Being self-employed can offer many benefits, such as flexibility and the ability to be your boss. However, it also comes with the responsibility of managing your finances effectively. One tool that can greatly assist in this endeavor is a self-employment ledger.

In this article, we will explore what a self-employment ledger is, why it is important, how to create one and provide examples and tips for the successful management of your finances as a self-employed individual.

What is a Self-Employment Ledger?

A self-employment ledger is a document that helps self-employed individuals keep track of their income and expenses. It serves as a record-keeping tool that allows you to monitor and analyze your financial activities, ensuring that you are meeting your financial goals and obligations.

The ledger typically includes columns for income, expenses, and a running balance to provide a clear overview of your financial situation.

Why is a Self-Employment Ledger Important?

Managing your finances is crucial for the success of any business, including self-employment. A self-employment ledger offers several benefits:

- Organized record-keeping: The ledger helps you maintain a systematic record of your income and expenses, making it easier to track your financial transactions.

- Budgeting and financial planning: By regularly updating your ledger, you can gain insights into your cash flow and make informed decisions about budgeting and financial planning.

- Tax preparation: A self-employment ledger provides a comprehensive overview of your income and expenses, simplifying the process of preparing your taxes and ensuring accurate reporting.

- Evidence for audits: In the event of an audit, having a well-maintained self-employment ledger can serve as evidence to support your income and expense claims.

How to Create a Self-Employment Ledger

Creating a self-employment ledger is a straightforward process. Here are the steps to follow:

- Gather necessary information: Collect all relevant financial documents, such as receipts, invoices, and bank statements, to ensure accurate record-keeping.

- Choose a template: Search for self-employment ledger templates online or create your own using spreadsheet software like Microsoft Excel or Google Sheets.

- Set up columns: Create columns for income, expenses, and running balance. You may also include additional columns for specific categories or subcategories, depending on your needs.

- Record income: Enter each source of income, including the amount, date, and any additional details you find relevant.

- Track expenses: Record all business-related expenses, categorizing them appropriately. Be sure to include the amount, date, and any supporting details.

- Calculate running balance: Deduct your expenses from your income to calculate the running balance for each entry. This will give you a clear picture of your financial situation at any given point.

- Maintain regular updates: Consistently update your self-employment ledger to ensure accurate and up-to-date financial records.

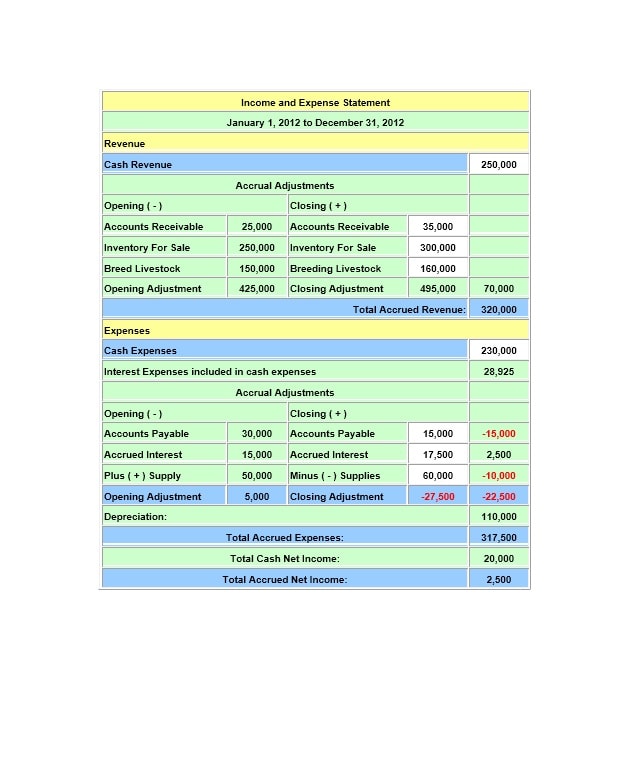

Examples

Here are some examples of how a self-employment ledger might look:

Tips for Successful Management of Your Self-Employment Ledger

While maintaining a self-employment ledger is relatively simple, here are some tips to ensure successful management:

- Be consistent: Update your ledger regularly, ideally on a daily or weekly basis, to ensure accurate and up-to-date records.

- Keep supporting documents: Retain copies of receipts, invoices, and other relevant documents as evidence for your entries in the ledger.

- Categorize expenses: Use categories or subcategories to organize your expenses, making it easier to analyze and identify areas where you can cut costs.

- Review and analyze: Regularly review your self-employment ledger to gain insights into your financial performance and identify areas for improvement.

- Seek professional advice: If you are unsure about managing your finances or need assistance, consider consulting with a financial advisor or accountant who specializes in self-employment.

- Backup your data: Regularly back up your self-employment ledger to ensure that your financial records are protected in case of computer or data loss.

Conclusion

A self-employment ledger is a valuable tool for self-employed individuals to effectively manage their finances. By creating and maintaining a well-organized ledger, you can gain control over your financial activities, make informed decisions, and ensure compliance with tax regulations.

Remember to update your ledger regularly, keep supporting documents, and seek professional advice when needed. With proper management of your self-employment ledger, you can enhance your financial stability and success as a self-employed individual.

Self-Employment Ledger Template Word – Download