Managing your finances can be a daunting task, especially when it comes to keeping track of your monthly expenses and income. One way to simplify this process is by using a monthly statement of account. This document allows you to see a detailed summary of your financial transactions for a specific period, providing you with a clear picture of your spending habits and helping you make informed decisions about your money.

What is a Monthly Statement of Account?

A monthly statement of account is a document that summarizes your financial transactions over a specific period, typically a month. It includes information about your income, expenses, and any other financial activities, such as deposits, withdrawals, and transfers. This statement provides you with a snapshot of your finances, allowing you to see how much money is coming in and going out, and where it is being spent.

Many financial institutions, such as banks and credit card companies, provide their customers with monthly statements of account. These statements are usually sent via mail or email and can be viewed online or printed for reference. However, if you prefer a more tangible and customizable option, you can create your monthly statement of account using a template or spreadsheet software.

Why Use a Monthly Statement of Account?

There are several reasons why using a monthly statement of account can be beneficial:

- Financial Awareness: By regularly reviewing your monthly statement of account, you can gain a better understanding of your financial situation and make more informed decisions about your money. It allows you to identify areas where you may be overspending or where you can cut back on expenses.

- Budgeting Tool: A monthly statement of account can serve as a valuable tool for budgeting. It helps you track your income and expenses, making it easier to create a realistic budget and stick to it. By comparing your actual spending to your budget, you can identify areas where you need to make adjustments.

- Record Keeping: Keeping a record of your financial transactions is essential for tax purposes, expense reimbursement, and financial planning. A monthly statement of account provides you with a detailed record of your income and expenses, making it easier to organize and categorize your financial information.

- Financial Goal Tracking: If you have specific financial goals, such as saving for a vacation or paying off debt, a monthly statement of account can help you track your progress. By regularly reviewing your statement, you can see how your actions are impacting your financial goals and make adjustments if necessary.

How to Create a Monthly Statement of Account

Creating a monthly statement of account is relatively simple and can be done using a template or spreadsheet software. Here is a step-by-step guide:

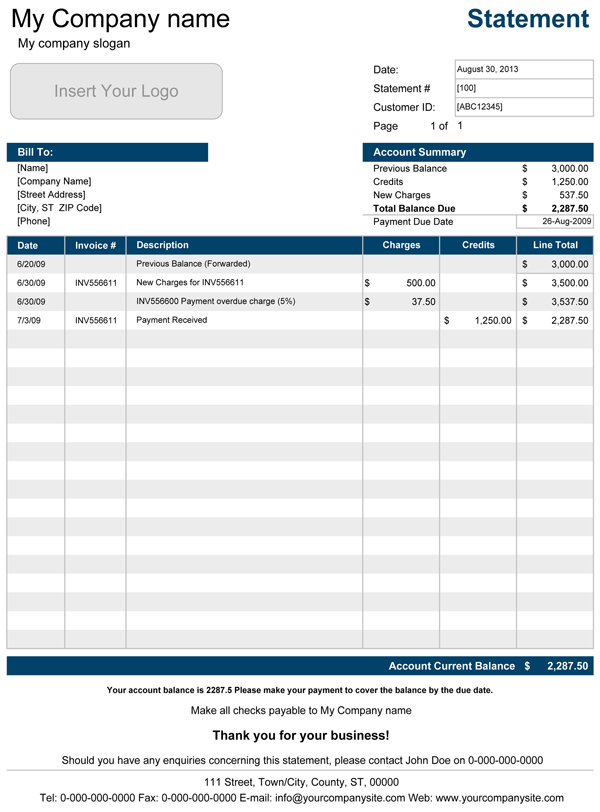

- Choose a Template or Software: Start by selecting a template or spreadsheet software that suits your needs. There are many free templates available online or you can use software like Microsoft Excel or Google Sheets.

- Gather Your Financial Information: Collect all your financial information, including bank statements, credit card statements, and any other relevant documents. Make sure you have the necessary details, such as transaction dates, descriptions, and amounts.

- Create Columns and Rows: Set up your template or spreadsheet by creating columns for transaction dates, descriptions, amounts, and categories. You can customize these columns based on your preferences and specific financial needs.

- Enter Your Financial Transactions: Start entering your financial transactions into the appropriate columns. Be sure to include all income, expenses, deposits, withdrawals, and transfers. Double-check the accuracy of your entries to ensure the information is correct.

- Calculate Totals: Use formulas or functions to calculate the totals for each category and your overall income and expenses. This will give you a clear picture of your financial situation for the month.

- Format and Customize: Format your monthly statement of account to make it visually appealing and easy to read. You can add colors, borders, and headers to make it more organized and professional-looking. You can also customize it further by adding your logo or personal branding.

- Print and Review: Once you are satisfied with your monthly statement of account, print a copy and review it for accuracy. Make any necessary corrections or adjustments before finalizing it.

Tips for Successful Financial Management

Managing your finances effectively requires discipline and attention to detail. Here are some tips to help you succeed:

- Create a Budget: Establish a budget based on your income and expenses. This will help you prioritize your spending and ensure that you are living within your means.

- Track Your Expenses: Keep track of every expense, no matter how small. This will help you identify areas where you can cut back and save money.

- Automate Your Savings: Set up automatic transfers to a savings account to ensure that you are consistently saving money.

- Avoid Impulse Purchases: Before making a purchase, take some time to consider whether it is a necessary expense or simply an impulse buy.

- Pay Bills on Time: Avoid late fees and interest charges by paying your bills on time. Set up reminders or automatic payments to help you stay organized.

- Review Your Financial Statements: Regularly review your monthly statements of account to identify any discrepancies or fraudulent activity.

- Seek Professional Advice: If you are struggling with your finances or need help creating a budget, consider consulting with a financial advisor or planner.

Download The Template!

A monthly statement of account is a valuable tool for managing your finances. It provides a comprehensive overview of your financial transactions, helping you stay organized and make informed decisions about your money. By using a template or spreadsheet software, you can easily create a customized statement that suits your needs.

Remember to review your statement regularly, track your expenses, and follow the tips for successful financial management to achieve your financial goals.

Monthly Statement of Account Template Excel – Download