As a business owner, it’s crucial to have a clear understanding of your financial standing and prospects. One way to achieve this is by creating a projected balance sheet. This document provides a snapshot of your company’s financial health and helps you make informed decisions regarding budgeting, investment, and growth strategies.

This article will explore what a projected balance sheet is, why it is important, how to create one, provide examples and samples, and offer tips for successful implementation.

What is a Projected Balance Sheet?

A projected balance sheet is a financial statement that shows the assets, liabilities, and equity of a business at a specific point in time. It provides an overview of the company’s financial position and helps stakeholders assess its ability to meet financial obligations, determine profitability, and make informed decisions about the future.

Unlike the regular balance sheet, which reflects historical data, a projected balance sheet estimates future financials based on anticipated revenue, expenses, and growth.

Why is a Projected Balance Sheet Important?

A projected balance sheet is important for several reasons:

- Financial Planning: It helps in setting realistic financial goals and planning for the future.

- Budgeting: It assists in developing an accurate budget by projecting future income and expenses.

- Investment Decisions: It aids in evaluating investment opportunities and determining the financial impact of different scenarios.

- Growth Strategies: It enables business owners to assess their financial capacity for expansion, such as securing loans or attracting investors.

- Identifying Financial Issues: It highlights potential cash flow problems, debt obligations, or liquidity concerns.

How to Create a Projected Balance Sheet

Creating a projected balance sheet involves several key steps:

- Gather Financial Data: Collect all relevant financial information, including historical balance sheets, income statements, and cash flow statements.

- Estimate Future Revenue: Use sales forecasts, market research, and historical data to project future revenue.

- Forecast Expenses: Estimate future expenses based on historical data, industry trends, and planned changes.

- Calculate Assets: Determine the value of your business assets, including cash, accounts receivable, inventory, and fixed assets.

- Assess Liabilities: Identify and quantify your business liabilities, such as accounts payable, loans, and outstanding debts.

- Calculate Equity: Calculate the equity of your business by subtracting liabilities from assets.

- Compile the Data: Organize the projected financial data into a balance sheet format.

- Review and Adjust: Review the projected balance sheet for accuracy and make adjustments as needed.

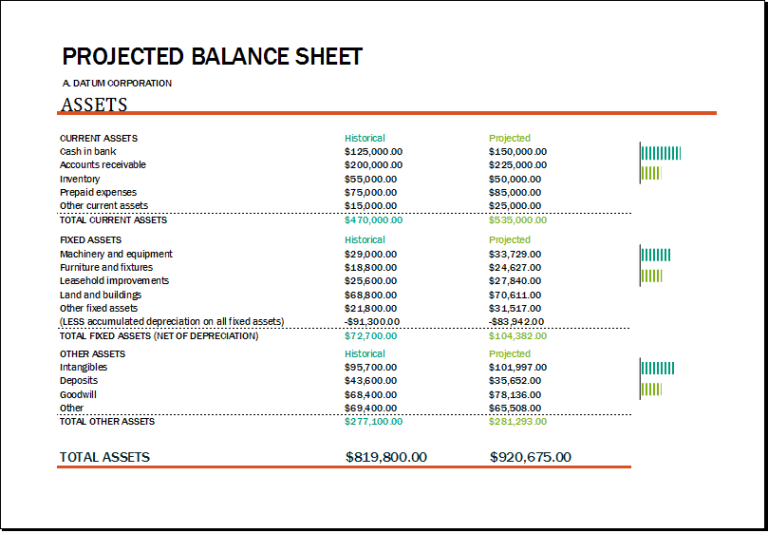

Example and Sample of a Projected Balance Sheet

Here is an example of a projected balance sheet:

XYZ Company

Projected Balance Sheet

| Assets | Amount | Liabilities | Amount |

|---|---|---|---|

| Cash | $50,000 | Accounts Payable | $10,000 |

| Accounts Receivable | $20,000 | Loans Payable | $30,000 |

| Inventory | $30,000 | Other Liabilities | $5,000 |

| Fixed Assets | $100,000 | Total Liabilities | $45,000 |

| Total Assets | $200,000 | Equity | $155,000 |

Tips for Successful Implementation of a Projected Balance Sheet

Here are some tips to ensure successful implementation of a projected balance sheet:

- Regular Updates: Update the projected balance sheet regularly to reflect changes in your business and financial circumstances.

- Accuracy: Ensure the accuracy of your projections by relying on reliable data, market research, and expert advice.

- Realistic Assumptions: Use realistic assumptions when projecting future revenue and expenses to avoid overestimating or underestimating.

- Scenario Analysis: Perform scenario analysis by creating multiple versions of the projected balance sheet to assess the financial impact of different scenarios.

- Professional Help: Consider seeking assistance from a financial advisor or accountant to ensure the accuracy and reliability of your projected balance sheet.

Free Projected Balance Sheet Template!

A projected balance sheet is a valuable tool for any business owner. It provides a clear picture of your company’s financial health, helps with financial planning, budgeting, and investment decisions, and enables you to identify and address potential financial issues.

By following the steps outlined in this article and implementing the tips provided, you can create an accurate and reliable projected balance sheet that will assist you in making informed decisions and driving the success of your business.

Projected Balance Sheet Template Excel – Download