Managing your expenses and staying on budget can be a challenging task, especially when it comes to controlling costs. However, with the help of cost control tools, you can effectively monitor your spending and find ways to save money.

This guide will explore cost control, why it is important, and how you can use it to your advantage. Whether you are trying to manage your finances or a business owner looking to streamline expenses, this guide will provide you with the knowledge and tools you need to take control of your costs.

What is Cost Control?

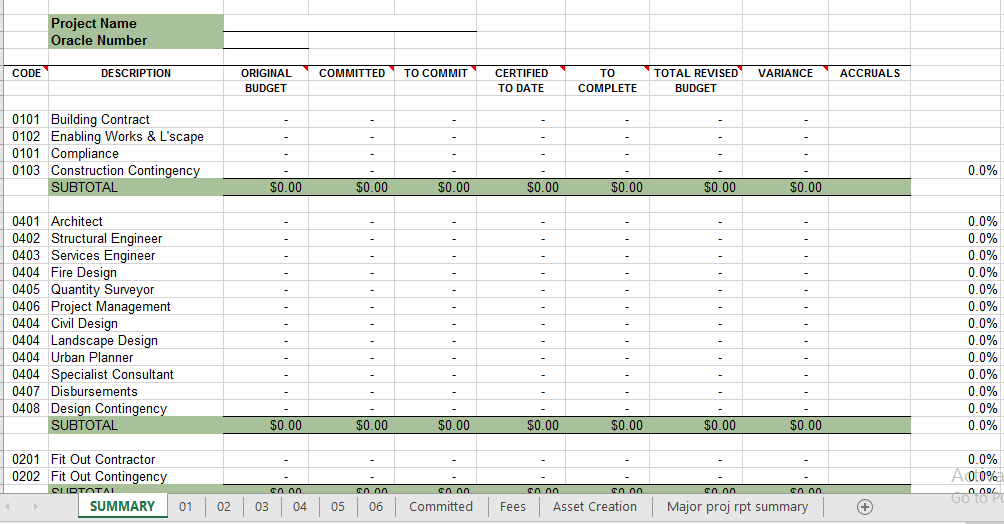

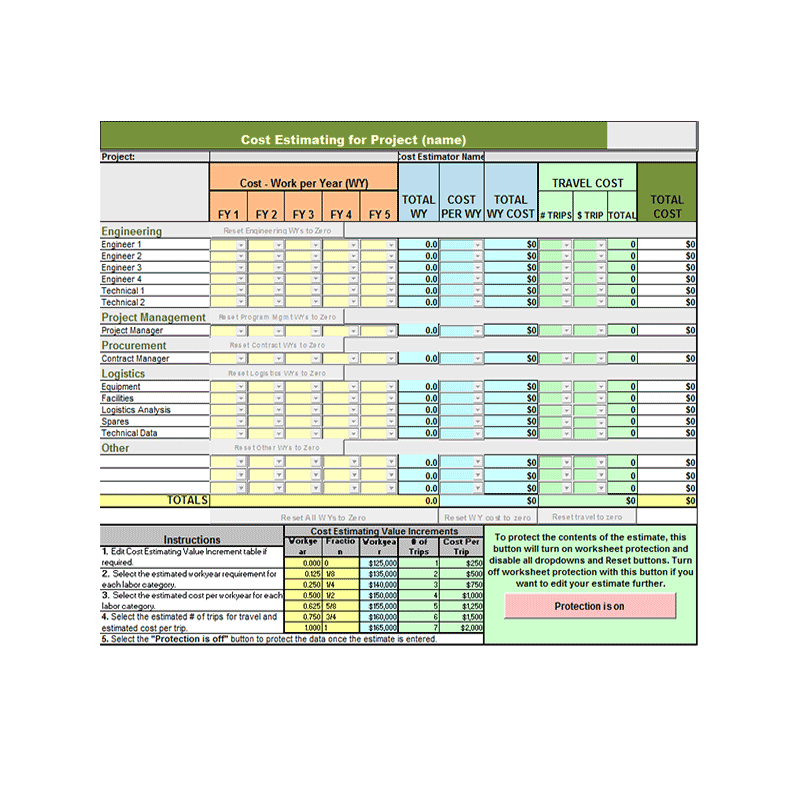

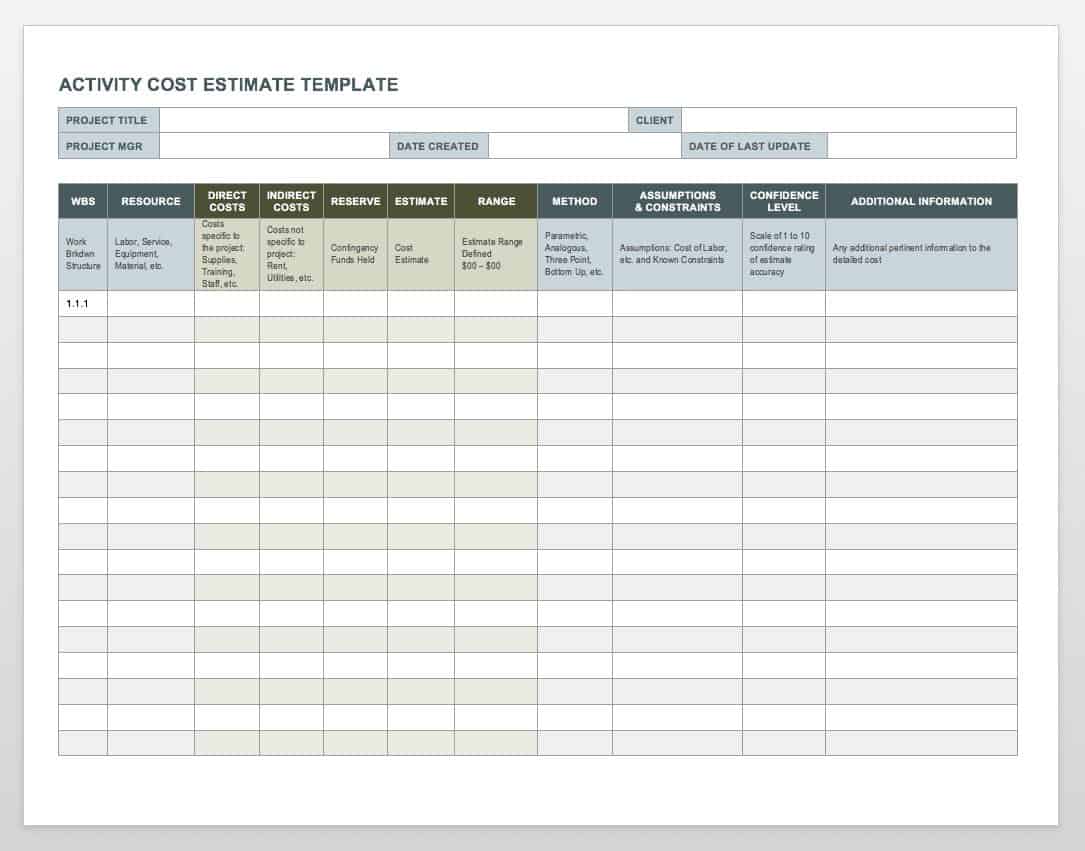

cost control refers to the use of templates and worksheets to track and analyze expenses. These tools are designed to help individuals and businesses keep a record of their spending, identify areas of overspending, and find opportunities for cost savings. By using cost control tools, you can gain a better understanding of where your money is going and make informed decisions to reduce your expenses.

Cost control is important for several reasons.

- It allows you to have a clear overview of your expenses, which can help you identify areas where you are overspending. By having a visual representation of your spending habits, you can make more informed decisions and adjust your budget accordingly.

- Cost control tools can help you set financial goals and track your progress toward achieving them. Whether your goal is to save for a vacation or pay off debt, these tools can provide you with a roadmap to success.

- Cost control can help you develop healthy financial habits. By regularly reviewing your expenses and finding ways to save money, you can build a strong foundation for long-term financial stability.

How to Use Cost Control Tools

Using cost control tools is easy and can be done in a few simple steps:

- Step 1: Determine Your Financial Goals. Before you start using cost control tools, it is important to define your financial goals. Whether you want to save a certain amount of money each month or reduce your monthly expenses by a specific percentage, having clear goals will help you stay focused and motivated.

- Step 2: Choose the Right Tools. There are various cost control templates and worksheets available online. Choose the ones that best suit your needs and preferences. Some common tools include expense trackers, budget planners, and savings goal trackers.

- Step 3: Fill in the Details. Once you have chosen your tools, start filling in the details. Record your expenses, categorize them, and calculate your total spending. Be thorough and ensure that every expense is accounted for.

- Step 4: Analyze Your Spending. Once you have completed your expense tracking, take the time to analyze your spending patterns. Look for areas where you can make cuts or find more affordable alternatives. This could include reducing discretionary expenses, negotiating better deals with service providers, or finding ways to save on everyday purchases.

- Step 5: Set a Budget. Based on your analysis, set a realistic budget that aligns with your financial goals. Allocate funds to different categories and make sure to leave room for unexpected expenses.

- Step 6: Track Your Progress. Regularly update your tools and track your progress towards achieving your financial goals. Make adjustments to your budget as needed and celebrate milestones along the way.

Final Thoughts

Cost control is a valuable tool for managing your expenses and staying on budget. By using templates and worksheets, you can gain a better understanding of your spending habits, identify areas of overspending, and find opportunities for cost savings.

Whether you are an individual or a business owner, cost control can help you take control of your finances and achieve your financial goals. Start using cost control tools today and experience the benefits for yourself.

Cost Control Template Excel – Download