In England the keeping enterprise is required to existing, furthermore to its typical stability sheet, a consolidated balance sheet masking the holding firm and its subsidiaries in addition to a consolidated revenue and decline account.

In India, the legislation would not insist on consolidated accounts but there is little doubt that for any distinct picture, it is fascinating to current one particular one equilibrium sheet of your keeping and subsidiary corporations in addition to a solitary profit and loss account. Just before the rules for consolidation are reviewed, it is necessary to see how dividend obtained through the subsidiary is handled from the textbooks of the holding company.

It’s been pointed out previously mentioned the income presently earned and accrued because of the subsidiary organization, as many as the date of acquisition in the shares through the keeping enterprise, are capital profits. If shares are acquired in the course of a yr, the profit should be handled as accruing from everyday (while in the absence of almost every other indication) and, hence, must be apportioned around the time foundation.

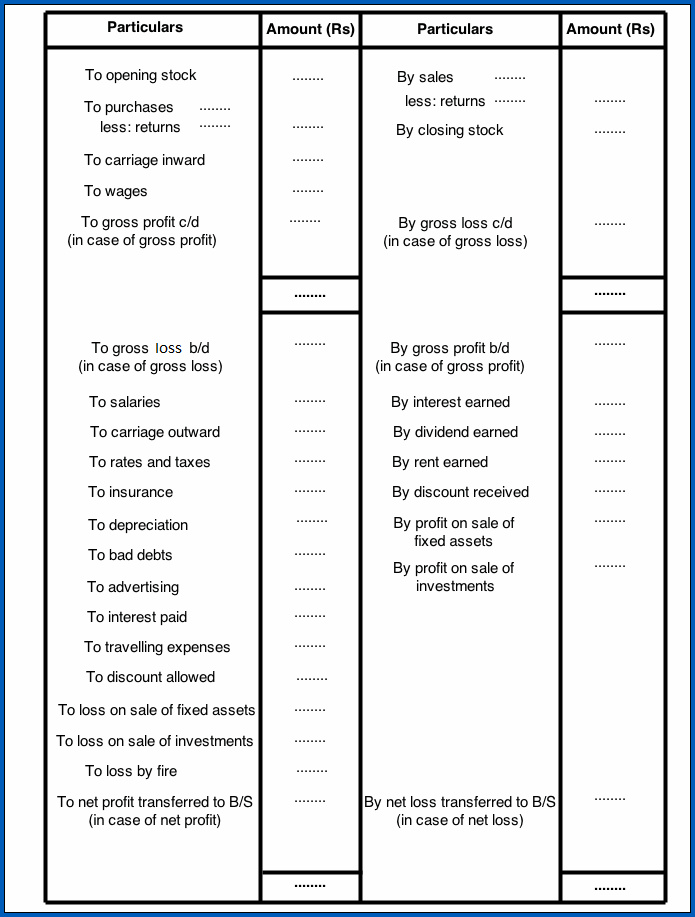

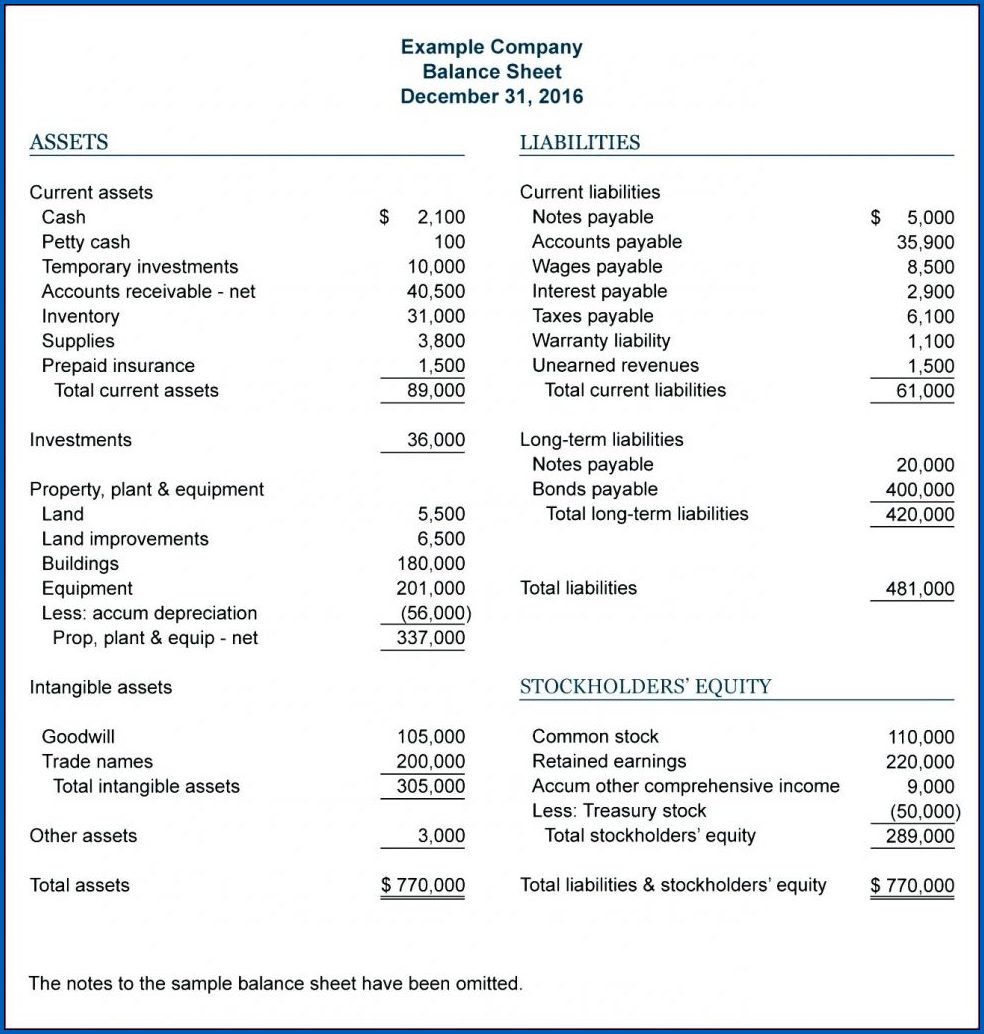

Samples of Profit And Loss Account And Balance Sheet :