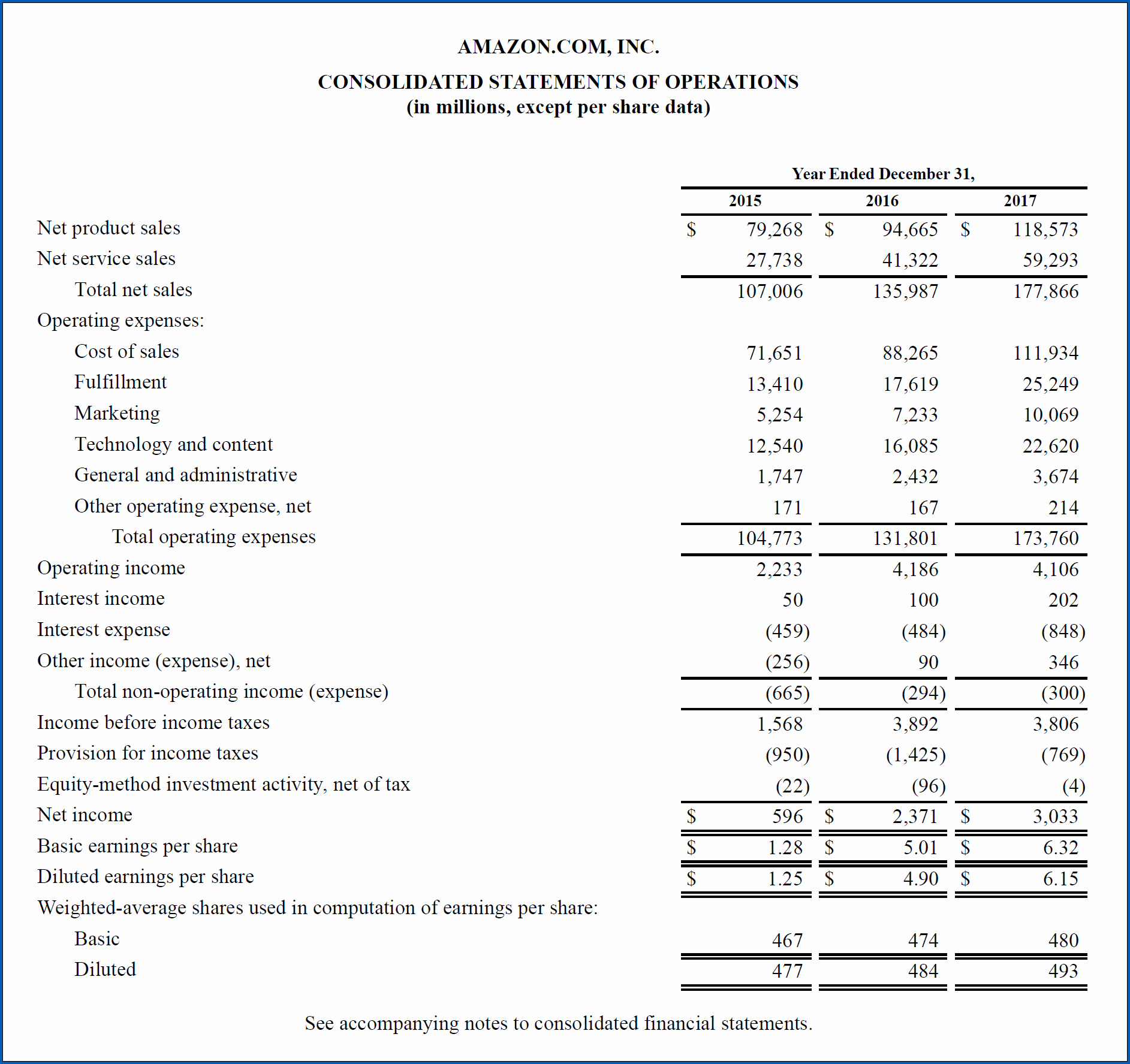

The income statement, also called the revenue and reduction assertion, is usually a report that reveals the revenue, costs, and resulting gains or losses of a corporation during a specific time period. The income assertion would be the first money statement ordinarily organized throughout the accounting cycle since the net money or reduction should be calculated and carried over to the assertion of owner’s equity prior to other money statements could be ready.

The revenue statement calculates the net money of a business by subtracting whole fees from full income. This calculation displays traders and lenders the general profitability with the organization in addition as how successfully the company is at producing earnings from complete revenues.

The money and expense accounts may be subdivided to work out gross gain plus the revenue or loss from functions. These two calculations are most effective revealed on a multi-step income assertion. Gross gain is calculated by subtracting charge of products marketed from net product sales. Functioning revenue is calculated by subtracting operating expenditures from your gross earnings.

As opposed to the balance sheet, the revenue assertion calculates net money or loss above a range of time. Such as yearly statements use revenues and expenditures in excess of a 12-month period of time, even though quarterly statements concentrate on revenues and costs incurred in the course of a 3-month period.

Some Samples of Income Statement Format :