Buying a car is an exciting experience, but it can also be a complex and overwhelming process. One of the most important factors to consider when purchasing a vehicle is the cost and affordability. This is where a vehicle mortgage payment calculator comes in handy. This tool allows you to calculate your monthly car loan payments, helping you make informed decisions and stay within your budget.

In this article, we will explore what a vehicle mortgage payment calculator is, how it works, and why it is beneficial for car buyers.

What is a Vehicle Mortgage Payment Calculator?

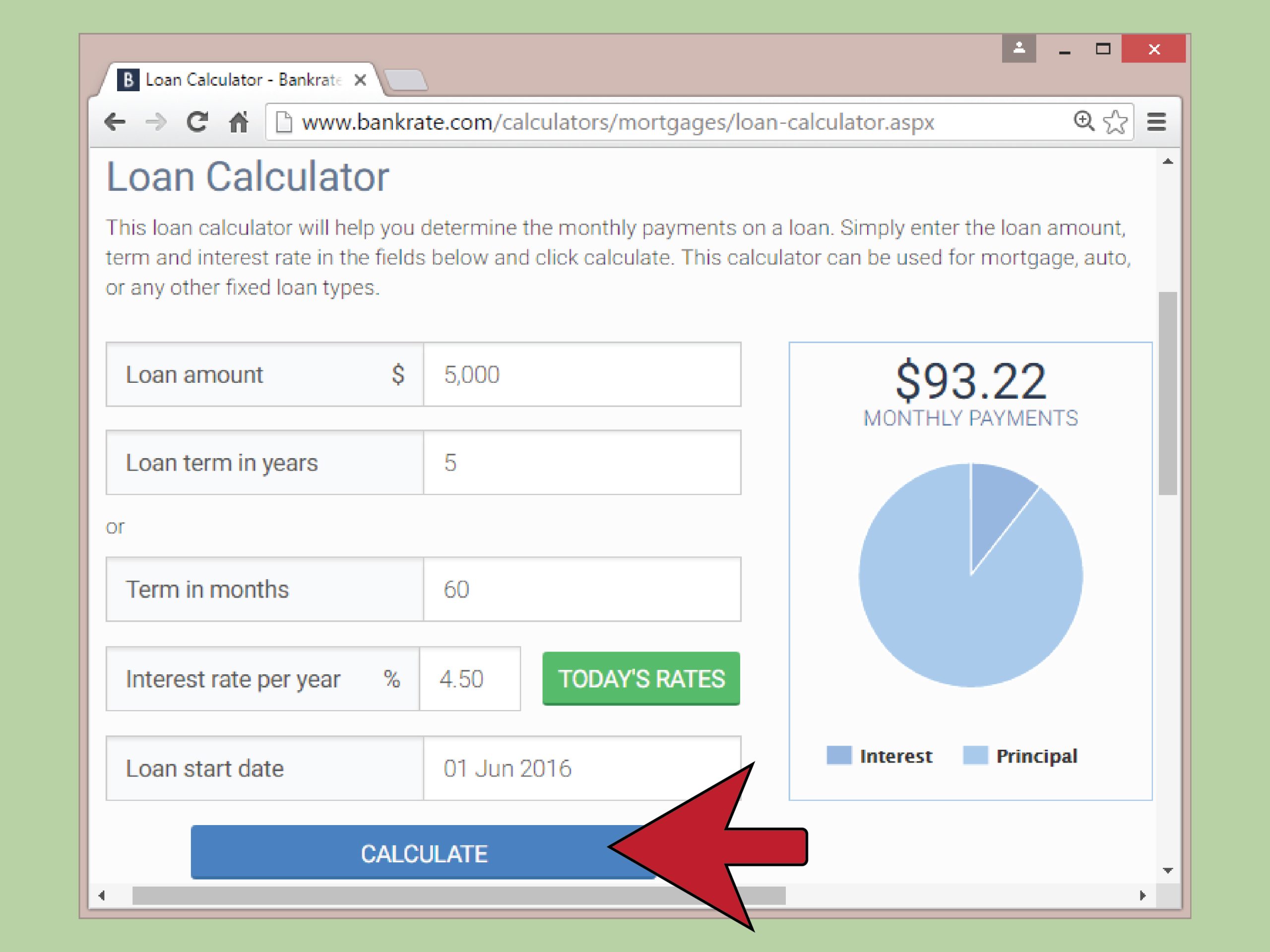

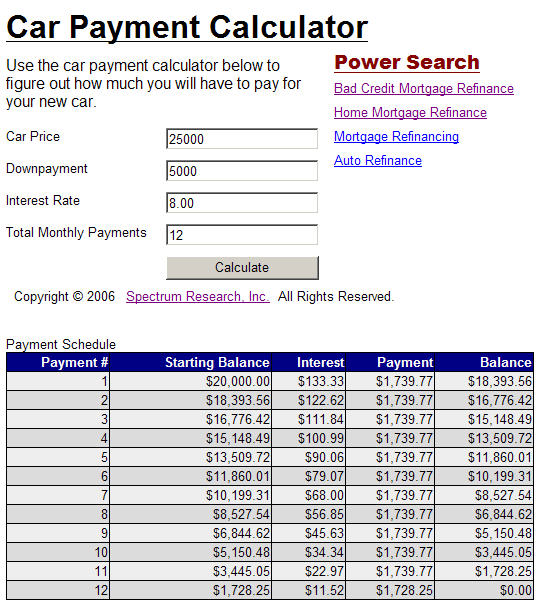

A vehicle mortgage payment calculator is a tool that helps car buyers estimate their monthly car loan payments. It takes into account factors such as the loan amount, interest rate, loan term, and down payment to calculate the monthly payment amount. This calculator provides a convenient way to determine how much you can afford to spend on a car and helps you budget accordingly.

By inputting the necessary information into the calculator, you can quickly see how different loan terms and interest rates affect your monthly payments. This allows you to compare different financing options and choose the one that best fits your financial situation.

How Does a Vehicle Mortgage Payment Calculator Work?

A vehicle mortgage payment calculator works by using a formula to calculate the monthly car loan payment. The formula takes into account the loan amount, interest rate, loan term, and down payment. By inputting these values into the calculator, it will generate the monthly payment amount.

Here’s an example of how a vehicle mortgage payment calculator works:

- Loan Amount: $20,000

- Interest Rate: 5%

- Loan Term: 60 months

- Down Payment: $5,000

Based on these values, the calculator will calculate the monthly car loan payment. In this example, the monthly payment would be approximately $318.42.

Why Should You Use a Vehicle Mortgage Payment Calculator?

Using a vehicle mortgage payment calculator offers several benefits for car buyers. Here are some reasons why you should consider using this tool:

- Budgeting: A vehicle mortgage payment calculator helps you determine how much you can afford to spend on a car. By inputting different loan terms and interest rates, you can see how they impact your monthly payments. This allows you to set a realistic budget and avoid overextending yourself financially.

- Comparison: With a vehicle mortgage payment calculator, you can compare different financing options. By inputting the details of each loan, you can see how they differ in terms of monthly payments and total interest paid. This helps you choose the most favorable financing option for your needs.

- Planning: By using a vehicle mortgage payment calculator, you can plan for your car purchase. It allows you to estimate your monthly payments and factor them into your overall budget. This helps you make informed decisions and ensures that you can comfortably afford your car loan.

- Flexibility: A vehicle mortgage payment calculator gives you the flexibility to adjust the loan amount, interest rate, loan term, and down payment to see how they affect your monthly payments. This allows you to explore different scenarios and find the one that suits you best.

Bottom Line

A vehicle mortgage payment calculator is a valuable tool for car buyers. It helps you estimate your monthly car loan payments, compare financing options, and plan for your car purchase.

So, next time you’re in the market for a car, don’t forget to use a vehicle mortgage payment calculator to simplify the buying process and make the right financial choices.

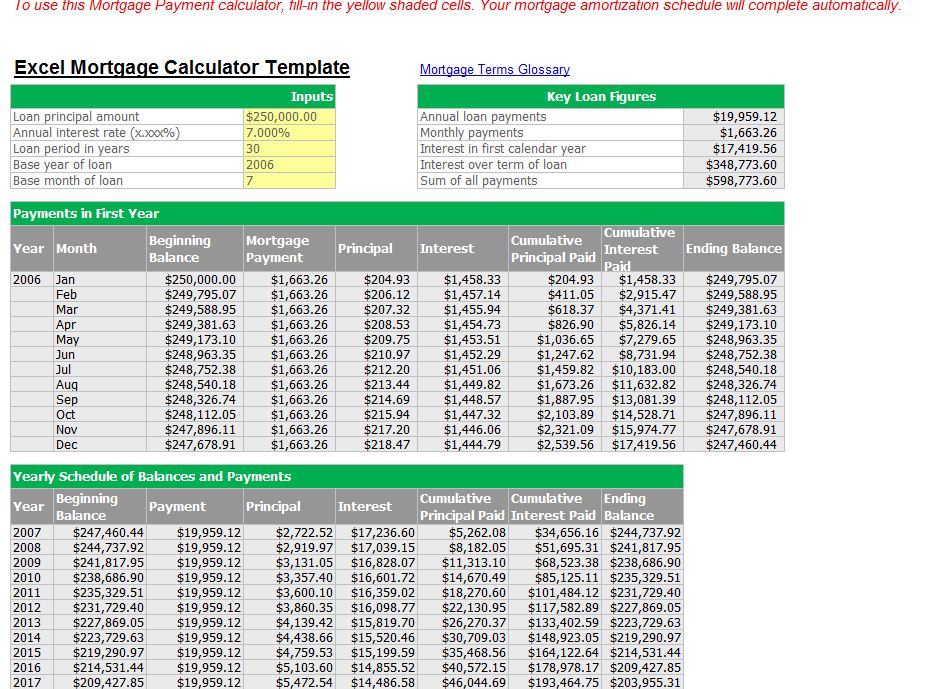

Vehicle Mortgage Payment Calculator Template Excel – Download