A personal financial budget is often a income allocation approach which happens to be section within your financial plan enabling you to outline your financial plans. Establishing a personal financial spending budget just isn’t challenging and it has remarkable payoffs. It is possible to far better create and regulate your financial sources, set and reach your financial aims, and make progress choices as to the way you want your budget greatest to function for you personally.

The key thought in building a personal financial spending budget should be to place apart a particular degree of dollars for anticipated and also unforeseen expenditures, depending on prior fees and charges, together with outline discounts amounts in its exceptional condition. It thus permits you to definitely place by yourself to construct wealth within the long-term. In order to create a handy individual financial budget as element personalized financial setting up it’s essential to do the next:

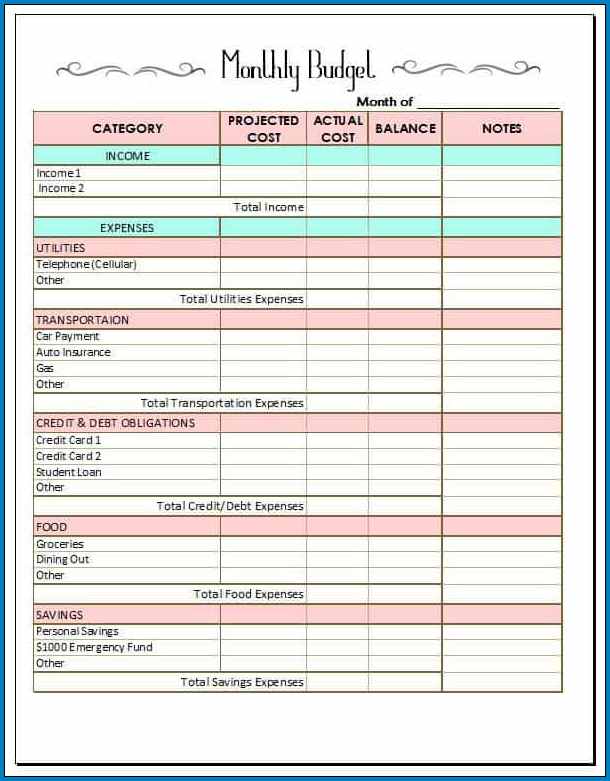

Stage 1. Ascertain the best way to allocate your compensation by initial determining your shelling out practices. Determine fastened charges (e.g., house, automobile, utilities, insurances, and so on.) comprehensively for just a month and generate almost everything down and insert it all up. Whether or not your utilities fluctuate just a little you could estimate the cost soon after a median month. Via good resolve of your “spending patterns”, it is possible to immediately establish options for producing a successful individual financial budget in your needs.

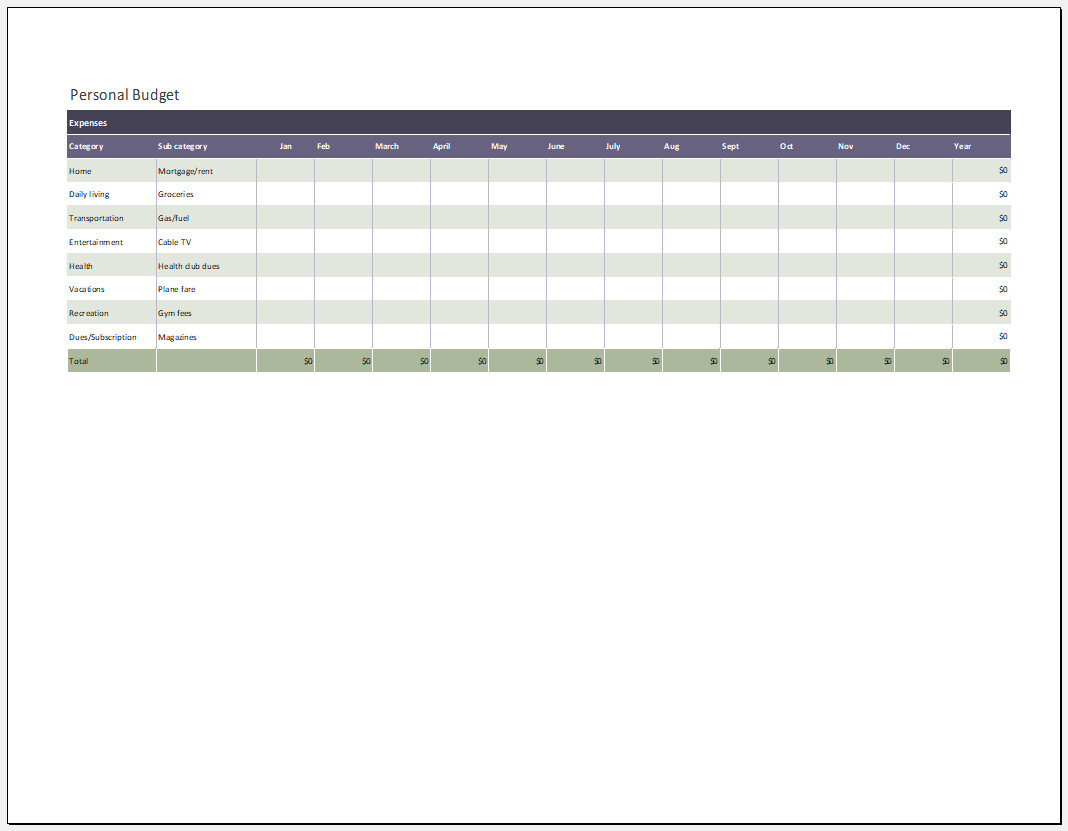

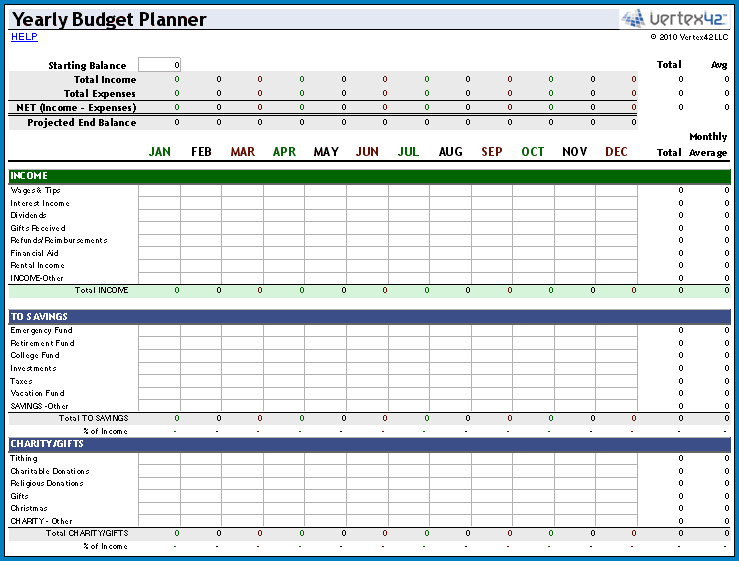

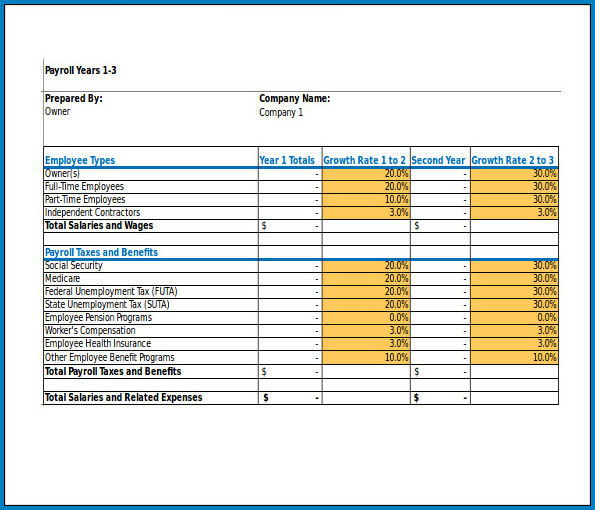

As an example, after you have got a constant monthly internet profits (following tax choose residence fork out) of $5,000, you need to subtract your entire identified month to month costs from that profits – making a listing of the normal monthly quantities. Spreadsheets are sometimes handy for keeping observe of the details. A lot of people typically make an excel spreadsheet budget to track expenditures. There can be gains to making various yr private financial budget designs.

Action two. Future, assess other bills, like those people that will arise periodically in the calendar year. These could be estimated then subtracted from your quantity of your revenue. You’ve got one of two methods of accomplishing this. The initial way will be to compute the whole for just a year, divide the total by twelve, and subtract that monthly total by placing the financial into discounts to create right until you require it. The 2nd way is if you’ve ample surplus it is possible to just budget the entire once-a-year, semiannual, or other bill in comprehensive or in some other payment arrangement.

Phase three. The equilibrium that remained soon after preset fees can now be budgeted across miscellaneous residence bills and savings. Budgeting for cost savings is commonly ignored and as a consequence usually will never get finished. A short-term 2-5 year price savings purpose desires a least 2-year personalized financial budget strategy which means you can see in which you are going. A short-term impulse getting perspective is usually what helps prevent people today from accumulating cost savings and setting up wealth.

Step four. To ideal establish tips on how to make certain you add to cost savings, you are able to do this one among two methods. You could use dollar quantities to get a group phone miscellaneous like fuel, outfits, enjoyment and groceries. Many people boost using proportions or percentages. But consider it, when your income increases, does that necessarily mean your miscellaneous expenses ought to or must your cost savings enhance as a substitute? So, employing dollar amounts in lieu of percentages might be useful to your price savings goal.

Move 5. Ideally you’ve got a minimum of 3 income or banking accounts. These expenditures must be allocated throughout two examining accounts – the primary for shelling out expenses and for transferring cash to at the least a 2nd checking account and a person savings account ( if you don’t have immediate deposit across these accounts). The 2nd checking account can be on your household, miscellaneous, paying income rather than the recurring bills. Then a third short-term savings/emergency account (later on incorporating longer-term discounts accounts not surprisingly) but these are generally commencing ways that lots of people today hardly ever set into observe.

Other Samples of Financial Budget :

These are strategies to build a fundamental financial prepare and to reduce use of non-allocated budget for miscellaneous or impulse fees. They are starting steps a large number of people today hardly ever put into practice which are helpful and will be designed on, for long-term financial arranging.

Financial Budget Template | Excel – download