Understanding and analyzing financial statements is crucial for businesses of all sizes. One essential tool in financial analysis is the balance sheet, which provides a snapshot of a company’s financial position at a specific point in time. To gain deeper insights into a company’s financial health, ratios derived from the balance sheet are often used.

This article will explore what calculating ratios balance sheet is, why it is important, how to calculate ratios, provide examples, and offer tips for successful ratio analysis.

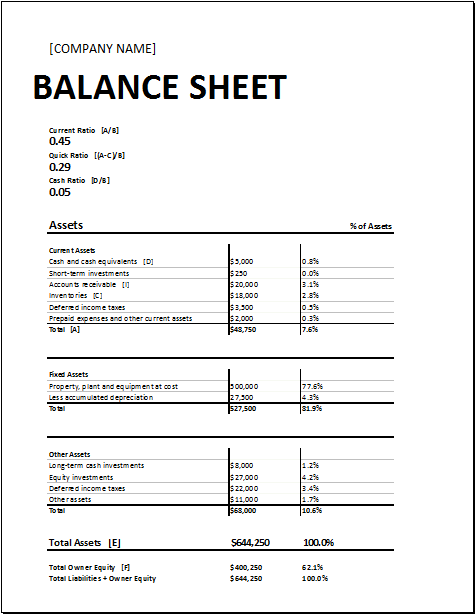

What is a Calculating Ratios Balance Sheet?

A calculating ratios balance sheet is a document that displays the financial position of a company in a format. It includes various financial ratios derived from the balance sheet, which help assess the company’s liquidity, solvency, profitability, and efficiency.

These ratios provide important insights into the company’s financial health and performance, allowing investors, creditors, and other stakeholders to make informed decisions.

Why is Calculating Ratios Balance Sheet Important?

The calculating ratios balance sheet is important because it allows for a comprehensive analysis of a company’s financial health. By calculating and interpreting ratios, stakeholders can gain a deeper understanding of the company’s strengths, weaknesses, and overall performance. This information is crucial for making investment decisions, assessing creditworthiness, and identifying areas for improvement.

How to Calculate Ratios from the Balance Sheet

Calculating ratios from the balance sheet involves using specific formulas to derive meaningful financial metrics. Here are some commonly used ratios and their formulas:

- Liquidity Ratios: These ratios measure a company’s ability to meet short-term obligations. Examples include the current ratio (current assets divided by current liabilities) and the quick ratio (current assets minus inventory divided by current liabilities).

- Solvency Ratios: Solvency ratios assess a company’s long-term financial stability and its ability to meet long-term obligations. The debt-to-equity ratio (total debt divided by total equity) and the interest coverage ratio (earnings before interest and taxes divided by interest expense) are examples of solvency ratios.

- Profitability Ratios: These ratios evaluate a company’s ability to generate profits. Examples include the gross profit margin (gross profit divided by net sales) and the return on assets (net income divided by total assets).

- Efficiency Ratios: Efficiency ratios measure how effectively a company utilizes its assets and manages its liabilities. The inventory turnover ratio (cost of goods sold divided by average inventory) and the accounts receivable turnover ratio (net credit sales divided by average accounts receivable) are examples of efficiency ratios.

These are just a few examples of the ratios that can be calculated from the balance sheet. The specific ratios to be calculated may vary depending on the industry and the purpose of the analysis.

Example of a Calculating Ratios Balance Sheet

To illustrate how a calculating ratios balance sheet works, let’s consider a fictional company, ABC Corporation:

- Total Assets: $500,000

- Total Liabilities: $200,000

- Total Equity: $300,000

- Current Assets: $250,000

- Current Liabilities: $100,000

- Inventory: $50,000

- Gross Profit: $100,000

- Net Sales: $300,000

- Net Income: $50,000

Using these figures, we can calculate various ratios:

- Current Ratio = Current Assets / Current Liabilities = $250,000 / $100,000 = 2.5

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities = ($250,000 – $50,000) / $100,000 = 2

- Debt-to-Equity Ratio = Total Debt / Total Equity = $200,000 / $300,000 = 0.67

- Interest Coverage Ratio = Earnings Before Interest and Taxes / Interest Expense = $100,000 / $10,000 = 10

- Gross Profit Margin = Gross Profit / Net Sales = $100,000 / $300,000 = 0.33

- Return on Assets = Net Income / Total Assets = $50,000 / $500,000 = 0.1

- Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory = $200,000 / $50,000 = 4

- Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable = $300,000 / $100,000 = 3

Tips for Successful Ratio Analysis

When conducting ratio analysis, consider the following tips to ensure accuracy and effectiveness:

- Use consistent financial data: Ensure that the data used for ratio calculation is from the same period and is consistent with the financial statements.

- Compare ratios to industry benchmarks: To gain meaningful insights, compare the calculated ratios to industry averages or benchmarks. This allows for a better understanding of how the company performs relative to its peers.

- Consider trends over time: Analyze the ratios over multiple periods to identify trends. This helps in assessing the company’s financial progress or decline.

- Look beyond ratios: Ratios provide valuable information, but they should not be the sole basis for decision-making. Consider other factors such as industry trends, management quality, and market conditions.

Free Calculating Ratios Balance Sheet Template!

A calculating ratios balance sheet is a valuable tool for analyzing a company’s financial health. By calculating and interpreting ratios derived from the balance sheet, stakeholders can gain insights into liquidity, solvency, profitability, and efficiency.

Understanding how to calculate ratios, using examples and samples, and following tips for successful ratio analysis can help stakeholders make informed decisions and assess a company’s financial performance accurately.

Calculating Ratios Balance Sheet Template – Download