Understanding More About The Business Receipt

For you who runs a business, this one kind of receipt should be understood thoroughly. Various types of receipts exist, but for a business purpose, of course, there is a business receipt that is used to serve as a legal document of an acknowledgment of a payment received for a product or services which is provided by a company. This receipt is different from an invoice usually given to the customer. Invoice states clearly about the demand payment of the customers or client meanwhile this receipt of business will be only issued after complete exchange. This receipt can be used for tax purposes to verify the legitimacy of the purchase.

In business, taxes should be paid in a certain period, usually at every quarter or at the end of each year. That is one of the reasons the business receipt template is kept. Well, in today’s trend, the electronically stored version is so popular. Meanwhile, the printout or physical receipt still be used when the customer does not provide the electronic option. Furthermore, Internal Revenue Service or IRS issued that profitable business has to save their receipt for three years. In other cases, the receipt must be kept for seven years if in any years the business claimed a loss. It is best to have both versions so that you have the soft file version and the hard file too.

Every single receipt has its individual goal, and should be made use of for specific transactions- have a look:

Sales Receipts

As being the title indicates, this receipt shows when your small business built a sale. Organizations will make a record of regardless of what merchandise were bought, the level of that invest in, the placement from the acquire, as well as strategy of payment. Product sales receipts are especially critical in retail corporations because customers wish to make exchanges and returns. A customer’s income receipt will verify that their items were being truly purchased from that individual B&M company.

Donation Receipts

Nonprofit organizations and corporations give these kinds of receipts because prospects can use them to get a tax deduction. For instance, organizations like Goodwill Industries will give these receipts for household items and clothing donations. However, as of June 2011, the IRS now requires donations to be worth more than $250 in order for customers to get this donation receipt. These receipts must include the identify from the donor (to avoid fraud), the donation’s exact or estimated market value, and anything the donor received in return. The receipt should really also verify your business’s nonprofit status.

Petty Cash Receipts

Several businesses possess a petty cash reserve. This cash is kept in cash considering the fact that it’s applied to generate small company purchases and give reimbursements. Considering that theft is prevalent with petty cash, most corporations require a receipt so that they know where by the cash is going. If a manager asks an employee to produce a small obtain with their very own cash, the manager would be required to reimburse the employee with money through the petty cash fund. A petty cash receipt must tell persons who is in charge from the cash fund, what small business items the cash was applied for, men and women who made use of the cash, along with the total volume spent.

Service Receipts

You can will need to use this service receipt in the event your organization performs a specialized service–like an auto repair shop, or a consulting firm. You could possibly charge your services by hour, or other factors, but a lot of companies try to standardize their services so that the prices can be added up more easily. This receipt ought to definitely include your business’s contact info, a fairly detailed list on the services the customer bought, as well as total sum of those services.

Other Samples of Business Receipt Template :

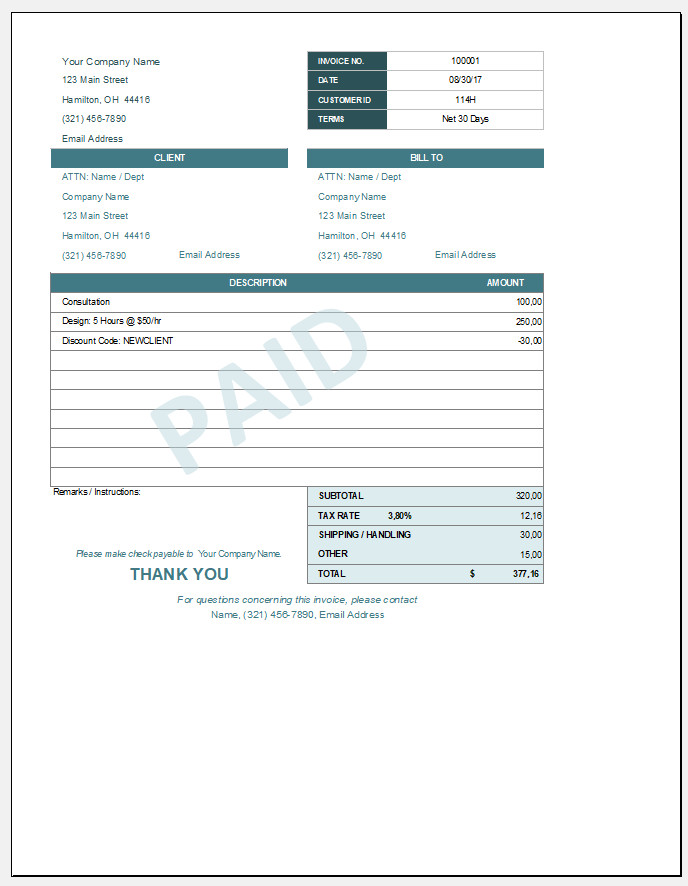

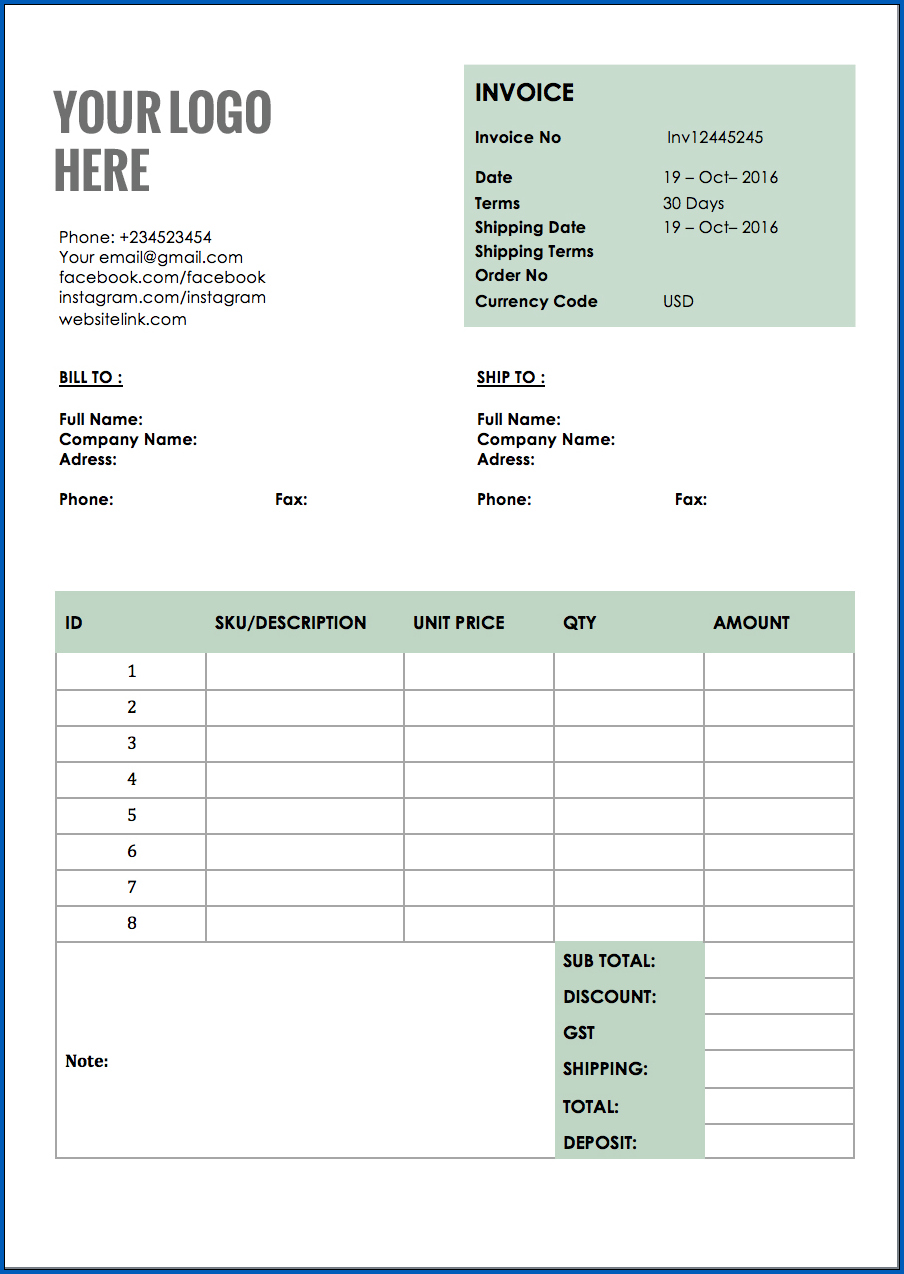

To get the best result, it is better to prepare the business receipt template by yourself. You can use the easiest way to download the file provided on the internet but if you want to take a little time to make one it is best to pay attention to what to include here. You can use either Word or Excel apps. The things that should be included are company or business’ information, the detail, date, receipt number, subtotal, tax rate, tax, total amount due, amount paid, customer’s or client’s information, payment method, and the signature. As for the business or company’s information, you must write the company name, address, city, state, zip, phone, fax (if any), e-mail. If you are interested in this type of template, you can download one for free at the bottom of this page.

Business Receipt Template | Excel – download