A Year to Date Profit And Loss Statement, also known as a YTD P&L statement, is a financial document that provides a snapshot of a company’s financial performance from the beginning of the fiscal year up to a specified date. It shows the revenues, expenses, and net profit or loss generated during this period. This statement is commonly used by businesses to track their financial progress and make informed decisions about their operations.

In this article, we will explore the key components of a Year To Date Profit And Loss Statement, how it is prepared, and its significance in evaluating a company’s financial health. We will also provide examples and tips on how to interpret and analyze this statement effectively.

What is a Year-to-Date Profit And Loss Statement?

A Year To Date Profit And Loss Statement is a financial statement that summarizes a company’s revenues, expenses, and net profit or loss for a specific period. It covers the time frame from the beginning of the fiscal year to a specified date, which can be any point in time during the year. This statement provides a comprehensive view of a company’s financial performance, allowing stakeholders to assess its profitability and sustainability.

The Year To Date Profit And Loss Statement is typically prepared by the accounting department or finance team of a company. It is an essential tool for management, investors, lenders, and other stakeholders to evaluate the company’s financial position and make informed decisions.

How to Prepare a Year To Date Profit And Loss Statement

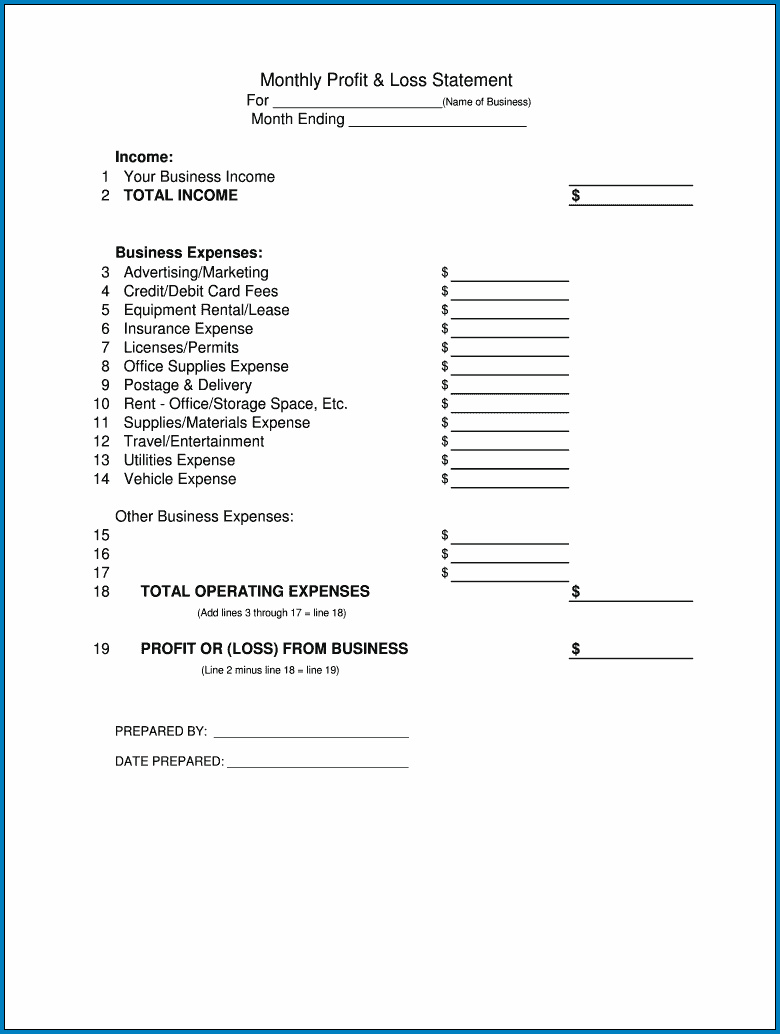

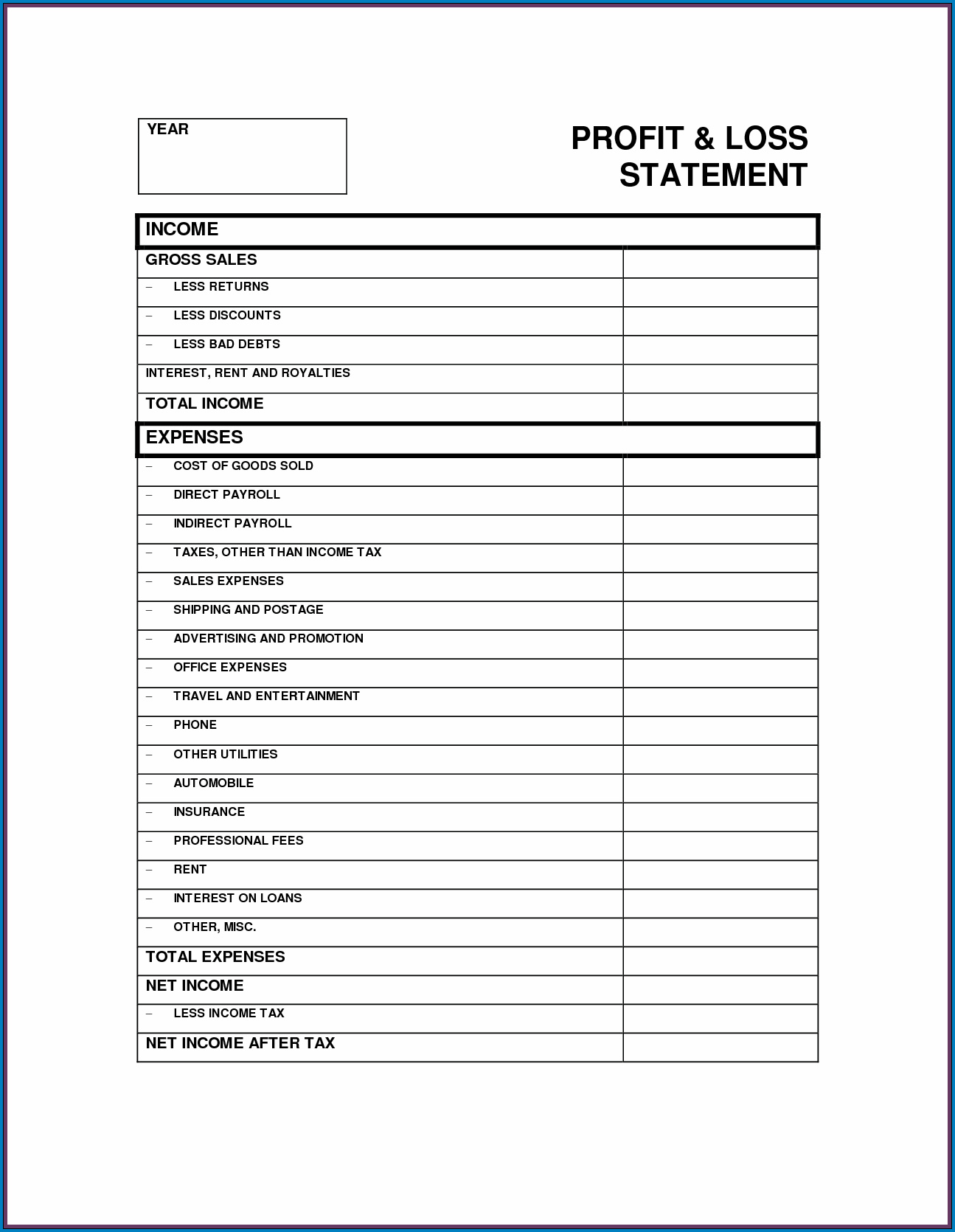

Preparing a Year To Date Profit And Loss Statement involves several steps. Here is a general outline of the process:

1. Gather the necessary financial data

To create an accurate Year To Date Profit And Loss Statement, you need to collect all the relevant financial data for the specified period. This includes information on revenues, expenses, and any other income or losses incurred during the year. Make sure to have detailed records and supporting documents for each transaction.

2. Organize the data into categories

Once you have gathered all the financial data, organize it into categories such as revenues, cost of goods sold, operating expenses, and non-operating expenses. This categorization helps in analyzing the company’s financial performance and identifying areas of improvement or concern.

3. Calculate the net profit or loss

After categorizing the data, calculate the net profit or loss by subtracting the total expenses from the total revenues. This figure represents the company’s financial performance for the specified period. A positive net profit indicates profitability, while a negative net loss indicates a deficit.

4. Present the statement in a clear format

Present the Year To Date Profit And Loss Statement in a clear and organized format that is easy to understand. Use headings, subheadings, and bullet points to highlight key information and make the statement visually appealing. Include a date range and any relevant notes or explanations to provide context for the financial data.

Why is the Year To Date Profit And Loss Statement Important?

The Year To Date Profit And Loss Statement is important for several reasons:

- Financial performance evaluation: It allows businesses to evaluate their financial performance over a specific period and identify trends or patterns that can impact their profitability.

- Decision-making: The statement provides valuable insights for decision-making, such as identifying areas where cost reductions can be made or revenue-generating opportunities can be pursued.

- Investor and lender assessment: Investors and lenders often rely on the Year To Date Profit And Loss Statement to assess a company’s financial health and determine its creditworthiness or investment potential.

- Comparison and benchmarking: Companies can compare their Year To Date Profit And Loss Statement with previous periods or industry benchmarks to gauge their performance relative to others in the market.

Overall, the Year To Date Profit And Loss Statement provides a comprehensive view of a company’s financial performance and helps in making informed decisions about its operations and future strategies.

Other Samples of Year To Date Profit And Loss Statement :

It might be quick to get bogged down in every economic transaction with your organization and reduce sight of the big picture… but understanding what is taking place with all your work-at-home business’s finances is crucial if you intend to make some really serious money. Which is wherever a P&L comes in handy.

Interpreting and Analyzing a Year To Date Profit And Loss Statement

Interpreting and analyzing a Year To Date Profit And Loss Statement involves understanding the key components and ratios used to assess a company’s financial health. Here are some important factors to consider:

1. Gross Profit Margin

The gross profit margin is calculated by dividing the gross profit (revenues minus cost of goods sold) by the total revenues. It indicates how efficiently a company is utilizing its resources to generate profits. A higher gross profit margin is generally favorable, as it suggests better cost management and pricing strategies.

2. Operating Expenses

Operating expenses include costs such as rent, utilities, salaries, and marketing expenses. Analyzing the trend and proportion of operating expenses can help identify areas where cost reductions can be made or where investments should be prioritized.

3. Net Profit Margin

The net profit margin is calculated by dividing the net profit after taxes by the total revenues. It measures the overall profitability of a company and indicates how much profit is generated from each dollar of revenue. A higher net profit margin is generally desirable, as it signifies efficient operations and effective cost management.

4. Cash Flow

Assessing the cash flow statement alongside the Year To Date Profit And Loss Statement provides a more comprehensive understanding of a company’s financial position. Positive cash flow indicates that the company has enough liquidity to cover its expenses and invest in growth opportunities.

5. Industry Comparison

Comparing the Year To Date Profit And Loss Statement with industry benchmarks or competitors’ statements can provide valuable insights into a company’s performance. It helps in identifying areas where the company is outperforming or lagging behind and can guide strategic decision-making.

6. Variance Analysis

Performing a variance analysis involves comparing the current Year To Date Profit And Loss Statement with previous periods or budgets. It helps in identifying significant changes or discrepancies and understanding the reasons behind them. This analysis can highlight areas where corrective actions need to be taken or where the company is excelling.

7. Future Projections

Based on the Year To Date Profit And Loss Statement, companies can make future projections and forecasts. This allows them to anticipate potential challenges or opportunities and develop strategies to achieve their financial goals.

Conclusion

The Year To Date Profit And Loss Statement is a crucial financial document that provides a comprehensive view of a company’s financial performance during a specific period. It helps businesses evaluate their profitability, make informed decisions, and assess their financial health. By understanding the components and analyzing the statement effectively, companies can identify areas of improvement, benchmark their performance, and plan for future growth.

Track your business’s financial performance effectively with our Printable Year-to-Date Profit and Loss Statement in Excel, available for immediate download. This template provides a comprehensive overview of your company’s financial health, summarizing revenues, expenses, and net income for the current year. With customizable fields and built-in formulas, it allows you to easily input your financial data and generate accurate profit and loss statements. Download now to gain valuable insights into your business’s performance.

Year To Date Profit And Loss Statement Template | Excel – download