When it comes to managing our finances, having a bank account is an essential part of our lives. However, there may come a time when you need to close your bank account for various reasons. In such cases, it is important to follow the proper procedure and notify your bank by writing a bank account termination letter. This article will guide you through the process of writing a bank account termination letter, including why you might need one, what to include in the letter, and how to write it effectively.

What is a Bank Account Termination Letter?

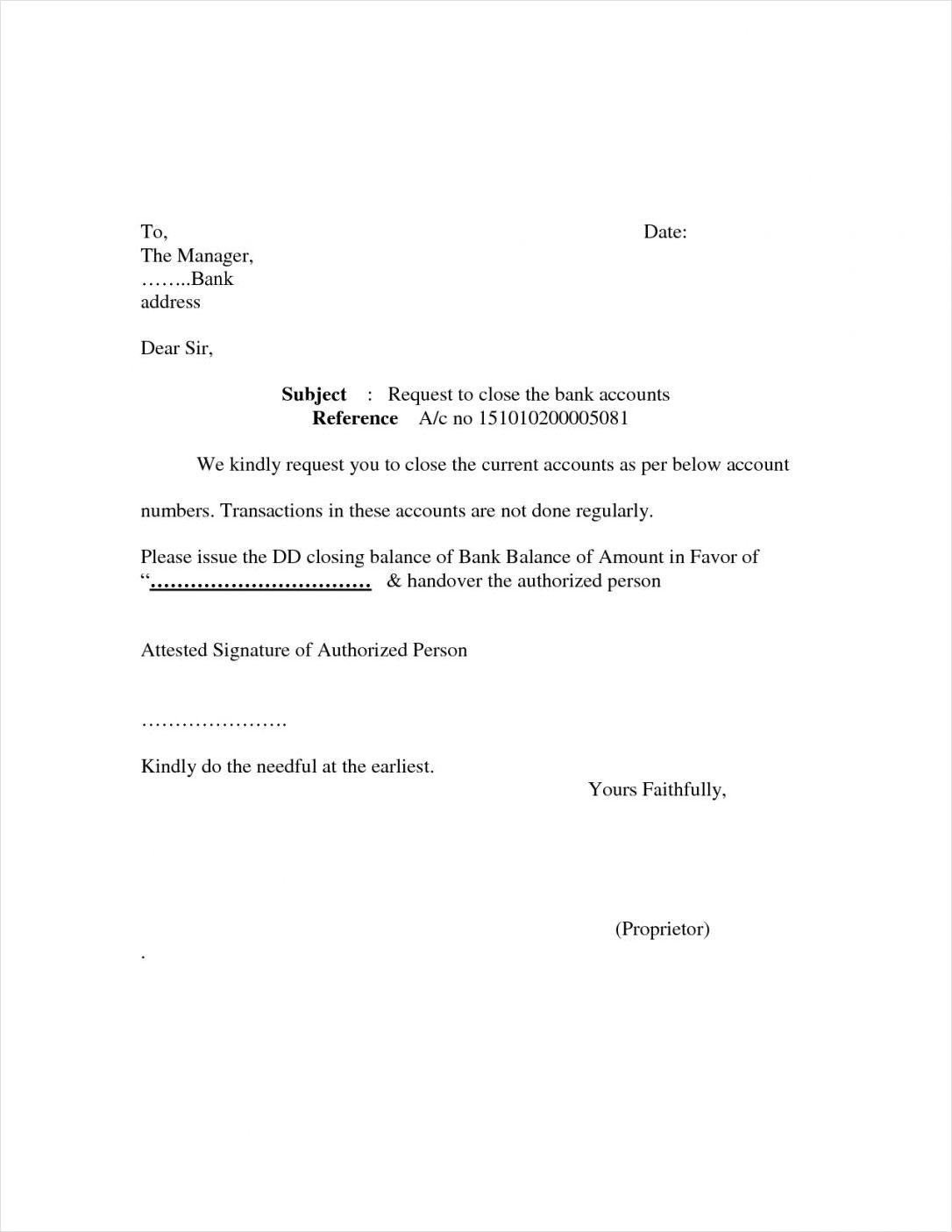

A bank account termination letter is a formal document that is used to request the closure of a bank account. It serves as a written confirmation of your intention to close the account, providing necessary details to the bank for their records. This letter is an important step in the account closure process and ensures that all parties involved are informed about the termination.

Why Do You Need a Bank Account Termination Letter?

There are several reasons why you might need to write a bank account termination letter. Some common situations include:

- Switching banks: If you decide to switch banks and open a new account elsewhere, you will need to close your existing account. A bank account termination letter is necessary to inform your current bank about your decision.

- Closure of an unused account: If you have an account that you no longer use, it is advisable to close it to avoid any potential fees or fraudulent activity. A bank account termination letter ensures that the closure is documented and confirmed by the bank.

- Relocation: If you are moving to a new location where your current bank does not have a branch, you may need to close your account. Writing a bank account termination letter will inform the bank of your relocation and your intention to close the account.

- Account consolidation: In some cases, you may have multiple bank accounts and decide to consolidate them into one. Closing the unnecessary accounts requires a bank account termination letter.

- Disputes or issues: If you have encountered any disputes or issues with your bank, closing your account may be the best solution. A bank account termination letter will formalize your request and provide a record of your dissatisfaction.

When Should You Write a Bank Account Termination Letter?

You should write a bank account termination letter when you have decided to close your account. It is important to give your bank sufficient notice, typically at least 30 days in advance, to ensure a smooth closure process. By providing a written notice, you can avoid any misunderstandings and ensure that the closure is processed correctly.

What to Include in a Bank Account Termination Letter?

When writing a bank account termination letter, it is crucial to include the following information:

- Your details: Start the letter by providing your full name, address, and contact information. This will help the bank identify your account and contact you if necessary.

- Account information: Include your account number and any other relevant details that will help the bank locate your account quickly.

- Reason for closure: Briefly explain the reason for closing your account. You can mention that you are switching banks, relocating, or any other valid reason.

- Confirmation request: Clearly state that you would like to receive written confirmation of the account closure. This will serve as proof that the closure has been processed.

- Instructions for remaining funds: If you have any remaining funds in your account, specify how you would like to receive them. You can request a check, electronic transfer, or any other suitable method.

- Contact information: Provide your contact information again at the end of the letter, making it easy for the bank to reach you if necessary.

How to Write a Bank Account Termination Letter?

When writing a bank account termination letter, follow these steps to ensure an effective and professional letter:

- Use a professional tone: Keep the tone of the letter formal and polite. Avoid using any offensive or confrontational language.

- Be concise and to the point: Clearly state your intention to close the account and provide the necessary details without unnecessary elaboration.

- Include all required information: Make sure to include your details, account information, reason for closure, and instructions for remaining funds.

- Proofread: Before sending the letter, carefully proofread it to check for any errors or typos. A well-written and error-free letter will leave a good impression.

- Send the letter: Once you have reviewed the letter, print it out and sign it. Send the letter to your bank through certified mail or deliver it in person to ensure it reaches the right department.

By following these steps and including all the necessary information, you can write an effective bank account termination letter that will facilitate the closure process.

Closing a bank account may seem like a daunting task, but with a well-written bank account termination letter, you can ensure a smooth and hassle-free closure. Remember to keep a copy of the letter for your records and follow up with your bank if you do not receive a confirmation within a reasonable timeframe. By following the proper procedure, you can close your bank account with confidence and move forward with your financial goals.

Bank Account Termination Letter Template Word – Download