Donating money to charitable organizations is a noble act that helps support various causes and make a positive impact in the world. When you make a cash or funds donation, it’s important to keep track of your contribution for both personal and tax purposes. This is where a cash or funds donation receipt comes in handy.

This article will explore the importance of donation receipts, how to create and use them effectively, and provide you with some helpful examples.

Why Do You Need a Cash or Funds Donation Receipt?

A cash or funds donation receipt serves as proof of your charitable contribution. It is a document that acknowledges the receipt of money by the charitable organization and provides details about the donation. Here are some reasons why you need a donation receipt:

- To keep track of your donations: Having a receipt helps you maintain a record of your charitable contributions, making it easier to keep track of the amount donated and the organizations you have supported.

- For tax purposes: Donations to eligible charitable organizations can be tax-deductible. The receipt serves as evidence of your donation when you file your taxes, allowing you to claim deductions and potentially reduce your taxable income.

- To establish credibility: When you donate money to a charitable organization, you want to ensure that your donation is being used for its intended purpose. A receipt provides proof that your donation has been received and will be put to good use.

What Information Should Include?

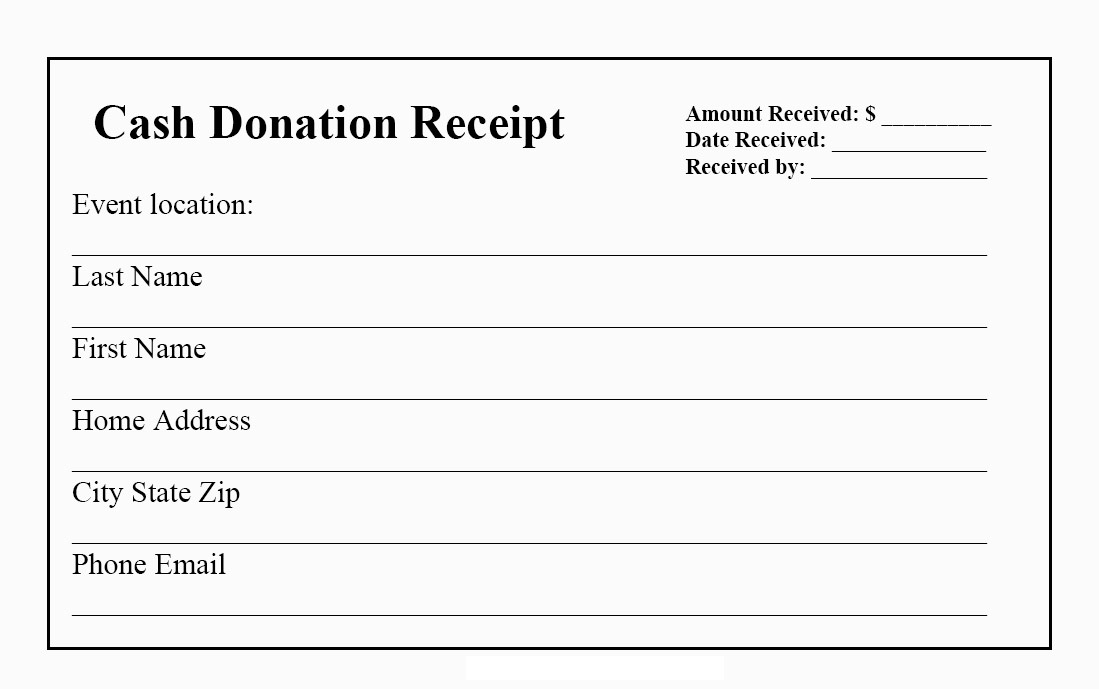

A cash or funds donation receipt should contain specific information to be considered valid and useful. Here are the key details that should be included:

- Organization’s name and contact information: The receipt should clearly state the name, address, and contact details of the charitable organization.

- Your name and contact information: Include your name, address, and contact details so that the organization can identify the donor.

- Date of donation: Specify the date on which the donation was made. This is crucial for tax purposes, as the donation must be made within the tax year to be eligible for deductions.

- Donation amount: Clearly state the amount of money donated. It’s recommended to provide both the numerical and written forms of the amount to avoid any confusion.

- Payment method: Indicate whether the donation was made in cash, by check, or through an electronic transfer.

- Purpose of donation: If you have specified a specific purpose for your donation, such as supporting a particular program or project, mention it in the receipt.

- Statement of tax deductibility: Include a statement indicating whether the organization is a qualified charitable organization and whether the donation is tax-deductible.

- Signature: The receipt should be signed by an authorized representative of the charitable organization to validate its authenticity.

How to Create a Donation Receipt

Creating a cash or funds donation receipt is a relatively simple process. Here are the steps to follow:

- Use a word processing or spreadsheet software: Open a blank document in a word processing or spreadsheet software program, such as Microsoft Word or Excel.

- Add your organization’s logo: If you have an organization logo, insert it at the top of the receipt to give it a professional look.

- Include organization details: Clearly state the name, address, and contact information of your organization.

- Add donor information: Create sections to include the donor’s name, address, and contact details.

- Specify the donation details: Create fields to capture the date of donation, donation amount, payment method, and purpose of the donation.

- Include a statement of tax deductibility: Add a statement indicating the tax-deductible status of the organization and whether the donation is eligible for tax deductions.

- Leave space for a signature: Allocate an area at the bottom of the receipt for an authorized representative of the organization to sign and date the document.

- Save and print: Save the receipt as a document file, such as PDF, and print copies to provide to donors.

Final Thoughts

A cash or funds donation receipt is a valuable tool for both donors and charitable organizations. It helps donors keep track of their contributions and provides proof for tax deductions, while also enabling organizations to maintain transparency and accountability. By following the steps outlined in this guide, you can create a professional and effective donation receipt that serves its purpose.

Remember to consult with a tax professional for advice specific to your situation to ensure compliance with tax regulations and maximize your deductions.

Cash Or Funds Donation Receipt Template Excel – Download