ensure that you are not being unfairly pursued for a debt. Remember to stay proactive and take action as soon as you receive a debt collection notice or are contacted by a debt collector.

Download: Debt Verification Letter Template