Insurance is an essential component of protecting your assets and minimizing financial risk. Whether you are a business owner or an individual, having insurance coverage provides peace of mind and financial security in case of unforeseen events.

A certificate of insurance is a document that serves as proof of insurance coverage. It outlines the type and amount of insurance held by the policyholder and can be provided to third parties as evidence of insurance. In this article, we will explore the benefits of having a certificate of insurance and how it can be obtained and utilized in various situations.

What is a Certificate of Insurance?

A certificate of insurance is a document that summarizes the key details of an insurance policy. It typically includes the policyholder’s name, the type of insurance coverage, the policy number, the effective dates of coverage, and the limits of liability. The certificate may also list any additional insured parties, who are individuals or entities that have been added to the policy as additional beneficiaries.

The purpose of a certificate of insurance is to provide proof of insurance coverage to third parties. For example, if you are a contractor, your clients may require you to provide a certificate of insurance before starting any work. This ensures that you have adequate insurance coverage in case of any accidents or damages that may occur during the project.

Why is a Certificate of Insurance Important?

A certificate of insurance is important for several reasons:

- Proof of Coverage: It serves as proof that you have insurance coverage, which may be required by clients, landlords, lenders, or other parties.

- Third-Party Protection: It protects third parties from potential liability by confirming that you have adequate insurance coverage to address any claims or damages.

- Contract Compliance: It ensures that you comply with contractual obligations that require you to maintain specific types and levels of insurance coverage.

- Professionalism: It enhances your professional reputation by demonstrating that you are a responsible and insured individual or business.

- Peace of Mind: It provides peace of mind knowing that you have the necessary insurance coverage to protect your assets and mitigate financial risks.

How to Obtain a Certificate of Insurance

To obtain a certificate of insurance, you will need to contact your insurance provider. They will be able to generate a certificate with the required information and send it to you either electronically or in paper format. The process typically involves providing the necessary policy details, such as the policy number and effective dates, as well as any additional insured parties that need to be included on the certificate.

Some insurance companies may offer online portals or mobile apps where you can access and download your certificate of insurance directly. This can be a convenient option, especially if you frequently need to provide proof of insurance to different parties.

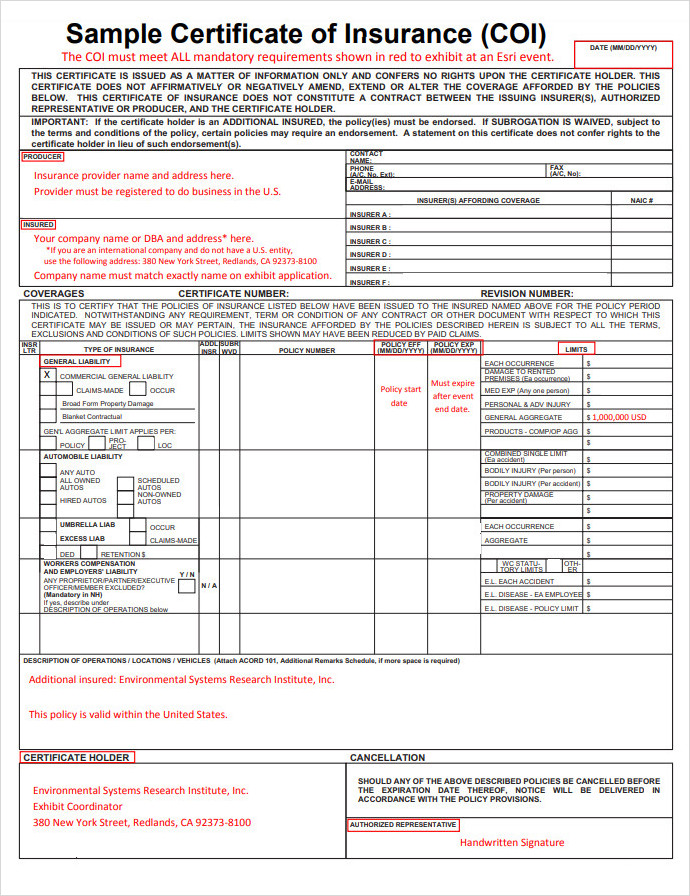

Example of a Certificate of Insurance

Here is an example of what a certificate of insurance may look like:

Tips for Successful Utilization of a Certificate of Insurance

When utilizing a certificate of insurance, consider the following tips to ensure successful implementation:

- Keep Digital Copies: Save digital copies of your certificate of insurance on your computer or in a cloud storage system for easy access and retrieval.

- Update Regularly: Keep your certificate of insurance up to date by renewing your policies on time and notifying your insurance provider of any changes to your coverage or additional insured parties.

- Communicate with Third Parties: Provide your certificate of insurance to the relevant parties promptly and communicate any changes or updates to your insurance coverage as needed.

- Know Your Coverage: Understand the scope and limits of your insurance coverage to ensure that you have adequate protection for your specific needs.

- Review Contracts Carefully: Read and understand any contracts or agreements that require you to provide a certificate of insurance, and ensure that you meet the specified insurance requirements.

A certificate of insurance is a valuable document that provides proof of insurance coverage and protects both the policyholder and third parties. By understanding its importance, obtaining one when necessary, and effectively utilizing it, you can ensure that you have the necessary insurance protection and meet the requirements of various parties.

Conclusion

A certificate of insurance is a crucial document that provides proof of insurance coverage and demonstrates your responsibility as an insured individual or business. It offers peace of mind, protects third parties, and ensures compliance with contractual obligations.

By obtaining a certificate of insurance and utilizing it effectively, you can safeguard your assets and mitigate financial risks in a variety of situations.

Certificate of Insurance Template – Download