As a business owner or freelancer, providing clear and detailed invoices to your clients is essential for maintaining a professional relationship and ensuring timely payments. One type of invoice that is often used is an itemized invoice.

In this article, we will explore what an itemized invoice is, why it is important, and how to create one effectively.

What is an Itemized Invoice?

An itemized invoice is a document that provides a breakdown of the goods or services provided to a client along with their corresponding costs. Unlike a regular invoice that simply states the total amount due, an itemized invoice provides a detailed list of each item or service, allowing the client to see exactly what they are being charged for. This level of transparency is crucial for maintaining trust and credibility with your clients.

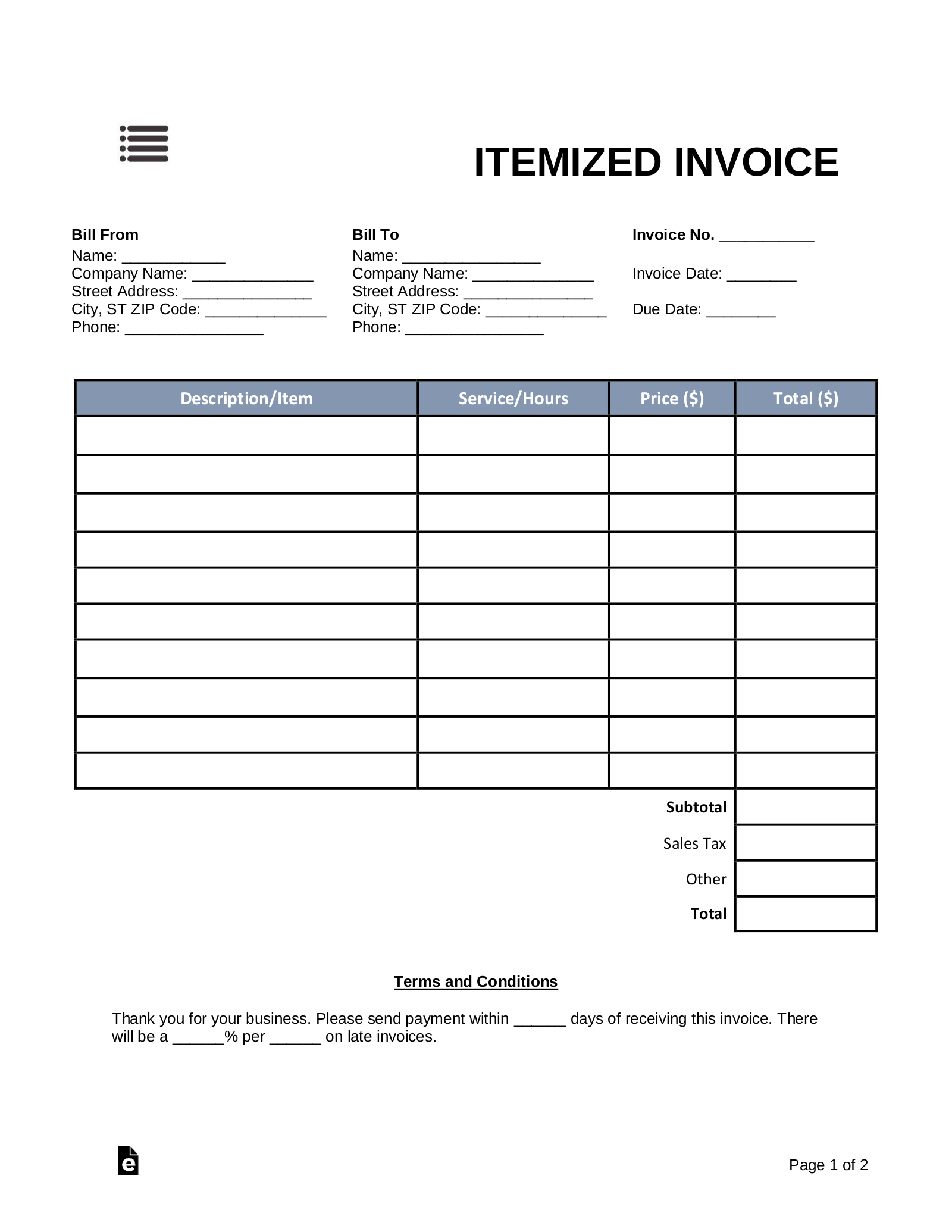

Itemized invoices typically include the following information:

- Date: The date the invoice was issued.

- Invoice number: A unique identifier for the invoice.

- Client information: The name, address, and contact details of the client.

- Itemized list: A detailed breakdown of each item or service provided, including their quantity, description, and individual cost.

- Subtotal: The total cost of all items or services before any taxes or discounts.

- Taxes: Any applicable taxes or fees.

- Discounts: Any discounts applied to the total amount due.

- Total: The final amount that the client is required to pay.

Why is an Itemized Invoice Important?

An itemized invoice is important for several reasons:

- Transparency: By providing a detailed breakdown of the goods or services provided, an itemized invoice ensures transparency and helps to build trust with your clients.

- Dispute resolution: If a client has any questions or concerns about the invoice, an itemized breakdown makes it easier to identify and resolve any discrepancies.

- Tax purposes: An itemized invoice provides a clear record of expenses, making it easier for both you and your client to track and report taxes.

- Budgeting: An itemized invoice allows your client to better understand where their money is going, helping them with budgeting and financial planning.

- Professionalism: Providing an itemized invoice shows that you take your business seriously and are committed to providing excellent service.

How to Create an Effective Itemized Invoice

Creating an effective itemized invoice involves several key steps:

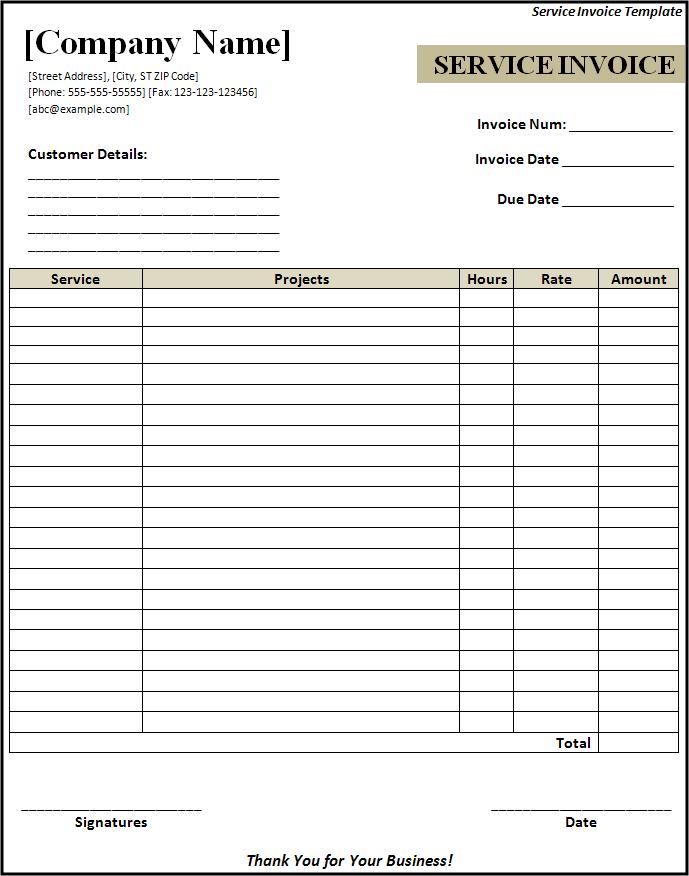

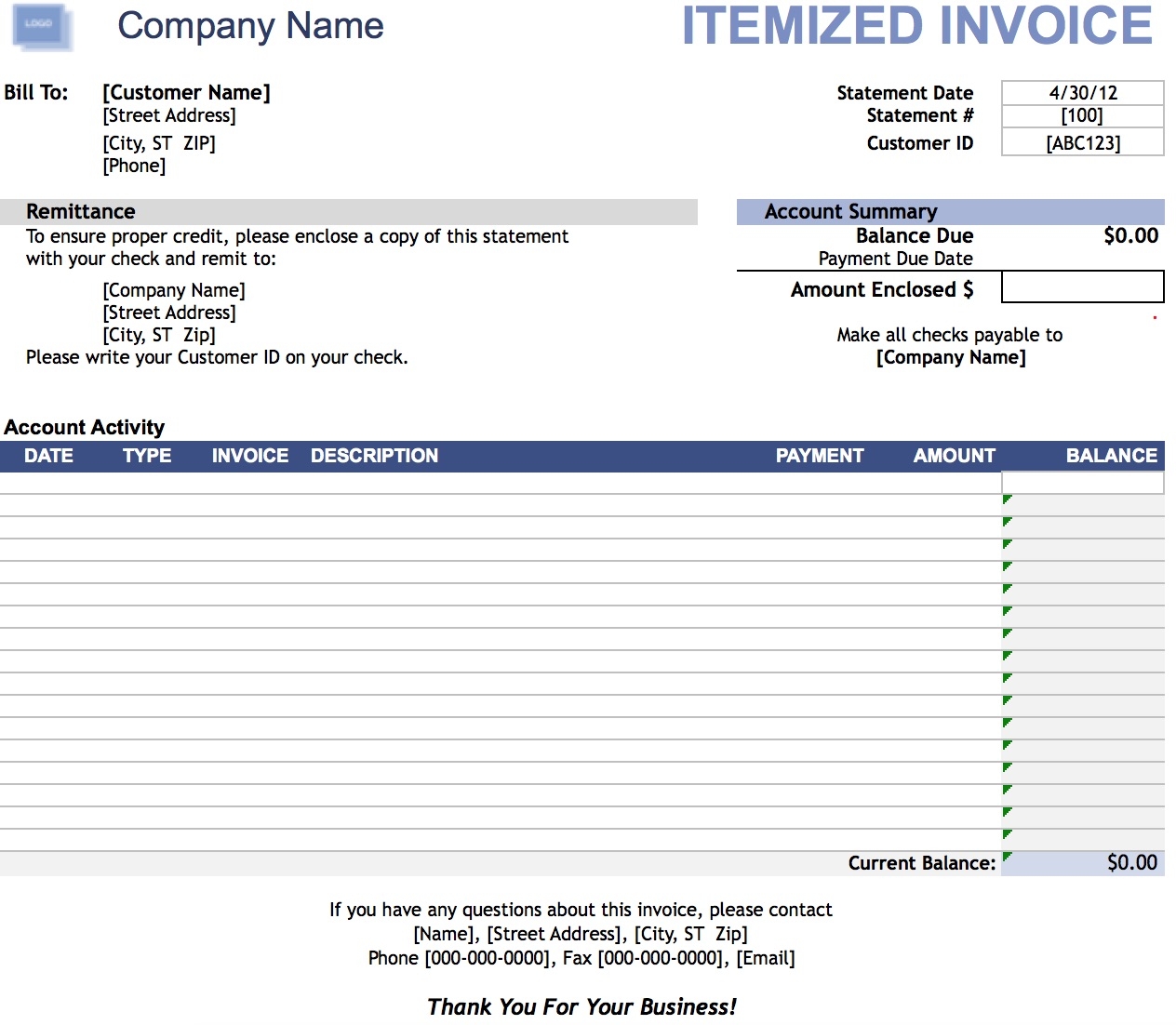

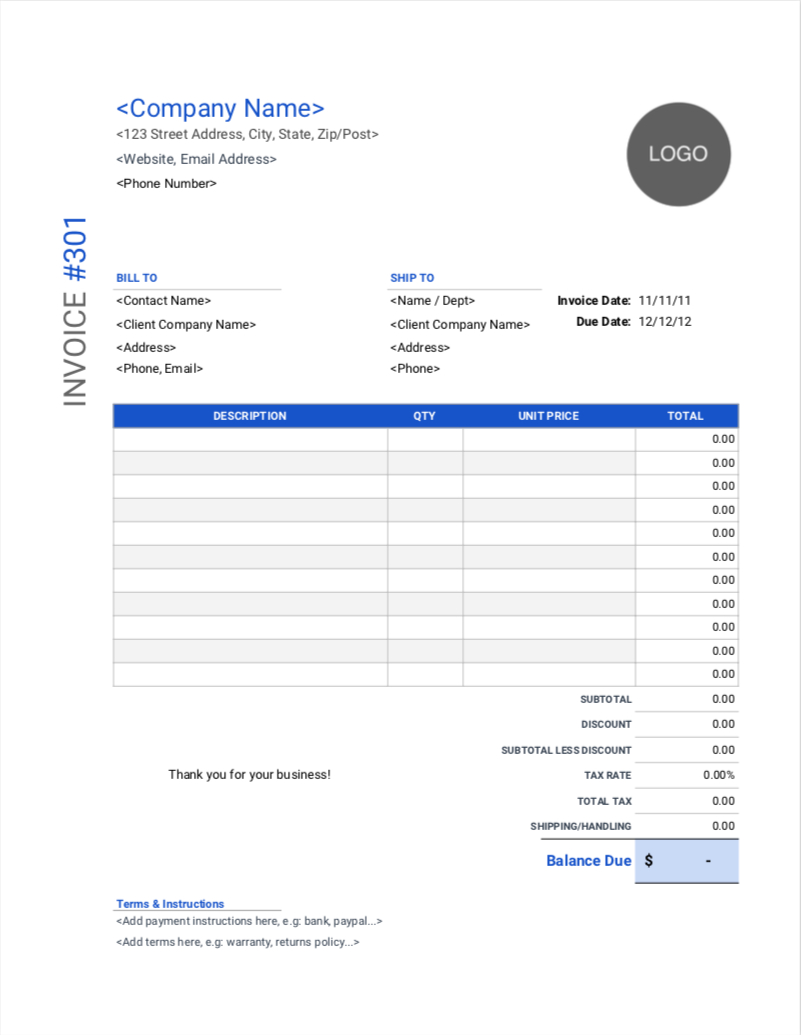

1. Use a Professional Invoice Template

Start by using a professional invoice template that includes all the necessary fields for an itemized invoice. This will ensure that your invoice looks polished and organized.

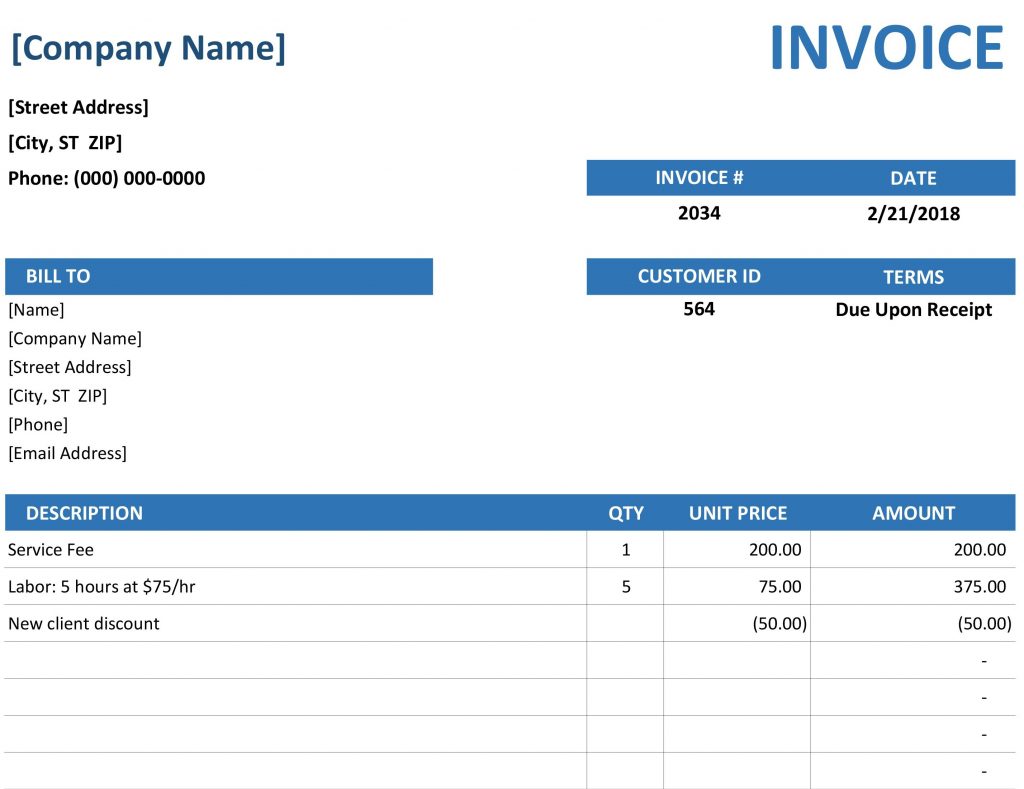

2. Include Clear Descriptions and Quantities

For each item or service provided, include a clear and concise description along with the quantity. This will help your client understand exactly what they are being charged for.

3. Calculate Costs Accurately

Double-check all calculations to ensure that the costs are accurate. Mistakes in calculations can lead to confusion and disputes with your clients.

4. Provide Subtotals and Totals

Include subtotals for each item or service, as well as a total amount due at the bottom of the invoice. This makes it easier for your client to see the breakdown of costs.

5. Specify Taxes and Discounts

If applicable, clearly state any taxes or discounts applied to the total amount due. This will help your client understand the final cost.

6. Use Professional Language

Ensure that your invoice is written in a professional tone and uses clear and concise language. Avoid jargon or technical terms that your client may not understand.

7. Include Contact Information

Provide your contact information, including your name, business name, address, phone number, and email address. This makes it easy for your client to reach out to you if they have any questions or concerns.

8. Send the Invoice Promptly

Send the invoice to your client as soon as possible after providing the goods or services. This demonstrates professionalism and helps to ensure timely payment.

Sample Itemized Invoice Template

- Item: Web Design Services

- Description: Design and development of a responsive website

- Quantity: 1

- Unit Cost: $1,500

- Subtotal: $1,500

- Taxes: $150 (10% sales tax)

- Total: $1,650

Conclusion

An itemized invoice is a valuable tool for both business owners and clients. It provides transparency, helps with budgeting and tax purposes, and enhances professionalism. By following the steps outlined in this article and using a clear and detailed template, you can create effective itemized invoices that facilitate smooth transactions and maintain strong client relationships.

Itemized Invoice Template Word – Download