Managing your credit card can sometimes feel overwhelming, especially when it comes to deciphering your credit card billing statement. However, understanding this document is crucial for your financial well-being.

In this article, we will walk you through everything you need to know about your credit card billing statement, from its components to how to read it effectively. By the end, you’ll feel confident in navigating your credit card statement and making informed financial decisions.

What is a Credit Card Billing Statement?

A credit card billing statement is a monthly report provided by your credit card issuer that outlines all the details of your credit card activity during a specific period. It serves as a summary of your spending, payments, fees, and other important information related to your credit card account. By reviewing your billing statement, you can keep track of your expenses, monitor your credit card balance, and ensure that there are no errors or fraudulent charges.

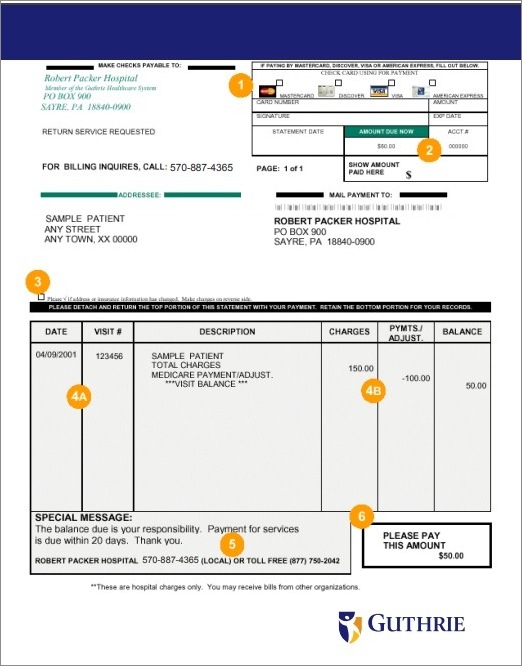

It’s important to note that credit card billing statements can vary among different issuers, but they generally include similar sections and information. Let’s explore the main components of a typical credit card billing statement:

1. Account Summary

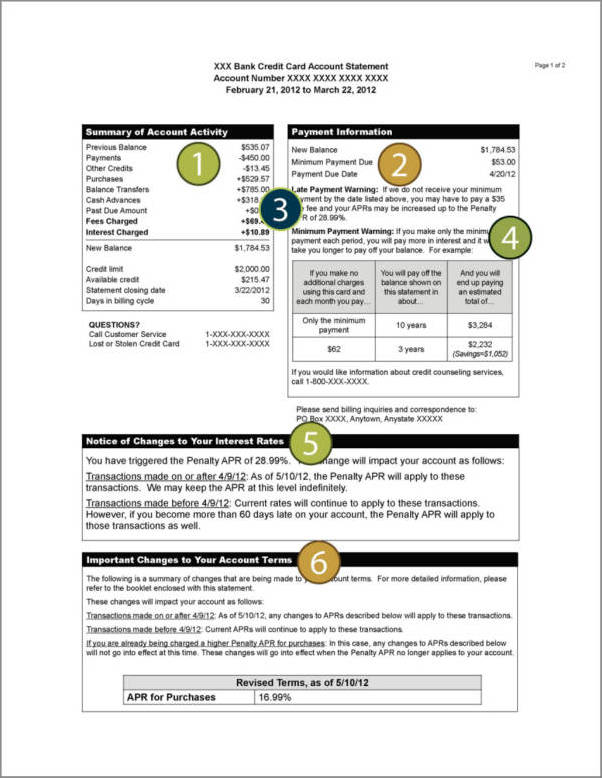

The account summary section provides an overview of your credit card account, including your account number, statement date, and the total balance due. It also includes the minimum payment due, which is the minimum amount you must pay by the due date to avoid late fees and penalties. This section is crucial for understanding your overall financial standing and ensuring you make timely payments.

2. Transaction Details

In this section, you’ll find a detailed list of all the transactions made with your credit card during the statement period. Each transaction is typically listed chronologically and includes the date, description of the purchase or transaction, and the amount charged. This allows you to review your spending habits and identify any unauthorized or unfamiliar charges.

3. Payment Information

The payment information section provides details about your previous payments, including the amount paid, the date of payment, and any fees or interest charges applied. It’s essential to review this section to ensure that your payments are accurately reflected and to keep track of any additional fees or interest that may have been incurred.

4. Fees

Here, you’ll find a breakdown of any fees or charges associated with your credit card account. Common fees include annual fees, late payment fees, cash advance fees, and foreign transaction fees. It’s important to carefully review this section to understand the costs associated with your credit card and to identify any potential areas where you can minimize fees.

5. Interest and APR

If you carry a balance on your credit card, this section will detail the interest charges applied to your account. It will include the Annual Percentage Rate (APR), which is the interest rate you’re charged on your outstanding balance. Understanding the interest rates and how they impact your balance is crucial for managing your credit card debt effectively.

6. Rewards and Benefits

If your credit card offers rewards or benefits, this section will outline the details. It will provide information about any rewards earned, such as cashback or travel points, and any redemption options available. This section is important for maximizing the benefits of your credit card and taking advantage of any rewards programs offered.

7. Important Notices and Updates

The final section of your credit card billing statement contains important notices and updates from your credit card issuer. This may include changes to terms and conditions, promotional offers, or updates to your account. It’s crucial to review this section carefully to stay informed about any changes that may affect your credit card usage.

How to Read Your Credit Card Billing Statement

Now that you understand the components of a credit card billing statement, let’s delve into how to read it effectively. Follow these steps to make the most out of your credit card statement:

1. Review the Account Summary

Start by reviewing the account summary section to understand your overall balance, minimum payment due, and statement date. This will give you a snapshot of your financial standing and help you plan your payments accordingly. Ensure that the information is accurate and matches your expectations.

2. Check for Unauthorized Transactions

Next, carefully review the transaction details section to identify any unauthorized or unfamiliar charges. If you notice any suspicious activity, contact your credit card issuer immediately to report the issue and initiate a dispute if necessary. It’s crucial to act promptly to protect yourself from fraudulent charges.

3. Verify Your Payments

Compare the payment information on your credit card statement with your records to ensure that your payments have been accurately reflected. Pay attention to any additional fees or interest charges applied and make sure they align with the terms and conditions of your credit card agreement.

4. Understand Your Charges

Take the time to understand the fees outlined in your billing statement. Identify any areas where you can minimize fees, such as avoiding late payments or foreign transactions. Being aware of the costs associated with your credit card will help you make more informed decisions and manage your finances effectively.

5. Calculate Your Interest Charges

If you carry a balance on your credit card, calculate the interest charges by multiplying your outstanding balance by the APR. This will give you an idea of how much interest you’re being charged and help you evaluate your repayment strategy. Consider paying more than the minimum payment to reduce your interest costs over time.

6. Maximize Your Rewards

If your credit card offers rewards or benefits, review the rewards and benefits section to understand how you can maximize your earnings. Take note of any promotional offers or redemption options that may be available to you. By taking full advantage of your credit card rewards, you can make the most out of your spending.

7. Stay Updated

Finally, read through any important notices and updates from your credit card issuer. Stay informed about any changes to terms and conditions, promotional offers, or updates to your account. Being aware of these updates will help you make informed decisions and avoid any surprises.

The Importance of Reviewing Your Credit Card Billing Statement

Reviewing your credit card billing statement is not just a good financial practice; it’s essential for your overall financial well-being. Here are some reasons why you should make it a habit to review your credit card statement regularly:

- Identify Errors: By reviewing your statement, you can identify and dispute any errors or unauthorized charges promptly. This helps protect you from financial losses and ensures the accuracy of your credit card account.

- Manage Your Expenses: Your credit card statement provides a detailed breakdown of your expenses, allowing you to track your spending habits and identify areas where you can cut back. This helps you stay within your budget and make more informed financial decisions.

- Avoid Late Payments: By reviewing your statement, you can ensure that you make timely payments and avoid late fees and penalties. Late payments can negatively impact your credit score, so staying on top of your due dates is crucial.

- Monitor Your Credit Utilization: Your credit card statement provides information about your credit utilization ratio, which is the percentage of your available credit that you’re using. By keeping an eye on this ratio, you can maintain a healthy credit score and improve your overall creditworthiness.

- Maximize Rewards: If your credit card offers rewards or benefits, reviewing your statement helps you stay updated on your rewards earnings and redemption options. This allows you to make the most out of your credit card perks and maximize your benefits.

Conclusion

Your credit card billing statement is a vital tool for managing your finances effectively. By understanding its components and learning how to read it properly, you can take control of your credit card usage and make informed financial decisions. Remember to review your statement regularly, identify any errors or unauthorized charges, and stay updated on any changes from your credit card issuer. By doing so, you’ll be on your way to financial success and peace of mind.

Credit Card Billing Statement Template – Download