Many parents are familiar with the child tax credit, a tax benefit that helps to reduce the amount of tax owed by families with dependent children. However, understanding the details and determining eligibility for this credit can be complicated. To simplify the process, the IRS provides a child tax credit worksheet that can assist parents in calculating the credit amount.

This article will explore the what, why, and how of the child tax credit worksheet, examples, tips for successful completion, and more.

What is a Child Tax Credit Worksheet?

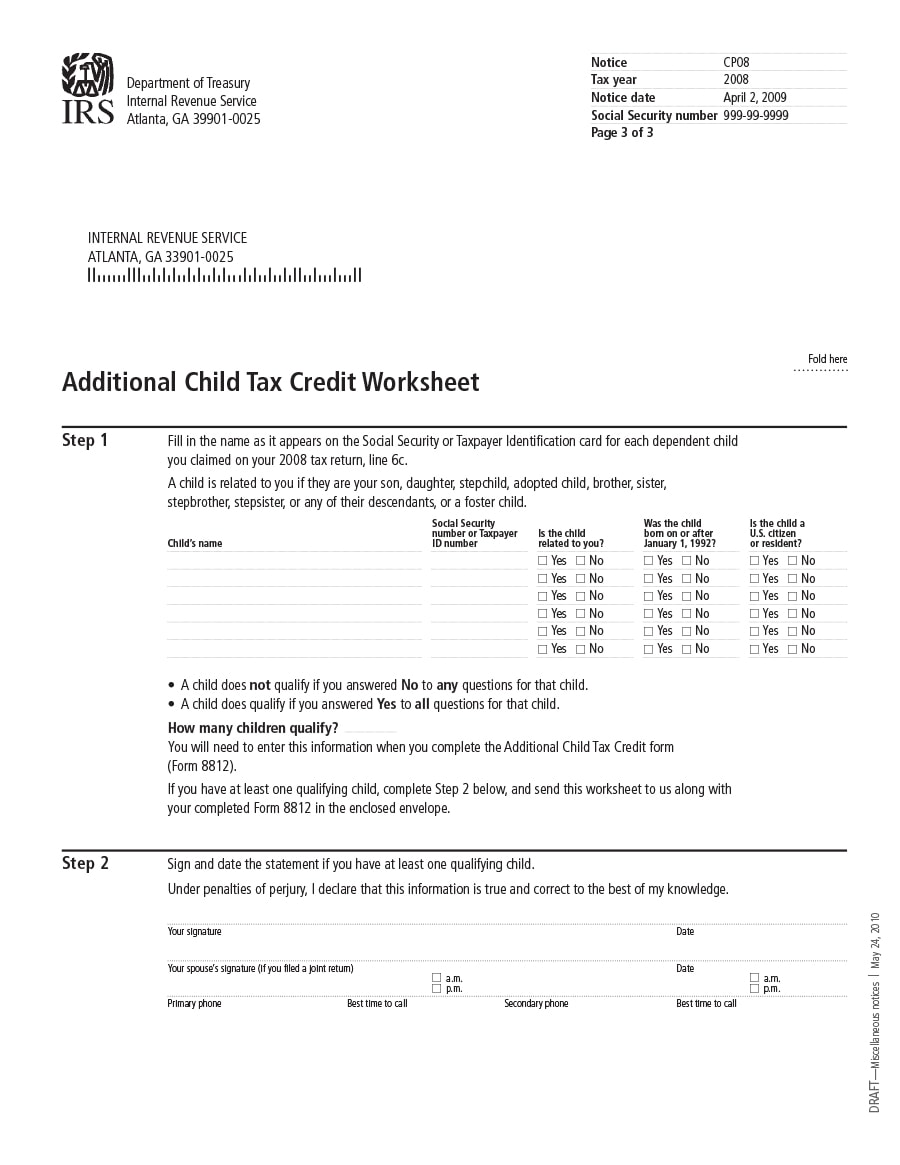

A child tax credit worksheet is a tool provided by the Internal Revenue Service (IRS) to help parents determine the amount of child tax credit they are eligible for. This worksheet takes into account various factors such as the number of qualifying children, their ages, and the parent’s income. By filling out the worksheet, parents can calculate their child’s tax credit and ensure they are receiving the maximum benefit available to them.

Why Use a Child Tax Credit Worksheet?

Using a child tax credit worksheet is beneficial for several reasons:

- Accuracy: The worksheet ensures that parents accurately calculate their child’s tax credit by taking into account all the necessary factors.

- Maximizing Benefits: By using the worksheet, parents can determine if they are eligible for the maximum amount of child tax credit.

- Tax Planning: The worksheet allows parents to plan their taxes more effectively by estimating their child’s tax credit in advance.

How to Use a Child Tax Credit Worksheet

Using a child tax credit worksheet is a straightforward process. Here is a step-by-step guide:

Step 1: Gather the Necessary Information

Before starting to fill out the worksheet, gather the following information:

- Social Security Numbers or Individual Taxpayer Identification Numbers (ITINs) for each qualifying child

- Income information, including adjusted gross income (AGI) and any other relevant income details

- Information about any other tax credits or deductions you may be eligible for

Step 2: Fill Out the Worksheet

Start by entering your filing status and the number of qualifying children on the worksheet. Then, follow the instructions provided on the worksheet to calculate your child’s tax credit. The worksheet will guide you through the process, considering factors such as income limits and phase-out amounts.

Step 3: Double-Check for Accuracy

After completing the worksheet, review your entries to ensure accuracy. Mistakes or omissions may result in incorrect calculations and potentially reduce your child’s tax credit.

Step 4: Transfer the Information to Your Tax Return

Once you have calculated your child tax credit using the worksheet, transfer the relevant information to your tax return. This may involve filling out additional forms or sections, depending on the tax software or method you are using.

Examples of a Child Tax Credit Worksheet

Let’s take a look at some examples of a child tax credit worksheet:

Tips for Successful Completion of a Child Tax Credit Worksheet

To ensure a successful completion of the child tax credit worksheet, consider the following tips:

- Gather all the necessary information beforehand to avoid interruptions during the filling process.

- Double-check your calculations to ensure accuracy.

- Keep supporting documents and records in case of an audit or verification.

- If you are unsure about any aspect of the worksheet, consult a tax professional for guidance.

Conclusion

The child tax credit worksheet is a valuable tool for parents to determine their eligibility and calculate the amount of child tax credit they can claim. By following the steps outlined in the worksheet and considering the tips provided, parents can maximize their tax benefits and ensure accurate reporting.

Remember to consult the IRS website or a tax professional for the most up-to-date information and guidance regarding child tax credits.

Child Tax Credit Worksheet Template – Download