Checking the Balance in your Account with Bank Reconciliation Form

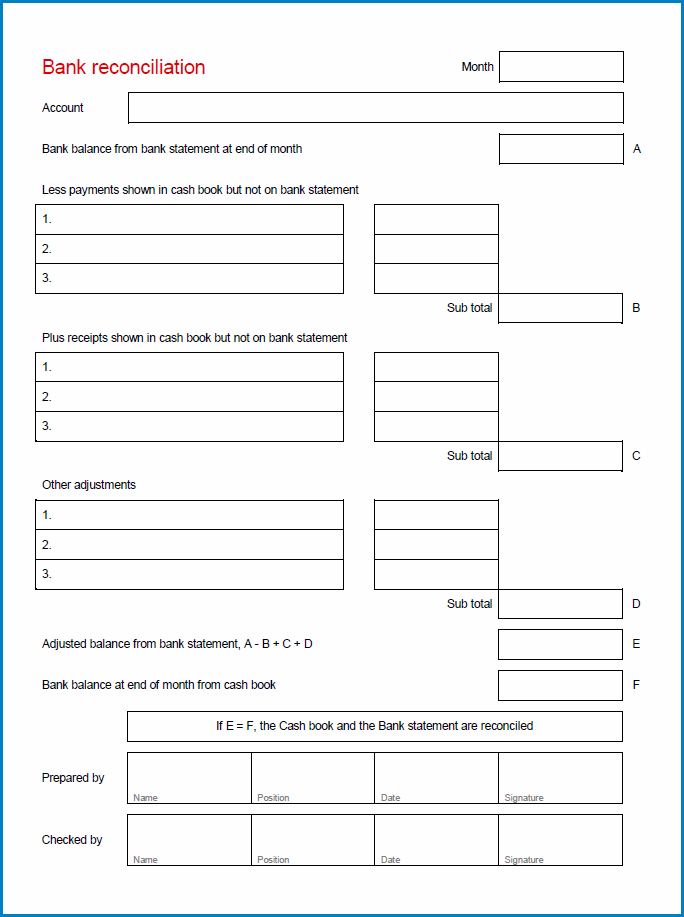

The document that could show you the difference between a company registration and a bank statement is usually called bank reconciliation. It should be done because if there are any differences caused by the transaction which is not recorded by the bank, it means that the company is not wrong. On the other contrary, if there are any differences caused by some other postal, then, it is needed to be adjusted between the company and the bank statements. To make these statements, you should gather the description related to the differences. The purpose of this reconciliation is to avoid accounting fraud from the start besides matching the statements that the company made and the bank statements.

Other Samples of Bank Reconciliation Form :

There are some situations where the bank reconciliation form is needed. Deposit on transit, current account service, outstanding check, blank check, and money order bill are some factors that cause reconciliation with the bank happen. Tocreate it, you can use different applications such as Microsoft Word or Excel for the template. You should write bank name, bank account, statements date, statements balance, description of deposit in transit, and subtract outstanding checks, total adjustments, bank charges, and interest. Besides that, the document is also available for monthly reconciliation. You can download the template provided for free, on the bottom of this page.

Bank Reconciliation Form | Excel – download