Being a self-employed contractor comes with its own set of challenges, one of which is managing your invoices. Invoices are an essential part of any business as they help you maintain a record of your transactions and ensure that you get paid for your services.

In this comprehensive guide, we will explore everything you need to know about self-employed contractor invoices, from what they are and why they are important, to how to create and manage them effectively.

What is a self employed contractor invoice?

A self-employed contractor invoice is a document that outlines the services provided by a contractor to a client and the amount owed for those services. It serves as a formal request for payment and includes important details such as the contractor’s name and contact information, the client’s name and contact information, a description of the services provided, the dates of the work, and the total amount due.

Self-employed contractors often work on a project basis or provide services on an hourly or daily rate. Invoices are typically issued at the end of a project or regularly, such as monthly or biweekly. They are an important tool for contractors to ensure they are paid accurately and on time.

Why are self employed contractor invoices important?

Self-employed contractor invoices are crucial for several reasons:

- Record keeping: Invoices help contractors maintain a record of their transactions, making it easier to track and manage their finances.

- Professionalism: Invoices give a professional impression to clients and help establish trust and credibility.

- Payment tracking: Invoices provide a clear breakdown of the services provided and the amount owed, making it easier to track payments and resolve any disputes.

- Tax compliance: Invoices serve as proof of income for tax purposes and are essential for ensuring compliance with tax regulations.

How to create a self employed contractor invoice

Creating a self-employed contractor invoice is relatively simple. Here are the steps you can follow:

- Include your contact information: Start by including your name, business name (if applicable), address, phone number, and email address. This information should be prominently displayed at the top of the invoice.

- Add the client’s contact information: Include the client’s name, business name (if applicable), address, phone number, and email address.

- Include an invoice number and date: Assign a unique invoice number to each invoice you create and include the date the invoice was issued.

- Provide a detailed description of the services: Clearly describe the services you provided, including the dates of the work, the number of hours or days worked, and any specific tasks or deliverables completed.

- Specify the payment terms: Clearly state the payment terms, including the amount due, the payment due date, and any late payment fees or discounts for early payment.

- Include your payment details: Provide your preferred payment method and any relevant payment details, such as your bank account number or PayPal email address.

- Add a thank you note: Conclude the invoice with a polite and professional thank you note, expressing your gratitude for the opportunity to work with the client.

Best practices for managing self employed contractor invoices

Managing your self-employed contractor invoices effectively is essential for maintaining a healthy cash flow and ensuring that you get paid on time. Here are some best practices to follow:

- Use invoicing software: Consider using invoicing software to create and manage your invoices. This can streamline the process and help you keep track of your invoices.

- Send invoices promptly: Send your invoices as soon as the work is completed or on the agreed-upon schedule. This helps ensure that your clients receive the invoice promptly and reduces the chances of payment delays.

- Follow up on overdue payments: If a client fails to pay on time, don’t hesitate to follow up with a polite reminder. Sometimes, a gentle nudge is all it takes to prompt payment.

- Keep copies of your invoices: Make sure to keep copies of all your invoices, both digital and physical. This will help you maintain a record of your transactions and provide proof of payment if needed.

- Consider offering online payment options: Offering online payment options, such as credit card or PayPal, can make it easier for clients to pay you and reduce payment delays.

- Review your invoices regularly: Regularly review your invoices to ensure that they are accurate and up to date. This includes checking for any errors or omissions and confirming that all necessary information is included.

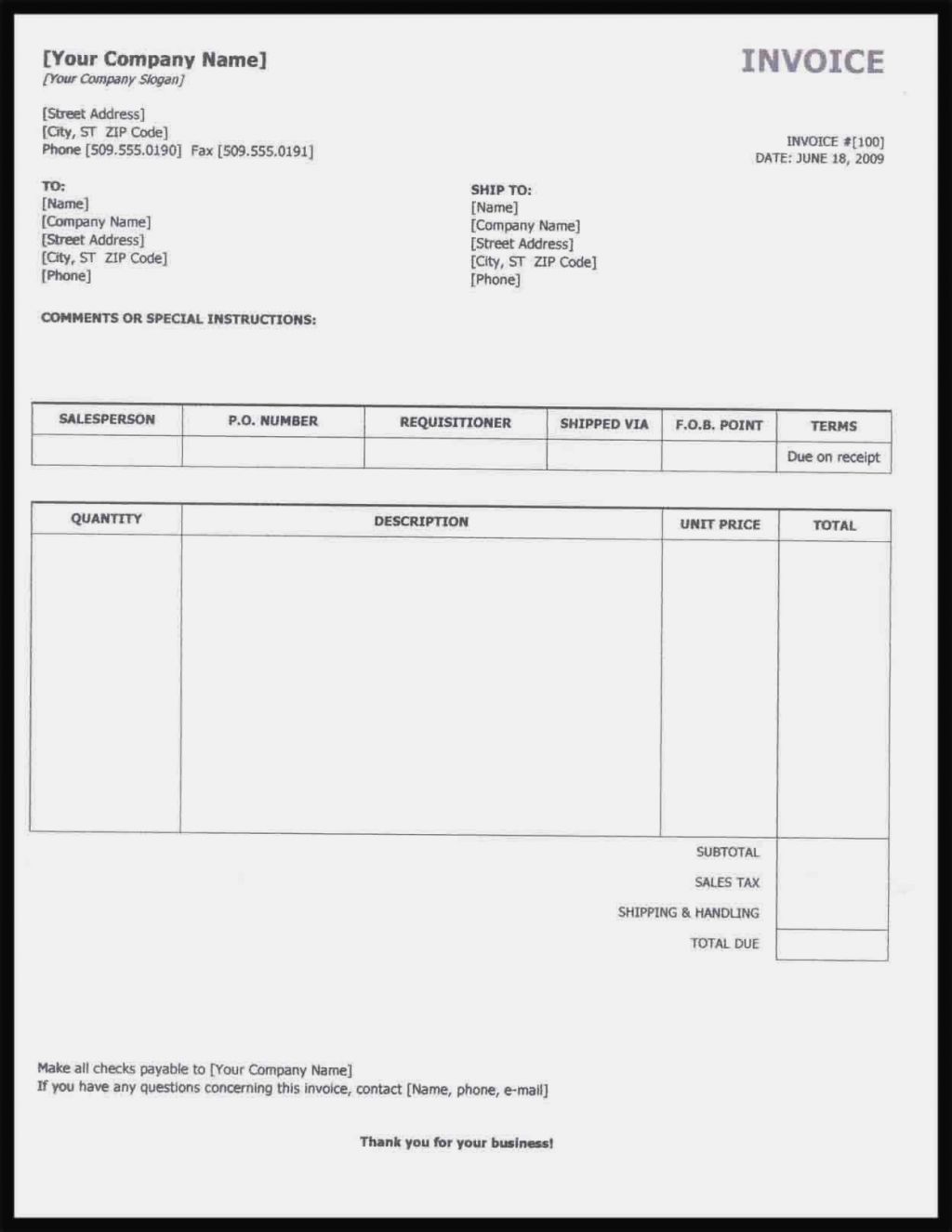

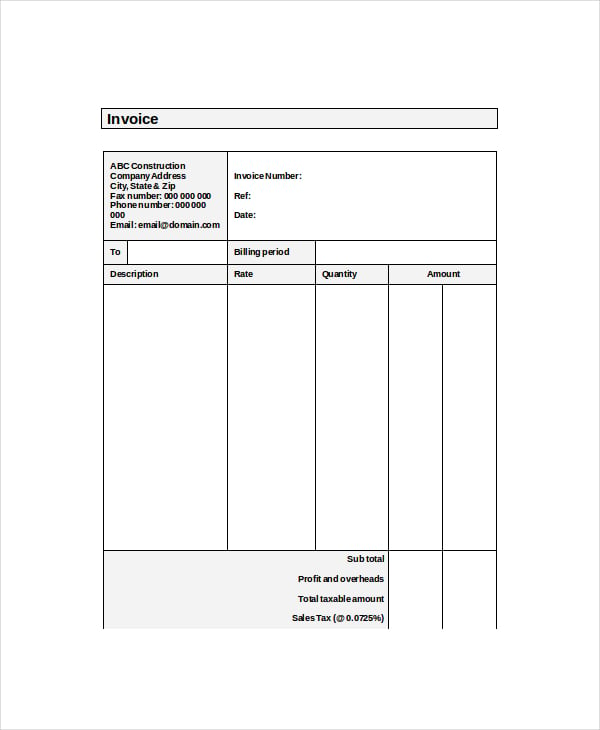

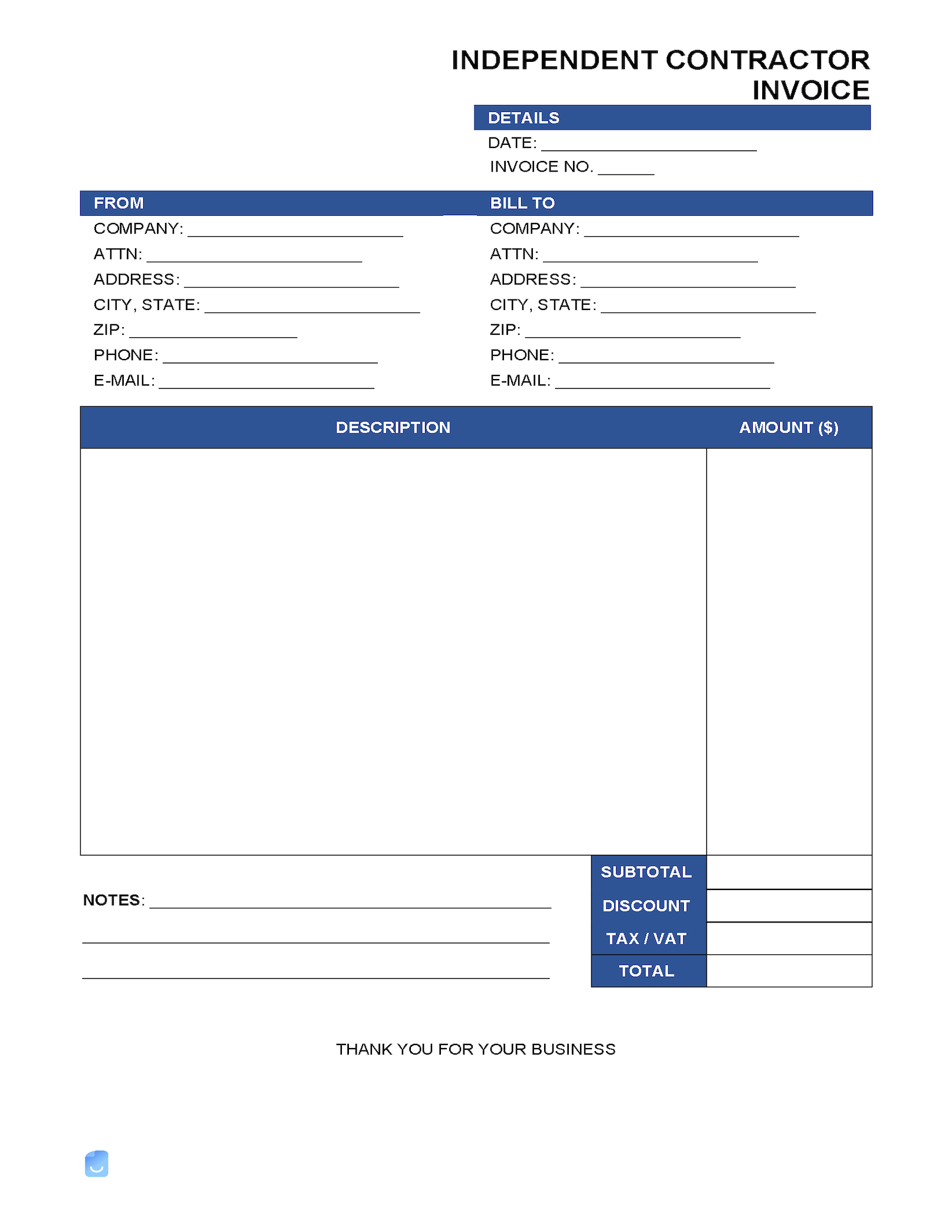

Sample self-employed contractor invoice

Here is an example of a self-employed contractor invoice:

Invoice Number: 00125

Date: July 15, 2022

From:

John Smith

123 Main Street

Anytown, USA

Phone: (555) 123-4567

Email: [email protected]

To:

ABC Company

456 Business Avenue

Somewhere, USA

Phone: (555) 987-6543

Email: [email protected]

Description:

Services provided for website development project:

– Design and development of website layout

– Implementation of e-commerce functionality

– Testing and bug fixes

– Training and support

Payment Terms:

Total Amount Due: $5,000

Payment Due Date: August 1, 2022

Late Payment Fee: $50 per day

Payment Details:

Bank Transfer

Account Number: 123456789

Routing Number: 987654321

Thank you for your business. Please let me know if you have any questions or require any further information.

Conclusion

Managing your self-employed contractor invoices effectively is crucial for maintaining a healthy cash flow and ensuring that you get paid on time. By understanding what a self-employed contractor invoice is, why it is important, and how to create and manage it, you can streamline your invoicing process and focus on what you do best – providing high-quality services to your clients.

Self-employed Contractor Invoice Template – Download