If you’re a self-employed cleaner, it’s essential to have a streamlined invoicing process to ensure timely payment for your services. Invoicing not only helps you keep track of your earnings but also presents a professional image to your clients.

In this comprehensive guide, we’ll walk you through everything you need to know about self-employed cleaner invoices, including why you need them, how to create them, and what information to include. Whether you’re just starting or looking to improve your invoicing system, this guide has got you covered.

What is a self-employed cleaner invoice?

A self-employed cleaner invoice is a document that outlines the services you’ve provided to your clients and requests payment for those services. It serves as a record of the work completed and the amount owed, ensuring both you and your client are on the same page regarding payment terms. Invoices also provide a paper trail for accounting purposes and can be used as proof of income.

Why do self-employed cleaners need invoices?

As a self-employed cleaner, invoices are essential for several reasons:

- Professionalism: Invoices help you present a professional image to your clients, showcasing your commitment to professionalism and organization.

- Payment tracking: Invoices provide a clear record of the services you’ve provided and the corresponding payments, helping you keep track of your earnings.

- Tax purposes: Invoices serve as crucial documentation for tax purposes, ensuring you can accurately report your income and expenses.

- Dispute resolution: In the event of a payment dispute, having a detailed invoice can help resolve the issue quickly and fairly.

What information should be included in a self-employed cleaner invoice?

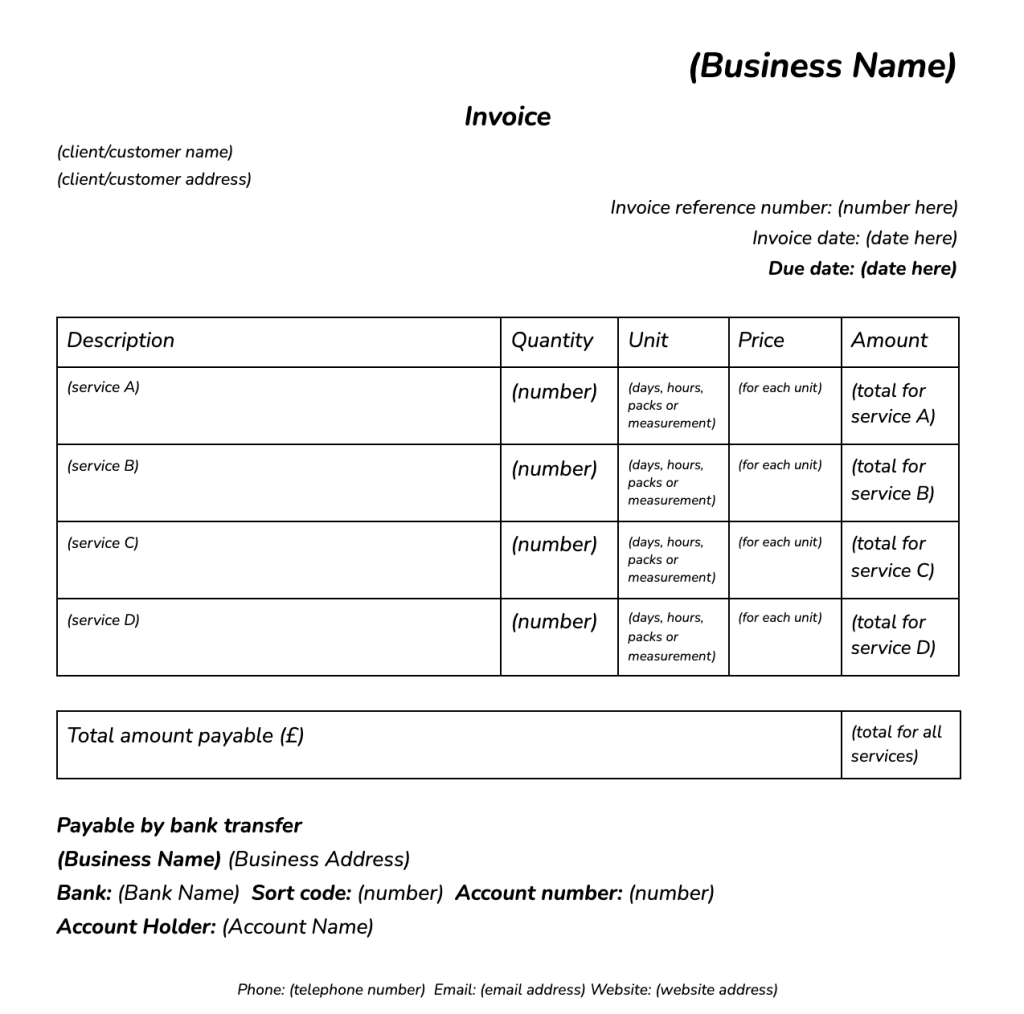

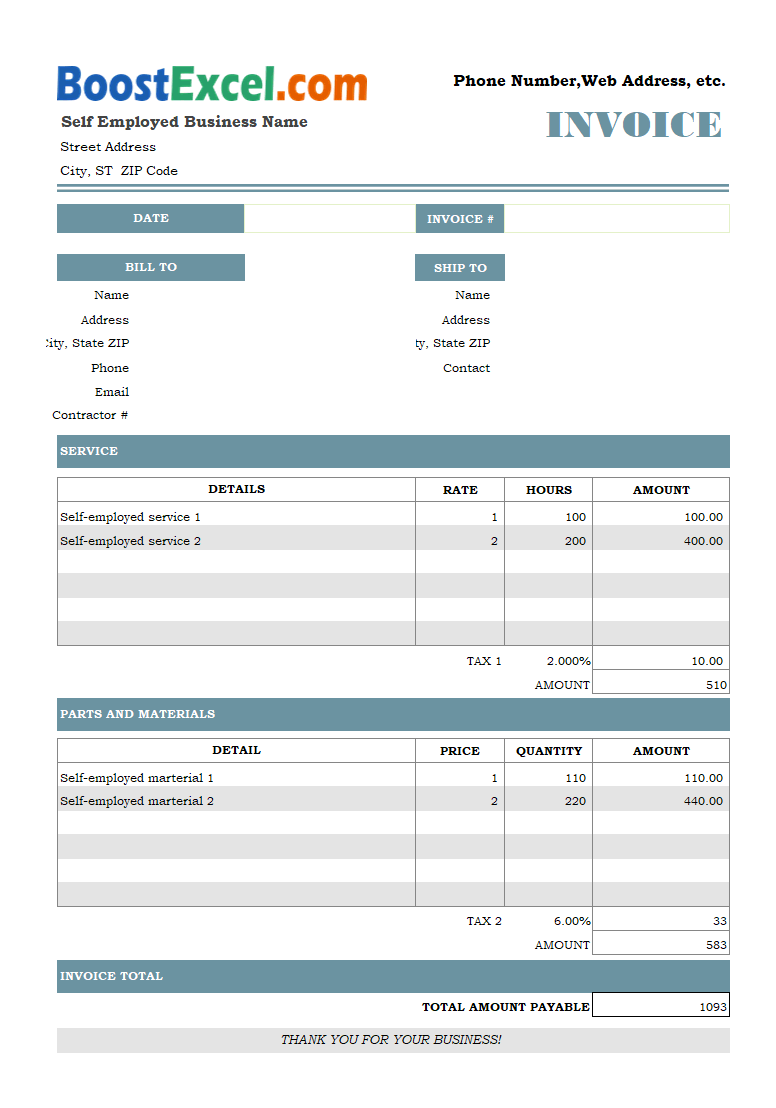

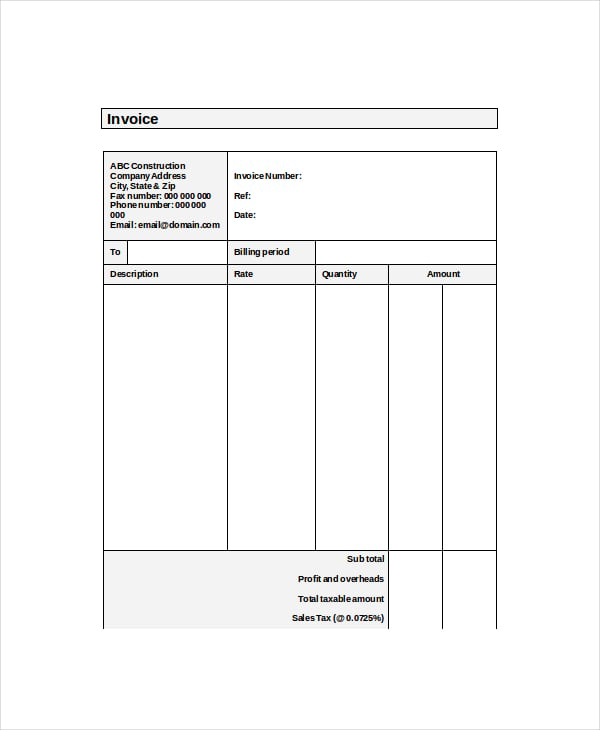

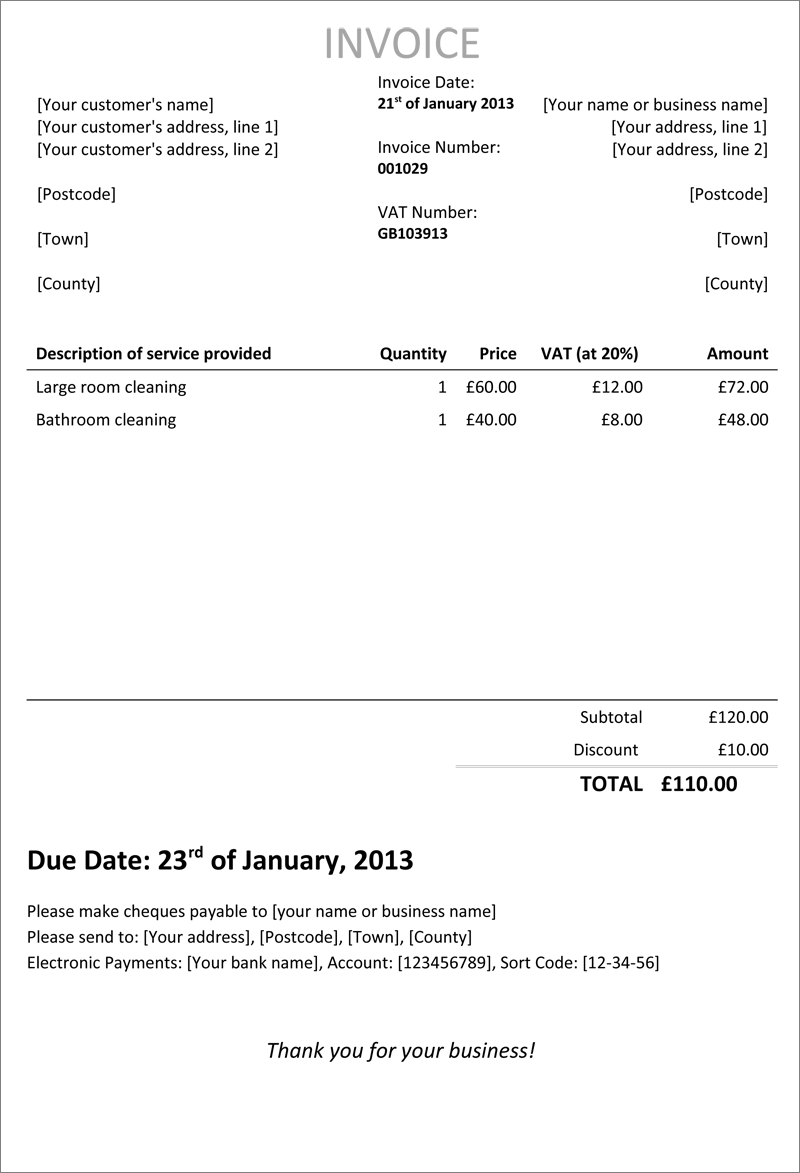

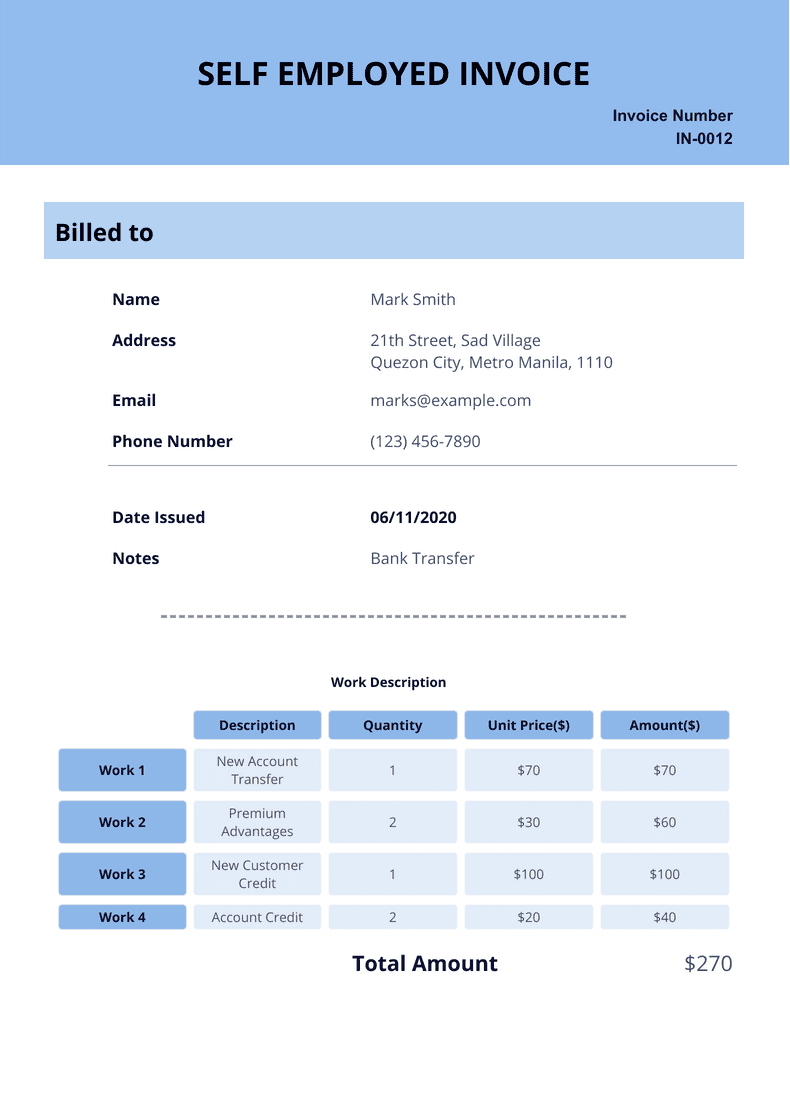

When creating a self-employed cleaner invoice, make sure to include the following information:

- Your contact information: Include your name, address, phone number, and email address. This information allows your clients to reach out to you if they have any questions or concerns.

- Client’s contact information: Include your client’s name, address, phone number, and email address. This information ensures that your invoice reaches the right person and helps with record keeping.

- Invoice number: Assign a unique invoice number to each invoice you send. This helps with organization and tracking.

- Date of the invoice: Include the date you issued the invoice. This is important for record-keeping and payment-tracking purposes.

- Description of services: Clearly outline the services you’ve provided. Be specific and include any relevant details, such as the number of hours worked or the type of cleaning tasks completed.

- Rate and total amount: State your hourly rate or the agreed-upon rate for the cleaning job. Multiply the rate by the number of hours worked to calculate the total amount owed.

- Payment terms: Specify your payment terms, including the due date and preferred payment method. If you offer any discounts or late payment penalties, include that information as well.

How to create a self-employed cleaner invoice

Creating a self-employed cleaner invoice is straightforward, especially with the help of online invoicing tools. Follow these steps to create your own professional invoice:

1. Choose an invoicing template or software

Start by selecting an invoicing template or software that suits your needs. There are numerous free and paid options available online, offering customizable templates and automatic calculations.

2. Customize the template

Once you’ve chosen a template, customize it with your branding elements and fill in your contact information. This step ensures that your invoice aligns with your professional image and is easily recognizable by your clients.

3. Add client details

Include your client’s name, address, phone number, and email address in the designated fields. Double-check this information to ensure accuracy.

4. Assign an invoice number and date

Assign a unique invoice number to your invoice and include the date of issue. This helps with organization and record-keeping.

5. Describe the services provided

Clearly outline the services you’ve provided, including any relevant details such as the number of hours worked or specific cleaning tasks completed. This information helps avoid any confusion or disputes regarding the services rendered.

6. State the rate and total amount

State your hourly rate or the agreed-upon rate for the cleaning job. Multiply the rate by the number of hours worked to calculate the total amount owed. Make sure to include any applicable taxes or additional charges.

7. Specify payment terms

Specify your payment terms, including the due date and preferred payment method. If you offer any discounts or late payment penalties, include that information as well. Clear payment terms help ensure timely payment and minimize misunderstandings.

8. Review and send the invoice

Before sending the invoice, review it carefully to ensure accuracy and professionalism. Double-check all the information, including contact details, rates, and payment terms. Once you’re satisfied, send the invoice to your client via email or a preferred method.

Self-employed Cleaner Invoice Template – Download