The IRS self-employed year-to-date profit and loss statement needs are described in Type 1040–Schedule C Gain or Reduction from Enterprise. On this assertion, you should report your gross earnings from self-employment plus your gross costs. Additionally to listing income and fees, the IRS necessitates which you designate a particular accounting system you employ for organization.

The Plan C provides two types of accounting approaches from which to decide on otherwise you can decide on the “other” category and observe your accounting approach. The IRS features the selected on the dollars and accrual accounting approaches. You use the cash method if you don’t rely any revenue as cash flow right until you receive payment from a customers so you usually do not rely your fees until finally you fork out them out.

You utilize the accrual technique if you count your transactions as cash flow when get the orders, irrespective of irrespective of whether you may have gained payment from the shoppers and you simply rely your bills once you obtain the products or solutions regardless of irrespective of whether you’ve compensated for them nonetheless.

The IRS demands you to definitely report all of your current self-employment income you gained for your tax 12 months. This incorporates gross receipts, cost of goods sold and returns and allowances. Gross receipts would be the payments you acquired from customers in return of offering them using a excellent or assistance.

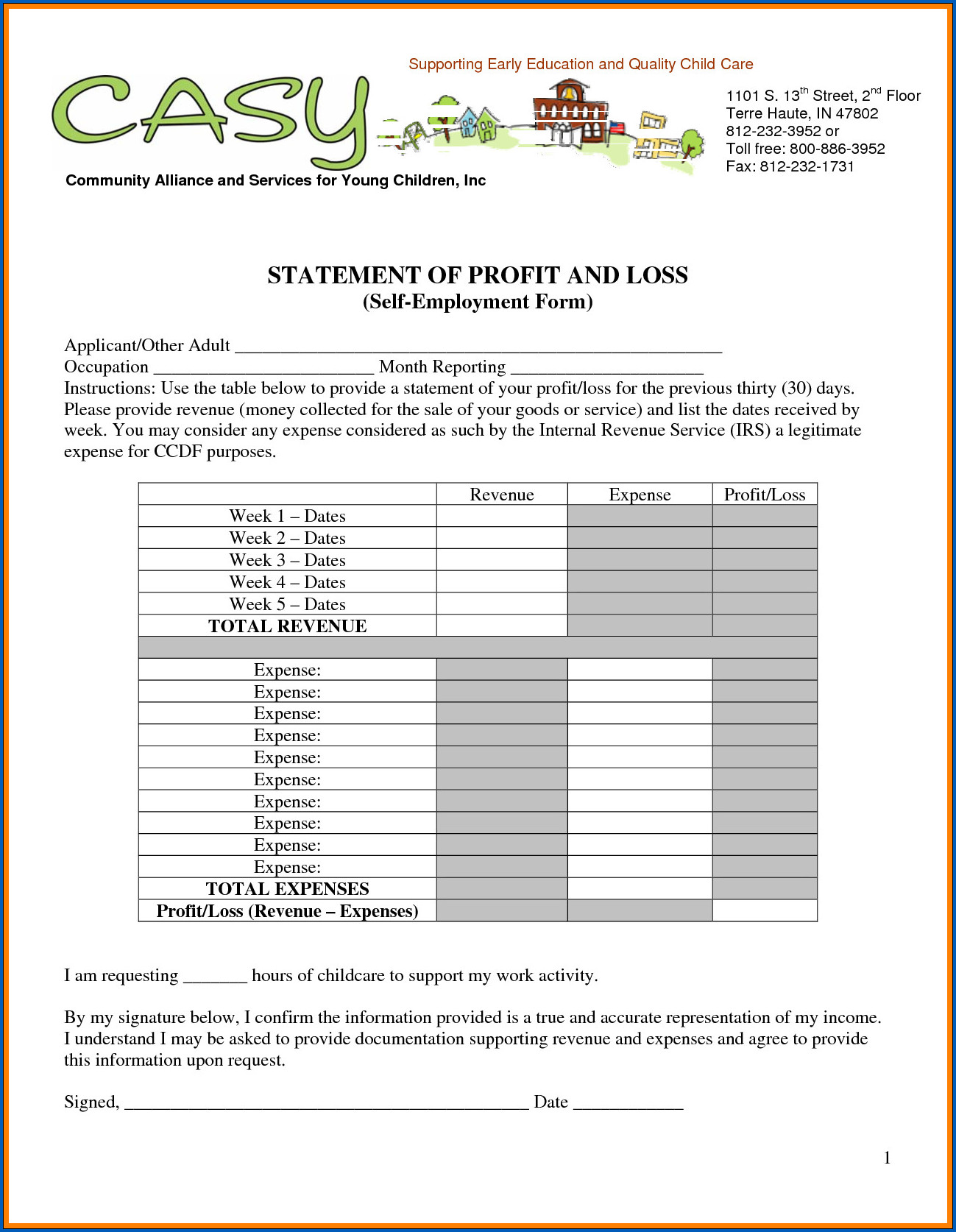

Samples of Profit And Loss Statement For Self Employed :

When you promote merchandise, then the cost of products offered is your charges directly similar to marketing people specific merchandise. Returns and allowances are any refunds, credits or rebates you gave to the buyers over the calendar year.

This is often where you enter your entire fees connected into the functioning of your respective business enterprise. Examples of the costs you will need to include within this portion of your Routine C are promoting fees, depreciation of property and gear, car costs, business office charges, workplace supplies, legal fees, company insurance policies expenditures and automobile expenditures. In case you spend a property finance loan or hire on the home for your personal company, you incorporate it in this segment.

In the event you utilize a portion of your respective house on your business, you must first comprehensive IRS Sort 8829 – Charges for Business enterprise Use of Your home. You then transfer the quantity on line 35 of Variety 8829 to line thirty of your respective Agenda C.

While in the expense of fine marketed part, the IRS necessitates that you simply report all of the costs directly similar on the goods you sell with your enterprise. These prices contain acquire charges, the fee of resources and provides and almost every other prices relevant towards your solutions. You include the fee of labor you paid to staff to produce your goods if relevant, however , you don’t contain any amounts you spend to oneself.