Amortization is paying out off a credit card debt in excess of time in equivalent installments. Portion of each individual payment goes toward the financial loan principal, and section goes towards interest. With mortgage amortization, the quantity going towards principal starts off out small, and slowly grows greater thirty day period by month. In the meantime, the quantity going toward curiosity declines month by month for fixed-rate loans. Your amortization schedule displays the amount cash you shell out in principal and desire above time. Use this calculator to find out how all those payments break down around your loan time period.

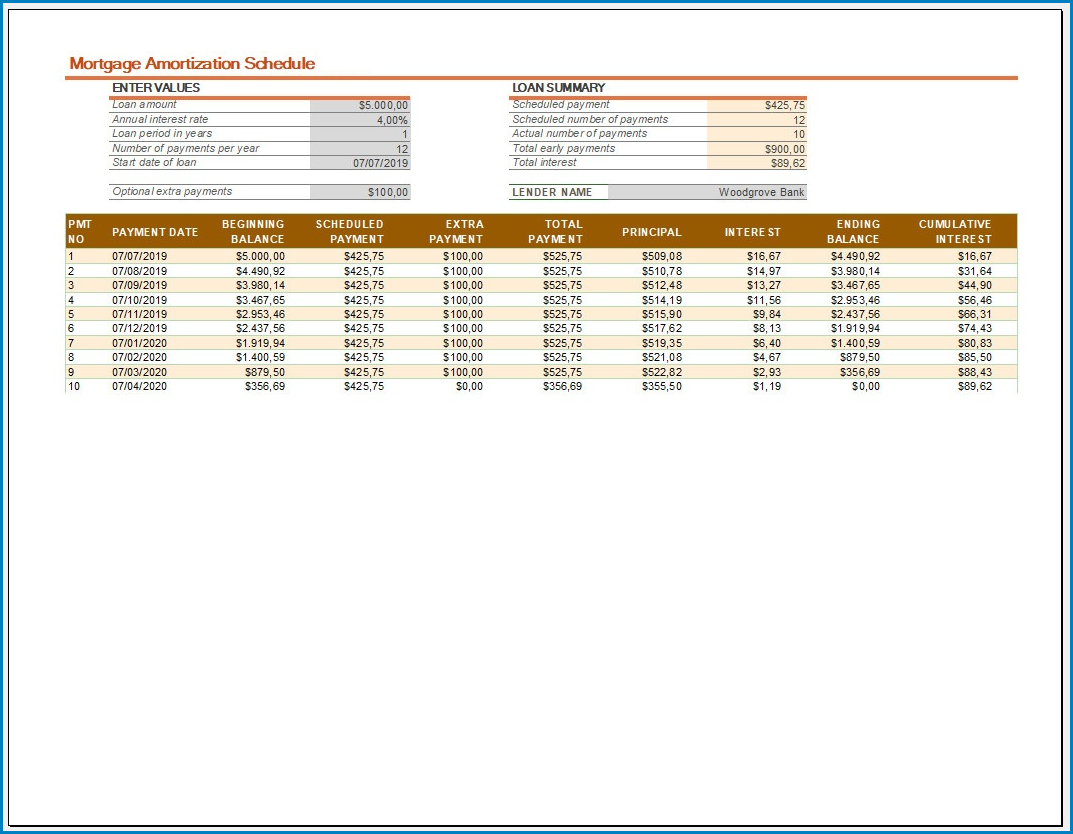

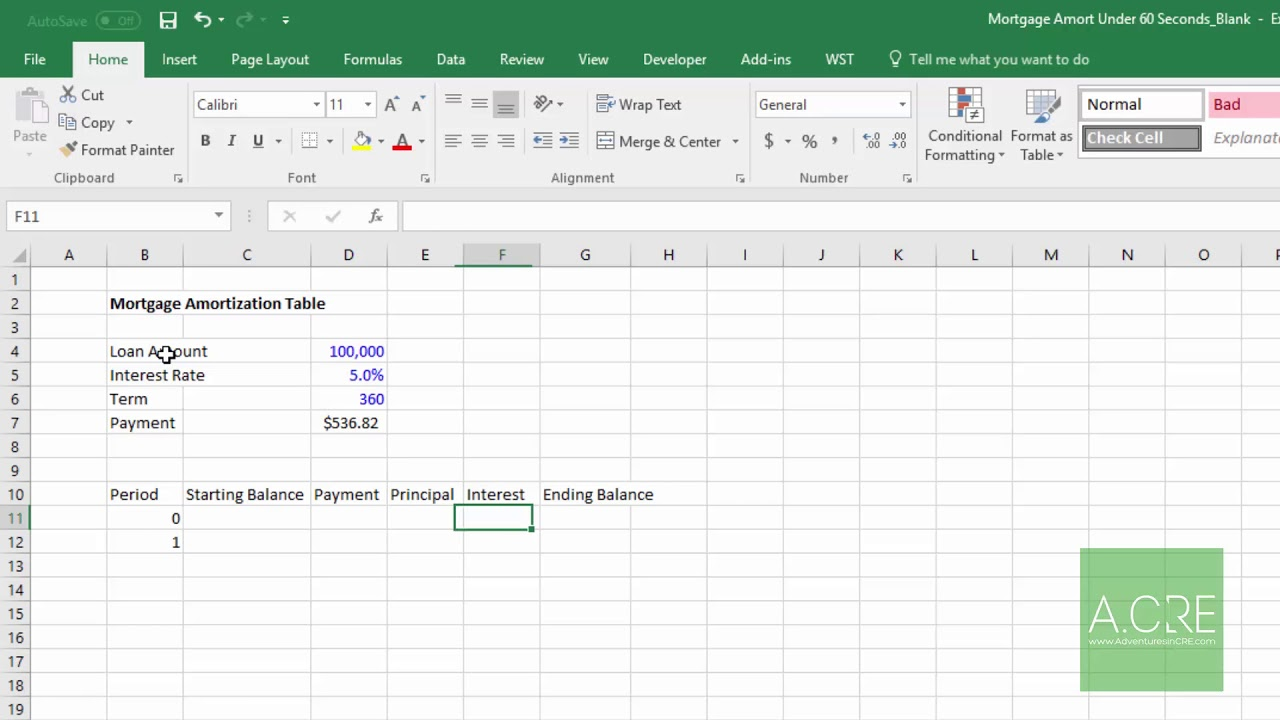

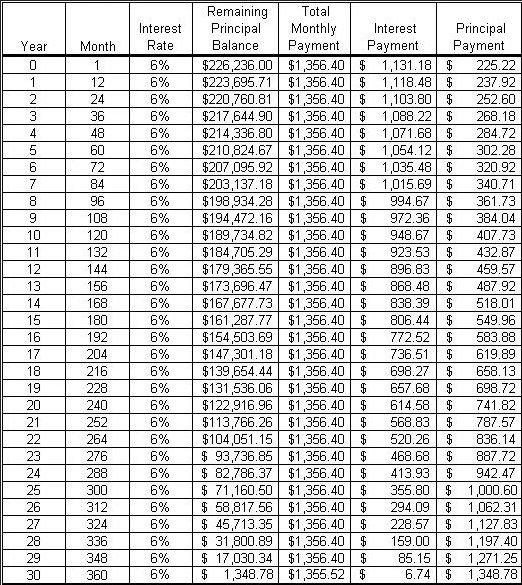

An amortization schedule is a desk that lists each common payment on a mortgage above time. A portion of every payment is utilized towards the principal equilibrium and desire, plus the amortization schedule information how much will go towards each and every component of the mortgage payment.

Samples of Mortgage Amortization Schedule :

At first, almost all of your payment goes toward the curiosity as an alternative to the principal. The schedule will display because the phrase of your respective loan progresses, a larger share of your respective payment goes toward paying down the principal until eventually the loan is paid in comprehensive at the end of your time period.

Mortgage Amortization Schedule Excel Template – download