Attorney invoices are an essential part of running a law practice. They provide a detailed breakdown of services rendered to clients and serve as a record of the work performed. Invoices also play a crucial role in ensuring that lawyers get paid for their services promptly. However, creating and managing attorney invoices can be a complex task.

This article will guide you through the process, providing valuable insights and tips to help you streamline your invoicing process and improve your cash flow.

What is an Attorney Invoice?

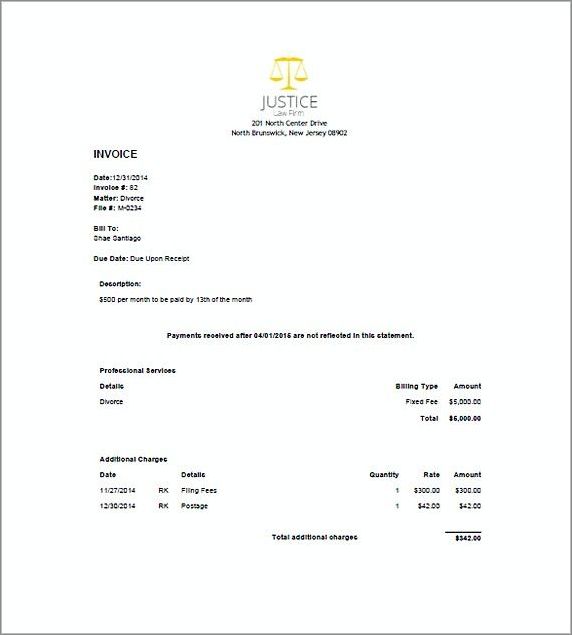

An attorney invoice is a document that lawyers send to their clients to request payment for legal services rendered. It includes detailed information about the work performed, such as the date, time spent, description of services, and the associated costs. The invoice also outlines the payment terms and provides instructions on how to make the payment. Attorney invoices are essential for maintaining accurate financial records and ensuring that clients understand the services provided and the fees associated with them.

Why is it Important to Have a Well-Structured Attorney Invoice?

A well-structured attorney invoice is crucial for several reasons:

- Clarity: A well-structured invoice provides clear and concise information about the services rendered and the associated costs. This helps clients understand what they are being billed for and reduces the likelihood of disputes or confusion.

- Professionalism: An organized and professional-looking invoice reflects positively on your law practice. It shows that you take your work seriously and value your clients’ time and money.

- Efficiency: A well-structured invoice makes it easier for clients to process and pay their bills promptly. This improves cash flow and reduces the need for follow-ups and late payment reminders.

- Compliance: In some jurisdictions, attorneys are required to provide detailed invoices to their clients. Having a well-structured invoice ensures compliance with legal and ethical obligations.

What Should an Attorney Invoice Include?

An attorney invoice should include the following information:

- Law Firm Details: Include your law firm’s name, address, phone number, and email address. This information helps clients identify your practice and contact you if needed.

- Client Details: Include the client’s name, address, phone number, and email address. This information ensures that the invoice is sent to the correct recipient and helps with client identification.

- Invoice Number: Assign a unique invoice number to each invoice you send. This helps with record-keeping and makes it easier to track payments.

- Date: Include the date the invoice was issued. This helps both you and the client keep track of payment deadlines.

- Description of Services: Provide a detailed description of the services rendered. Include the date, time spent, and a summary of the work performed. This helps clients understand what they are being billed for and provides transparency.

- Hourly Rate or Fee Structure: Specify the hourly rate or fee structure for each service provided. If you have different rates for different types of work, clearly outline them in the invoice.

- Total Amount Due: Calculate the total amount due for the services provided. Include any applicable taxes or additional charges.

- Payment Terms: Clearly state the payment terms, including the due date and acceptable payment methods. Provide instructions on how to make the payment.

How to Create an Attorney Invoice

Creating an attorney invoice involves several steps:

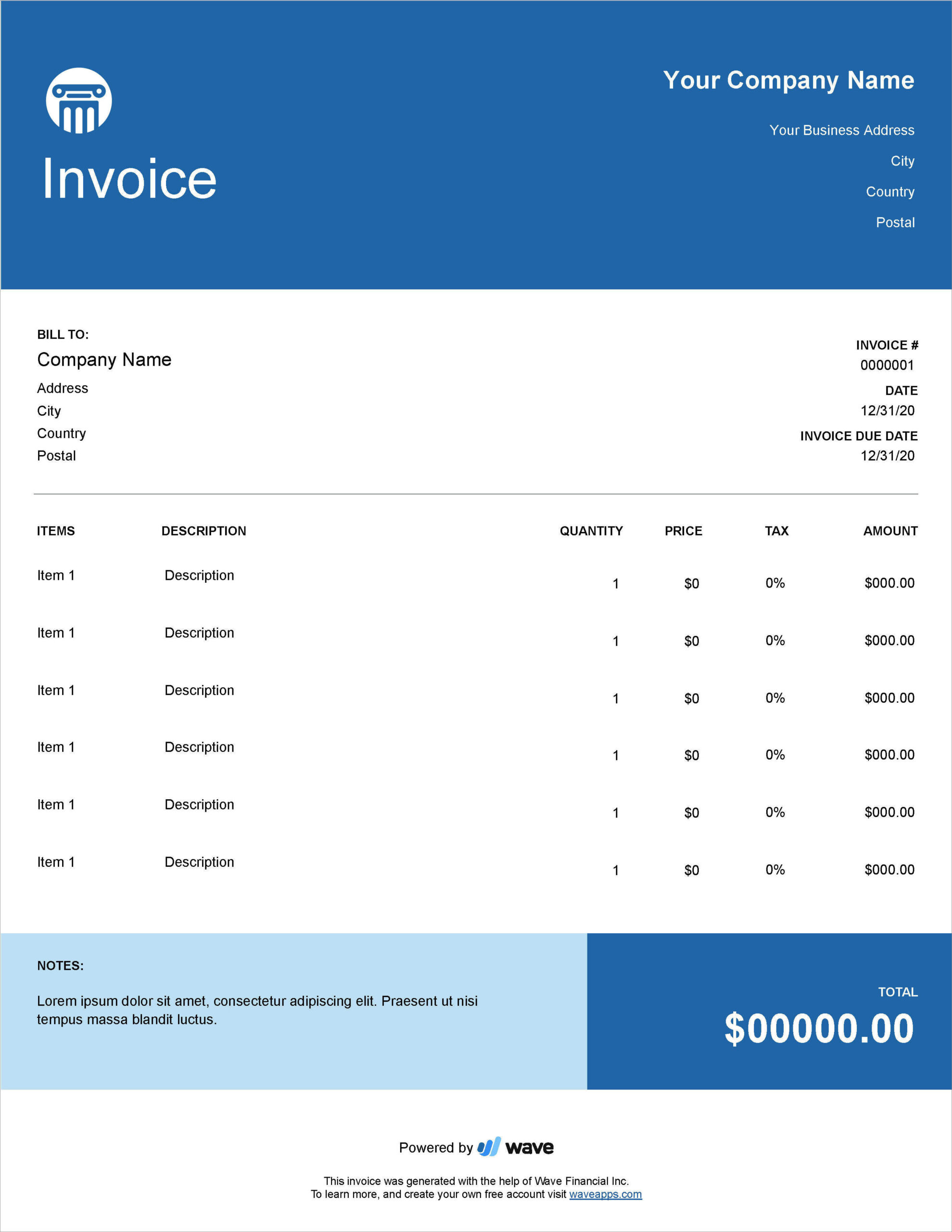

Step 1: Choose an Invoice Template

Start by selecting an invoice template that suits your law practice. There are many free online templates available that you can customize to meet your specific needs. Look for a template that includes all the essential elements mentioned earlier.

Step 2: Customize the Invoice Template

Once you have chosen a template, customize it with your law firm’s logo, colors, and branding elements. Add your law firm’s details and remove any unnecessary fields or sections.

Step 3: Add Client and Matter Information

For each invoice, input the client’s name, address, and contact information. Include the matter or case number, if applicable. This helps with organization and makes it easier to track payments and reconcile accounts.

Step 4: Provide a Detailed Description of Services

Include a detailed description of the services rendered, including dates, time spent, and a summary of the work performed. Be specific and avoid using legal jargon that clients may not understand. Transparency is key to building trust with your clients.

Step 5: Calculate the Total Amount Due

Calculate the total amount due for the services provided. If you have different rates for different types of work, clearly outline them in the invoice. Include any applicable taxes or additional charges.

Step 6: Specify the Payment Terms

Clearly state the payment terms, including the due date and acceptable payment methods. Provide instructions on how to make the payment, whether it’s by check, credit card, or bank transfer. Consider offering multiple payment options to accommodate your clients’ preferences.

Step 7: Review and Send the Invoice

Double-check the invoice for accuracy and completeness. Review the client’s details, service description, and payment terms to ensure everything is correct. Once you are satisfied, send the invoice to the client via email or mail.

Best Practices for Managing Attorney Invoices

Managing attorney invoices effectively is crucial for maintaining a healthy cash flow and ensuring timely payments. Here are some best practices to consider:

- Use Legal Billing Software: Consider using legal billing software to streamline your invoicing process. These tools allow you to create professional-looking invoices, track billable hours, and manage client accounts.

- Send Invoices Promptly: Send invoices as soon as the work is completed or at regular intervals, such as monthly or biweekly. Prompt invoicing improves cash flow and reduces the likelihood of payment delays.

- Follow Up on Overdue Payments: Keep track of overdue payments and send polite reminders to clients who haven’t paid on time. Offer assistance or alternative payment arrangements if necessary.

- Keep Detailed Records: Maintain accurate records of all invoices sent, payments received, and outstanding balances. This helps with financial planning, tax preparation, and tracking client accounts.

- Offer Online Payment Options: Consider setting up online payment options, such as credit card processing or electronic fund transfers. This makes it easier for clients to pay their invoices and reduces payment processing time.

- Regularly Review and Update Fee Structures: Periodically review your fee structures to ensure they are competitive and aligned with the value you provide. Communicate any changes to your clients in advance.

- Provide Detailed Billing Statements: In addition to invoices, consider providing detailed billing statements that break down the services rendered and the associated costs. This gives clients a clear understanding of the work performed and helps with transparency.

- Offer Discounts for Early Payments: Consider offering discounts or incentives for clients who pay their invoices early. This can motivate clients to pay promptly and improve your cash flow.

Conclusion

Creating and managing attorney invoices is a critical task for lawyers. By following the steps outlined in this guide and implementing best practices for invoice management, you can streamline your invoicing process, improve cash flow, and ensure timely payments. Remember, a well-structured and professional invoice not only helps you get paid but also reflects positively on your law practice.

Attorney Invoice Template Word – Download