When it comes to invoicing, several key components need to be included to ensure a smooth and efficient payment process. One of the most important elements is providing bank details on your invoices.

In this article, we will explore why including bank details is crucial, how to do it effectively, and the benefits it can bring to your business.

Why Should You Include Bank Details in Your Invoices?

Bank details in invoices serve as a vital link between your business and your clients. By providing this information, you are making it easier for your clients to pay you promptly and accurately. Here are some reasons why including bank details in your invoices is essential:

- Streamlined Payment Process: By providing your bank details, you eliminate any confusion and make it easy for your clients to transfer funds directly to your account.

- Professional Image: Including bank details on your invoices portrays professionalism and instills confidence in your clients, as they can see that you are an established and trustworthy business.

- Accuracy and Transparency: Bank details ensure that payments are made to the correct account, reducing the risk of errors and misunderstandings.

- Faster Payments: When clients have your bank details readily available, they can make payments promptly, speeding up the entire invoicing process.

- Convenience: By providing your bank details, you offer your clients the convenience of choosing their preferred payment method, whether it’s a bank transfer or online payment.

How to Include Bank Details in Your Invoices

Including bank details in your invoices is a straightforward process. Here are the steps to follow:

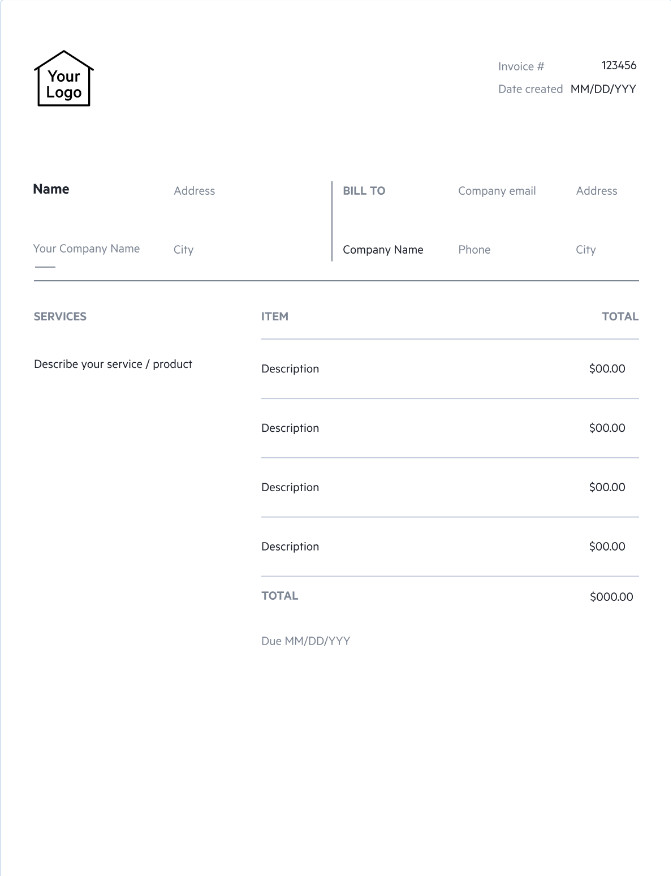

- Start by creating a professional invoice template that includes your business logo, contact information, and a section for bank details.

- Ensure that your bank details are accurate and up to date. Double-check the account number, routing number, and any other relevant information.

- Clearly label the section for bank details on your invoice. You can use a heading such as “Bank Details” or “Payment Information.”

- Include all necessary information, such as the name of your bank, the account holder’s name, the account number, and the routing number.

- If applicable, provide additional instructions or details for specific payment methods, such as international transfers or online payments.

- Consider adding a QR code that can be scanned by clients to easily access your bank details and make payments directly from their mobile devices.

Best Practices for Including Bank Details in Your Invoices

While including bank details in your invoices is important, it’s equally crucial to follow best practices to ensure the security and accuracy of the information. Here are some tips to consider:

- Double-Check Accuracy: Always verify that your bank details are correct before sending out an invoice. Mistakes in account numbers or routing numbers can lead to delays or even lost payments.

- Use Secure Communication: When sharing bank details, make sure you are using a secure method of communication, such as encrypted email or a secure file-sharing platform.

- Keep Information Up to Date: Regularly review and update your bank details to ensure that they are current. If you switch banks or open a new account, update your invoices accordingly.

- Include Multiple Payment Options: While bank transfers are a common payment method, consider offering additional options such as credit card payments or online payment platforms to accommodate different preferences.

- Provide Clear Instructions: If there are any specific requirements or instructions for making payments, such as reference numbers or payment deadlines, clearly communicate them to your clients.

Example of an Invoice with Bank Details

Here is an example of how bank details can be included in an invoice:

Invoice Number: INV-2021001

Date: January 15, 2021

Due Date: February 15, 2021

Bill To:

Client Name

123 Main Street

City, State, Zip Code

Bank Details:

- Bank Name: ABC Bank

- Account Holder: Your Company Name

- Account Number: 1234567890

- Routing Number: 987654321

- Additional Instructions: Please include the invoice number as the reference when making the payment.

Conclusion

Including bank details in your invoices is a crucial step in ensuring smooth and efficient payment processing. By providing accurate and up-to-date information, you streamline the payment process, project professionalism, and improve the overall experience for your clients. Remember to follow best practices and provide clear instructions to make the payment process as seamless as possible.

Invoice Template With Bank Details – Download