Managing employee expenses is a crucial task for any HR department. It involves tracking and reimbursing expenses incurred by employees on behalf of the company. One effective way to streamline this process is by using an employee expense report sheet.

This article will explore what an employee expense report sheet is, why it is important, how to create one and provide tips for successful expense reporting.

What is an Employee Expense Report Sheet?

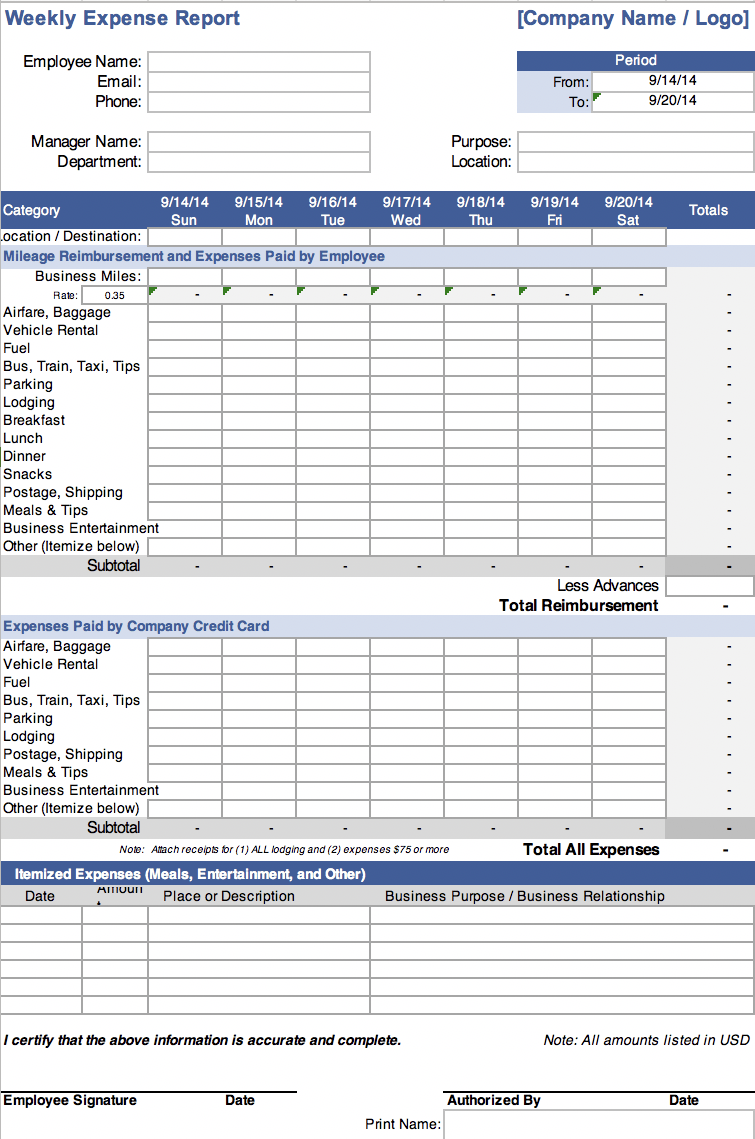

An employee expense report sheet is a document that helps employees record their business-related expenses in a structured format. It typically includes fields for capturing expense details such as date, description, amount, and category. The sheet is then submitted to the HR department for review and reimbursement.

Using an employee expense report sheet offers several advantages. It helps ensure that all expenses are properly documented, reduces the chances of errors or omissions, and facilitates the reimbursement process for employees. It also enables the HR department to track and analyze expenses, identify trends, and make informed decisions regarding budget allocation.

Why is an Employee Expense Report Sheet Important?

An employee expense report sheet is important for both employees and the HR department. For employees, it provides a standardized and organized way to report expenses, ensuring they are reimbursed promptly and accurately. It also helps employees maintain a record of their business-related expenditures for tax or auditing purposes.

For the HR department, an employee expense report sheet simplifies the expense management process. It allows HR personnel to easily review and verify expenses, ensuring compliance with company policies and expense guidelines. The sheet also serves as a valuable tool for financial analysis, enabling the HR department to identify areas of overspending or potential cost-saving opportunities.

How to Create an Employee Expense Report Sheet?

Here is a step-by-step guide to help you get started:

Step 1: Determine the Required Fields

Start by identifying the essential fields that need to be included in the expense report sheet. Common fields include:

- Date: The date the expense was incurred.

- Description: A brief explanation of the expense.

- Amount: The total amount of the expense.

- Category: The expense category (e.g., travel, meals, office supplies).

- Receipt: Whether a receipt is attached or not.

You can customize these fields based on your company’s specific requirements.

Step 2: Design the Layout

Design the layout of the expense report sheet using spreadsheet software or a word processor. Consider using a table format to ensure a neat and organized appearance. Leave enough space for employees to fill in the required information.

Step 3: Add the Company Logo and Details

Include your company’s logo and contact details at the top of the expense report sheet to give it a professional look. This will also help employees easily identify the document and associate it with your organization.

Step 4: Incorporate Expense Categories

Create a section where employees can select the appropriate expense category from a predefined list. This will facilitate expense tracking and analysis.

Step 5: Include Instructions and Guidelines

Provide clear instructions and guidelines on how to complete the expense report sheet. This will help employees understand the reporting process and ensure consistency in the information provided.

Step 6: Test and Review

Before implementing the expense report sheet, test it with a few employees and gather feedback. Make any necessary revisions or improvements based on the feedback received. Review the final version to ensure it meets your organization’s requirements.

Tips for Successful Expense Reporting

Effective expense reporting is crucial for maintaining financial transparency and accountability within an organization. Here are some tips to ensure successful expense reporting:

- Submit Expenses Promptly: Encourage employees to submit their expense reports as soon as possible to avoid delays in reimbursement.

- Provide Clear Guidelines: Communicate your company’s expense policies and guidelines to employees to avoid confusion or errors.

- Require Receipts: Make it mandatory for employees to attach receipts for all expenses above a certain threshold. This helps validate the expenses and ensures accurate reimbursement.

- Regularly Review and Analyze Expenses: Regularly review and analyze the expenses submitted to identify any irregularities or areas for improvement.

- Automate the Process: Consider using expense management software or tools to automate the expense reporting process. This can help streamline the workflow and reduce manual errors.

- Train Employees: Conduct training sessions to educate employees on the expense reporting process, including the proper use of the expense report sheet.

- Monitor Compliance: Regularly monitor and enforce compliance with company expense policies to maintain financial discipline.

Download The Expense Report Template!

An employee expense report sheet is a valuable tool for both employees and the HR department. It simplifies the expense reporting process, ensures accurate reimbursement, and facilitates financial analysis.

By following the steps outlined in this guide and implementing the tips for successful expense reporting, you can effectively manage employee expenses and maintain financial transparency within your organization.

Employee Expense Report Sheet To HR Template Excel – Download