Retirement is a time to relax and enjoy the fruits of your labor. However, without proper planning, it can also become a time of financial stress. That’s why creating a retirement budget is essential. A retirement budget helps you manage your expenses, plan for the future, and ensure you have enough funds to live comfortably during your golden years.

In this guide, we will walk you through the process of creating a printable retirement budget that will set you up for financial success.

What is a Retirement Budget?

A retirement budget is a document that outlines your expected income and expenses during retirement. It helps you track your cash flow, plan for future expenses, and make informed financial decisions. With a printable retirement budget, you can easily see how much money you have coming in, how much you are spending, and where you can make adjustments to ensure your financial security.

Why Should You Create a Retirement Budget?

Creating a retirement budget is crucial for several reasons:

- Financial Security: A retirement budget gives you a clear picture of your financial situation and helps you plan for unexpected expenses.

- Peace of Mind: By creating a retirement budget, you can eliminate financial stress and enjoy your retirement years worry-free.

- Control Over Your Finances: A retirement budget allows you to take control of your money and make informed decisions about how to spend and save.

- Identify Areas for Savings: With a retirement budget, you can identify areas where you can cut back on expenses and save more money for the future.

Where to Start?

Creating a printable retirement budget may seem overwhelming, but with the right approach, it can be a straightforward process. Here are the steps to get started:

1. Determine Your Retirement Income

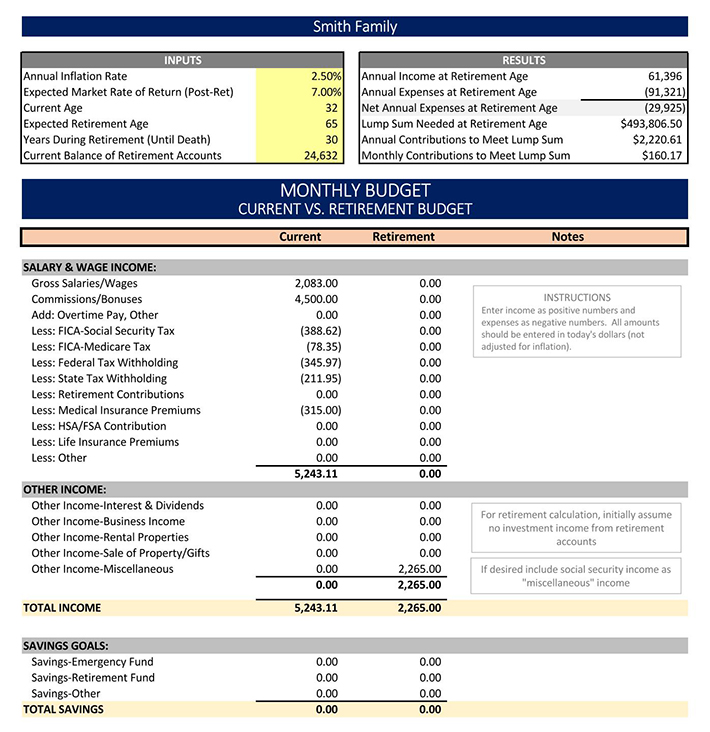

The first step in creating a retirement budget is to determine your expected retirement income. This includes any pensions, Social Security benefits, annuities, and investment income you may receive during retirement. Add up these sources of income to get an estimate of your monthly or annual income.

2. Calculate Your Expenses

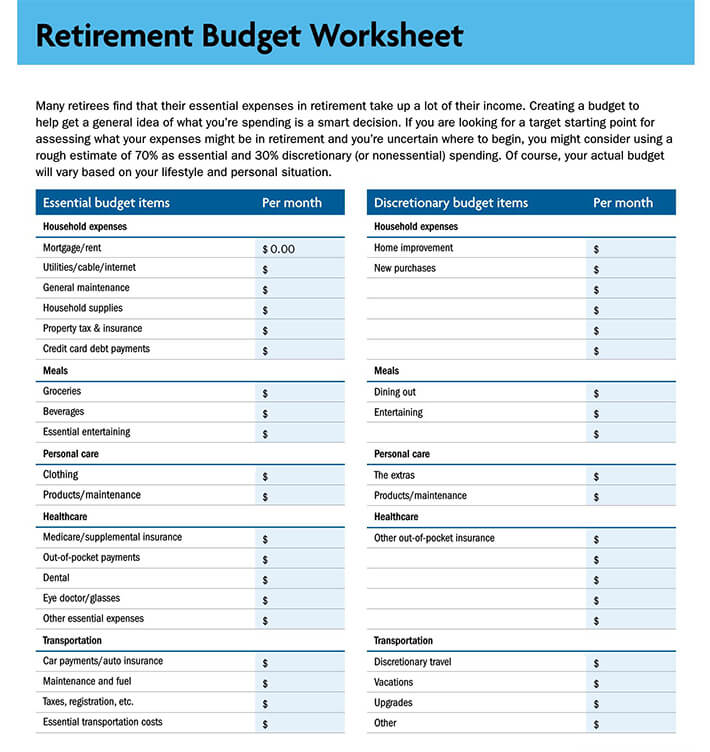

Next, you need to calculate your expected expenses during retirement. Start by listing your essential expenses, such as housing, food, healthcare, transportation, and utilities. Then, consider your discretionary expenses, such as travel, entertainment, hobbies, and dining out. Be realistic and include all possible expenses to get an accurate picture of your financial needs.

3. Factor in Inflation

When creating a retirement budget, it’s important to factor in inflation. Over time, the cost of goods and services will increase, so you need to account for this in your budget. Consider using an inflation rate of 2-3% to adjust your expenses for future years.

4. Evaluate Your Current Financial Situation

Before finalizing your retirement budget, evaluate your current financial situation. Take a look at your savings, investments, and any outstanding debts. This will help you determine if you need to make any adjustments to your retirement plan or if you need to save more aggressively in the years leading up to retirement.

5. Make Adjustments as Needed

Once you have calculated your income, and expenses, and evaluated your financial situation, it’s time to make adjustments. If your expenses exceed your income, you may need to find ways to cut back on spending or increase your income. On the other hand, if you have a surplus, you can allocate the extra funds toward savings, investments, or other financial goals.

6. Create a Printable Retirement Budget

Now that you have all the necessary information, it’s time to create your printable retirement budget. Use a spreadsheet or online budgeting tool to input your income, expenses, and any other financial details. Organize the budget in a clear and easy-to-read format, ensuring that all information is accurate and up-to-date. Once you have created the budget, print it out and keep it in a safe place where you can easily refer to it.

Sample Retirement Budget Template

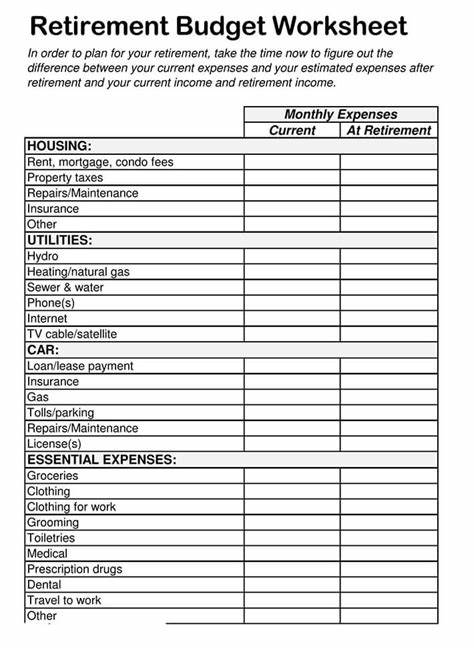

Here’s an example of a printable retirement budget template:

- Income: Include all sources of retirement income, such as pensions, Social Security benefits, annuities, and investment income.

- Expenses: Categorize your expenses into essential and discretionary expenses. Include items such as housing, food, healthcare, transportation, utilities, travel, entertainment, hobbies, and dining out.

- Savings: Allocate a portion of your income towards savings and investments to ensure financial security in the future.

- Debts: If you have any outstanding debts, include them in your budget and plan for repayment.

- Emergency Fund: Set aside a portion of your income for unexpected expenses or emergencies.

- Other Financial Goals: If you have any other financial goals, such as buying a second home or funding your grandchildren’s education, include them in your budget.

Tips for Managing Your Retirement Budget

Managing your retirement budget effectively is key to ensuring long-term financial security. Here are some tips to help you stay on track:

- Review Your Budget Regularly: Review your retirement budget at least once a year to make sure it aligns with your current financial situation and goals.

- Track Your Expenses: Keep track of your expenses to identify any areas where you can cut back and save more money.

- Automate Your Savings: Set up automatic transfers from your income to your savings and investment accounts to ensure you are consistently saving for the future.

- Adjust Your Budget as Needed: Life circumstances may change, so be prepared to adjust your retirement budget accordingly. This could include unexpected expenses, changes in income, or new financial goals.

- Seek Professional Advice: If you’re unsure about managing your retirement budget, consider consulting with a financial advisor who specializes in retirement planning.

Final Words

Creating a printable retirement budget is an essential step in planning for a financially secure retirement. By taking the time to evaluate your income, expenses, and financial goals, you can make informed decisions about your future. Remember to review and adjust your retirement budget regularly to ensure it remains aligned with your changing needs and circumstances. With a well-planned retirement budget, you can enjoy your golden years without worrying about your finances.

Retirement Budget Template – Excel